- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD): Assessing Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Applied Digital.

Despite the recent correction, Applied Digital’s momentum has been nothing short of dramatic. The company has seen a 170% year-to-date share price return and a 114% total shareholder return over the past year. After such a strong run, the recent volatility could reflect shifting sentiment or investors recalibrating risk as the company matures.

If the pace of change in Applied Digital’s story interests you, now is a prime moment to broaden your search and discover fast growing stocks with high insider ownership

With shares off their highs but long-term returns still impressive, the key question emerges: is Applied Digital undervalued today, or has the market already priced in all of its future growth potential?

Most Popular Narrative: 51.7% Undervalued

With the most popular narrative assigning a fair value of $43.70, Applied Digital’s recent close at $21.09 stands out as a major gap for investors to consider. This narrative projects significant upside and sets the stage for a bold forecast rooted in transformation underway at the company.

The accelerating industry need for high-density, geographically distributed data centers to support AI and machine learning workloads places Applied Digital in a favorable position. The company stands to capitalize on digital transformation trends that are set to drive ongoing utilization growth, improved asset values, and ultimately earnings expansion over the next several years.

Want to know what powers such a big gap in fair value? The narrative depends on striking projections for future growth, improved margins, and a sustained transformation in digital infrastructure. There is a single, aggressive set of financial forecasts supporting this price. What are the crucial numbers analysts are betting on? Only the full story reveals the quantitative leaps behind this valuation.

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on a few major customers and rapid sector changes could undermine Applied Digital’s strong growth narrative if momentum slows.

Find out about the key risks to this Applied Digital narrative.

Another View: Multiples Tell a Different Story

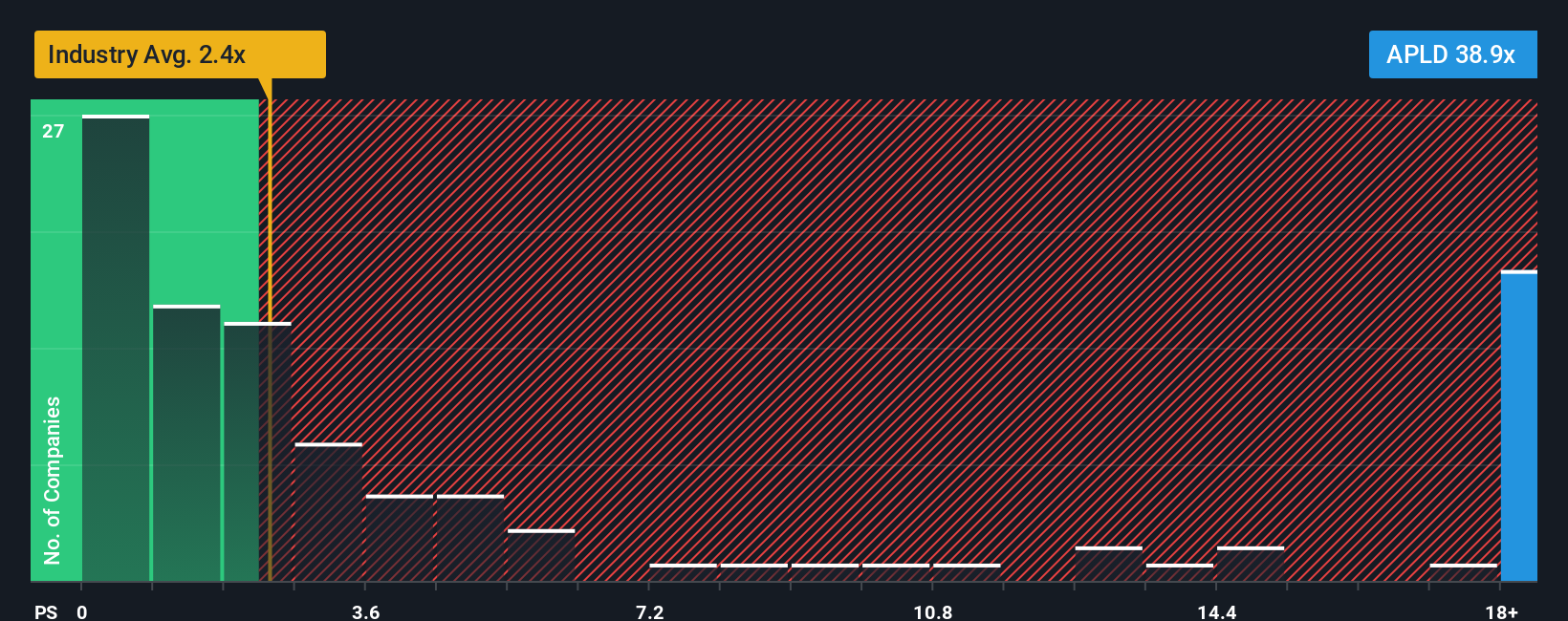

While the most popular narrative suggests that Applied Digital is deeply undervalued, a quick look at its sales ratio tells a different tale. Shares trade at 34.7 times sales, which is much higher than the industry average of 2.4 or the peer average of 4.1, and even well above the fair ratio of 19. This premium signals investors pay a steep price for growth, raising key questions about whether expectations have already run ahead of reality.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If the current outlook does not match your perspective, or you want to dig into the numbers on your own terms, you can quickly build your personal thesis in just minutes. Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Hesitate too long and you could miss stocks quietly outperforming today’s leaders. Let Simply Wall Street’s innovative screeners point you to the next big thing.

- Supercharge your returns by targeting high-potential companies with strong cash flow momentum. Start with these 919 undervalued stocks based on cash flows and spot tomorrow’s standouts before the crowd.

- Access new frontiers in healthcare by tapping into breakthroughs powered by artificial intelligence. Leverage these 30 healthcare AI stocks to get an edge on transformative trends.

- Amplify your passive income strategy by focusing on steady payouts. Pursue these 17 dividend stocks with yields > 3% and find reliable stocks offering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion