- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD): Assessing Valuation After a Sharp Pullback in a Triple-Digit Year-To-Date Rally

Reviewed by Simply Wall St

Applied Digital (APLD) has quietly become one of the bigger AI-infrastructure stories in the market, with the stock up almost 200% this year despite a sharp pullback this week.

See our latest analysis for Applied Digital.

The 1 year total shareholder return of 129.57% and year to date share price return of 194.62% show that, even after this week’s 17.52% one day share price drop and 28.43% 7 day share price decline, longer term momentum is still very much intact. The 90 day share price return of 18.09% suggests that investors are recalibrating near term risk rather than abandoning the broader AI infrastructure growth story.

If Applied Digital’s run has you thinking about what else could be setting up for big moves, it is worth exploring high growth tech and AI stocks as a starting point for other potential high growth tech and AI ideas.

With revenue still growing fast but profits lagging and the share price already up triple digits, the key question now is simple: Is Applied Digital still mispriced by a skeptical market, or is future growth already baked in?

Most Popular Narrative: 47.4% Undervalued

With the narrative fair value near $43.70 versus a last close of $22.98, the valuation case hinges on how quickly Applied Digital can scale AI data center earnings.

The accelerating industry need for high density, geographically distributed data centers to support AI and machine learning workloads places Applied Digital in a favorable position, capitalizing on digital transformation trends that are set to drive ongoing utilization growth, improved asset values, and ultimately earnings expansion over the next several years.

Curious how aggressive revenue ramps, shifting margins, and a lofty future earnings multiple all fit together, and why they still point to upside, not excess optimism?

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant crypto exposure and heavy, debt fueled expansion mean any slowdown in hyperscale leasing or utilization could quickly challenge the bullish narrative.

Find out about the key risks to this Applied Digital narrative.

Another View: Price Tag Gets Harder to Ignore

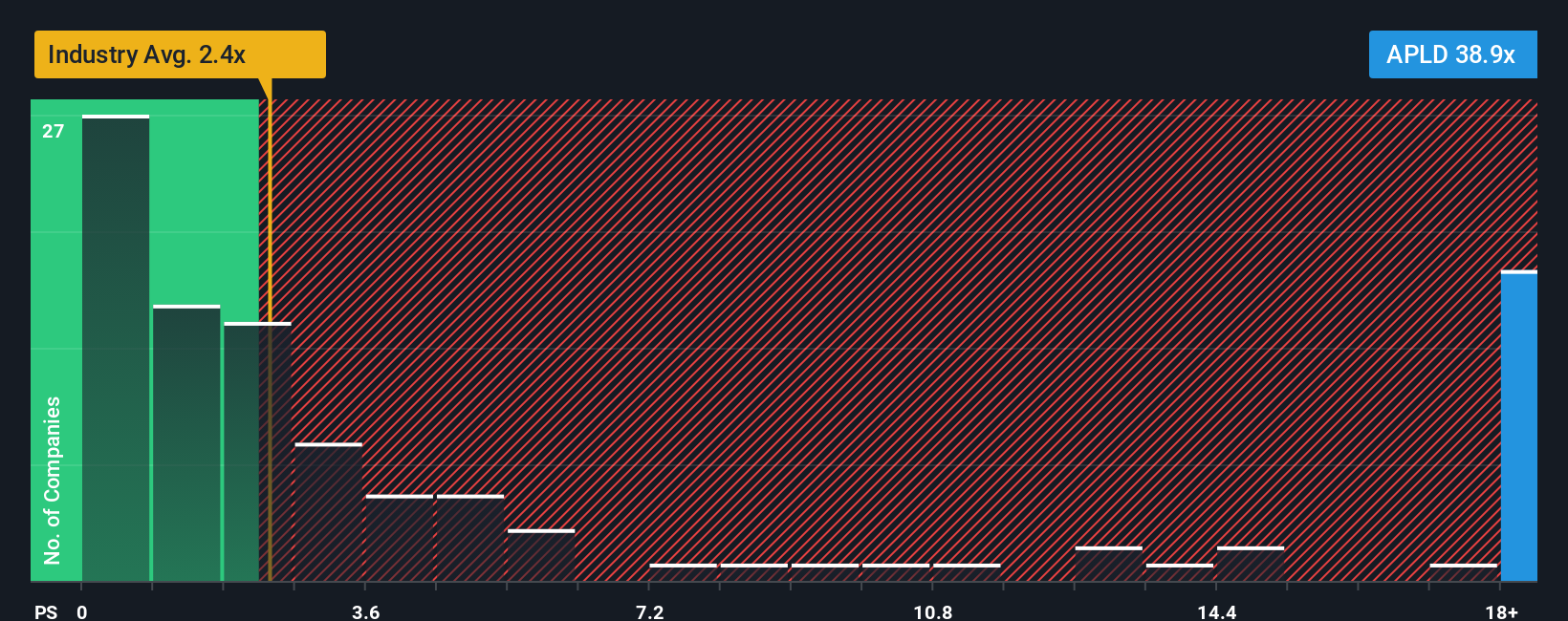

While the narrative fair value implies big upside, today’s price already bakes in a lot of hope. Applied Digital trades on a price to sales ratio of 45.8 times versus 4 times for peers and a 10.8 times fair ratio, leaving little room for execution slips or delays.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a personalized narrative in minutes: Do it your way.

A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next smart move?

Do not stop with one stock when you can systematically uncover fresh opportunities. Use the Simply Wall Street Screener now to stay ahead of slower investors.

- Capitalize on potential mispricings by targeting these 909 undervalued stocks based on cash flows that could offer strong upside if the market catches up.

- Ride powerful secular trends by focusing on these 26 AI penny stocks positioned to benefit as artificial intelligence reshapes entire industries.

- Strengthen your portfolio’s income engine by zeroing in on these 13 dividend stocks with yields > 3% that can help you build reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion