- United States

- /

- Software

- /

- NasdaqCM:AMPL

A Fresh Look at Amplitude (AMPL) Valuation After AI Product Launches and GitHub Partnership

Reviewed by Simply Wall St

Amplitude (AMPL) caught investor attention recently after sharing its quarterly earnings results, updating full-year sales guidance, and rolling out several new AI-focused product initiatives. The company also announced a strategic partnership with GitHub.

See our latest analysis for Amplitude.

With several new AI features and its GitHub partnership fueling buzz, Amplitude’s shares have seen some volatility lately. This reflects changing investor sentiment as the company pursues long-term growth. While the recent 1-year total shareholder return sits at just over 1%, longer-term holders are still facing a sizable three-year total shareholder loss.

Curious to see what other software innovators are making waves in tech and AI? Take the logical next step and explore See the full list for free.

But with shares trading well below analyst price targets and product innovation at the forefront, the real question is whether Amplitude is offering investors an attractive entry point or if future growth is already fully reflected in the stock price.

Most Popular Narrative: 36.1% Undervalued

Comparing Amplitude’s last close of $10.01 to the most popular narrative’s fair value of $15.67 reveals significant upside from current levels, underpinned by strategic expansion and AI-driven opportunities.

The continued investment and leadership in AI-driven analytics, supported by multiple strategic talent acquisitions and rapid product innovation (for example, AI agents, Guides, Surveys), position Amplitude to capitalize on the growing enterprise need for automated, actionable insights. This creates opportunities to increase ACV and command premium pricing, ultimately supporting margin expansion and stronger earnings.

Wondering which key metrics power this bold narrative? The future growth outlook, evolving profit margins, and big bets on AI all factor into the fair value calculation. Find out exactly how they build their case by reading the full details.

Result: Fair Value of $15.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as uncertain AI monetization and increased reliance on large enterprise clients could hinder Amplitude's growth prospects if not carefully managed.

Find out about the key risks to this Amplitude narrative.

Another View: What Does the Market Multiple Say?

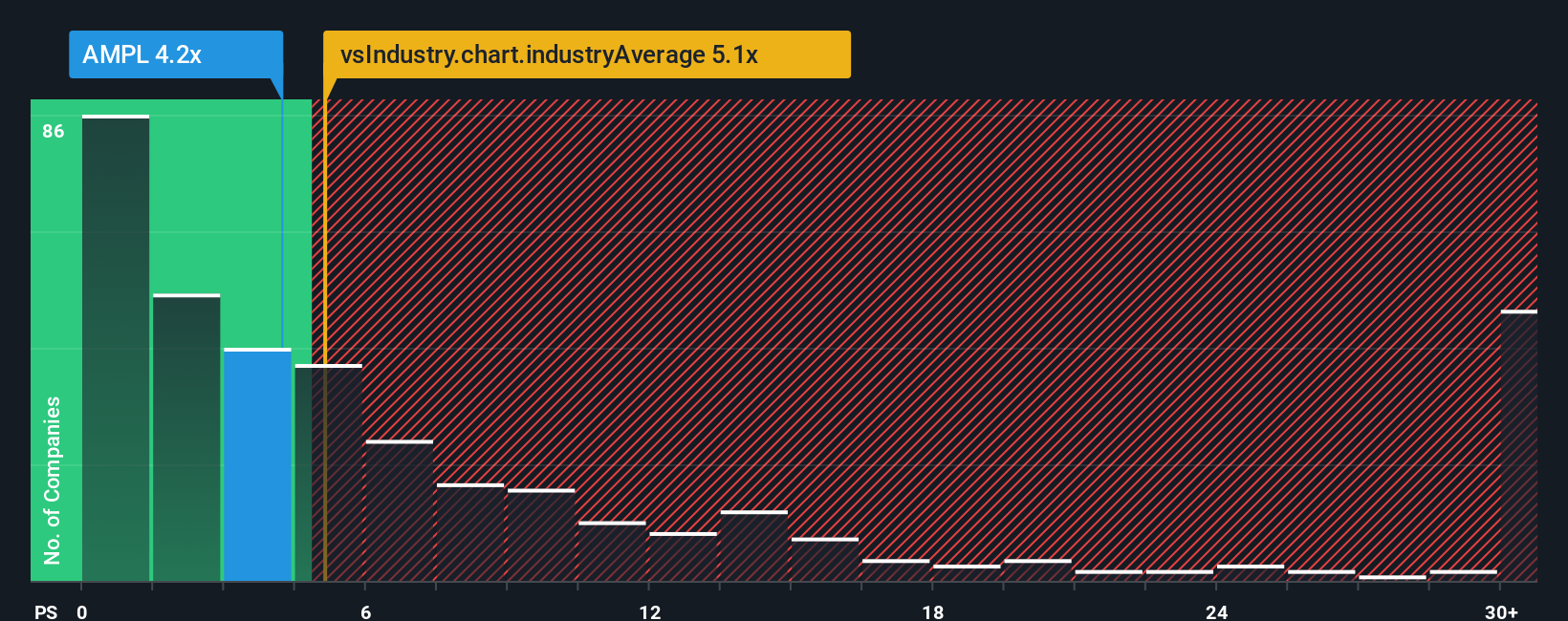

Looking at the price-to-sales ratio, Amplitude trades at 4.1x, which is a bit higher than similar peers at 3.8x but lower than the US software industry average of 4.8x. The fair ratio is estimated around 4.2x, putting Amplitude close to where the market could eventually settle. Does this suggest risks for buyers, or are investors overlooking long-term upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amplitude Narrative

If you have your own take on Amplitude's story or want to explore the underlying data yourself, you can craft your own narrative quickly and see how your view stacks up. Do it your way

A great starting point for your Amplitude research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your investing toolkit with Simply Wall Street's unique screeners. Don't miss out on standout opportunities that could shape your portfolio's growth story.

- Spot companies delivering value: unlock hidden gems by checking out these 874 undervalued stocks based on cash flows with strong fundamentals and real upside potential.

- Capitalize on tomorrow’s breakthroughs: target the future of computing and innovation by exploring these 28 quantum computing stocks making headlines in this fast-moving sector.

- Boost your income with stability: secure consistent returns when you access these 16 dividend stocks with yields > 3% offering attractive yields backed by solid track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AMPL

Amplitude

Provides a digital analytics platform that analyzes customer behavior in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives