- United States

- /

- Software

- /

- NasdaqGM:APPF

High Growth Tech Stocks To Watch In August 2024

Reviewed by Simply Wall St

The market is up 1.2% over the last week and has seen a substantial increase of 26% over the past 12 months, with earnings expected to grow by 15% per annum over the next few years. In this favorable environment, identifying high growth tech stocks that can capitalize on these trends is crucial for investors looking to maximize their returns in August 2024.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| Invivyd | 42.85% | 71.50% | ★★★★★★ |

| Ardelyx | 27.44% | 65.50% | ★★★★★★ |

| Super Micro Computer | 20.76% | 28.05% | ★★★★★★ |

| Iris Energy | 69.80% | 125.09% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| Amicus Therapeutics | 20.45% | 61.85% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

AppFolio (NasdaqGM:APPF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AppFolio, Inc., along with its subsidiaries, offers cloud-based business management solutions tailored for the real estate industry in the United States and has a market cap of approximately $8.32 billion.

Operations: AppFolio generates revenue primarily from its cloud-based business management software and Value+ platforms, totaling $722.08 million. The company focuses on providing specialized solutions for the real estate sector in the United States.

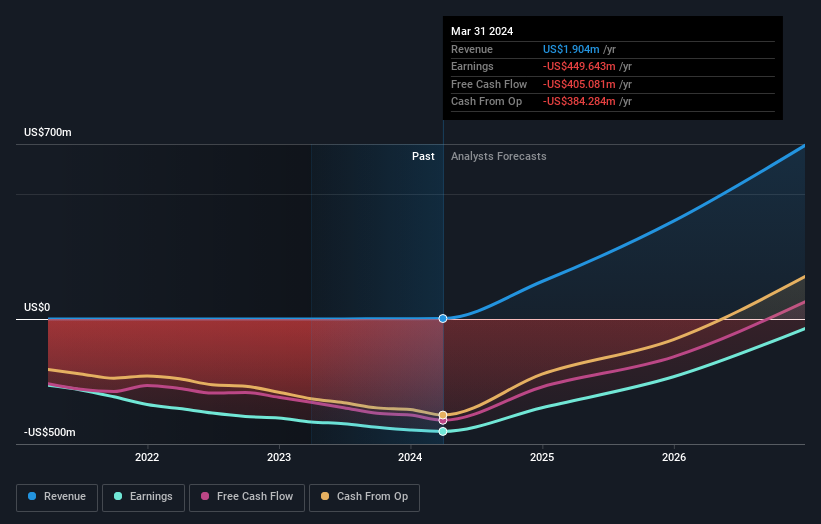

AppFolio's recent earnings report highlights a significant turnaround, with Q2 sales reaching $197.38 million, up from $147.08 million last year, and net income at $29.67 million compared to a loss of $18.9 million previously. The company's R&D expenses have been robust, reflecting its commitment to innovation; in 2023 alone, they invested approximately 16% of their revenue into R&D efforts. With projected annual earnings growth of 20.5%, AppFolio is positioned for sustained expansion in the software sector, particularly benefiting from its SaaS model which ensures recurring revenue streams. The addition of Marcy Campbell as Chief Revenue Officer is expected to further boost customer acquisition and product adoption rates, leveraging her extensive experience from Boomi and PayPal to drive growth initiatives effectively. Additionally, AppFolio's inclusion in multiple Russell indices underscores its growing market presence and investor confidence despite some index drops earlier this year.

- Dive into the specifics of AppFolio here with our thorough health report.

Review our historical performance report to gain insights into AppFolio's's past performance.

Iovance Biotherapeutics (NasdaqGM:IOVA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Iovance Biotherapeutics, Inc. is a commercial-stage biotechnology company focused on developing and commercializing cell therapies for treating metastatic melanoma and other solid tumor cancers, with a market cap of $3.60 billion.

Operations: Iovance Biotherapeutics generates revenue primarily from innovating, developing, and commercializing therapies using autologous tumor infiltrating lymphocytes (TIL), totaling $32.77 million. The company focuses on treating metastatic melanoma and other solid tumor cancers in the U.S.

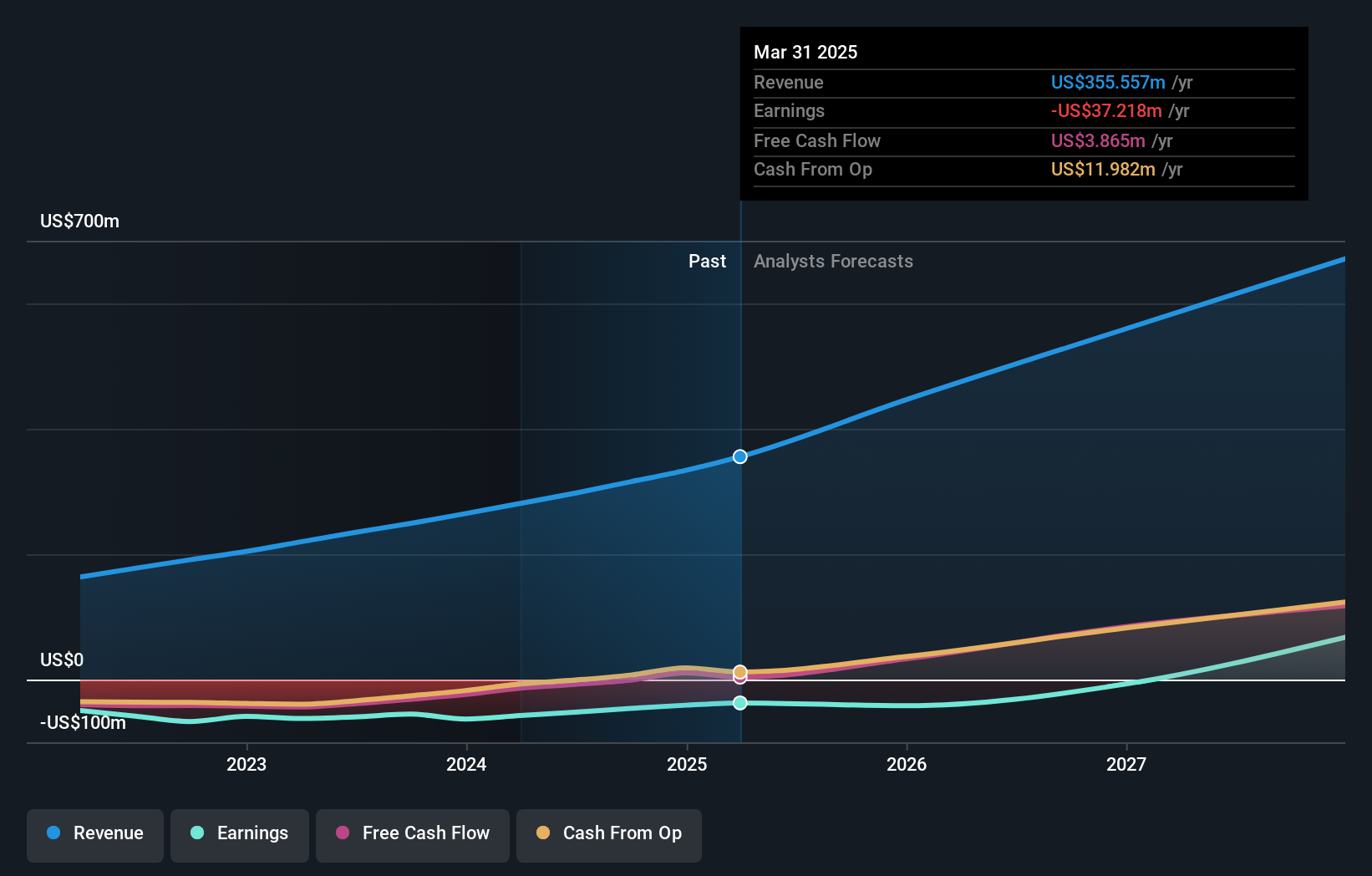

Iovance Biotherapeutics is making significant strides in the biotech sector, with a notable 45.6% annual revenue growth forecasted, outpacing the broader market's 8.8%. Their recent Q2 results show revenue surging to $31.11 million from $0.238 million a year ago, although they still reported a net loss of $97.1 million. The company's R&D expenses reflect strong investment in innovation, crucial for advancing their therapies; they spent approximately 66% of their revenue on R&D activities last year.

- Click here and access our complete health analysis report to understand the dynamics of Iovance Biotherapeutics.

Evaluate Iovance Biotherapeutics' historical performance by accessing our past performance report.

Alkami Technology (NasdaqGS:ALKT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market cap of $3.34 billion.

Operations: Alkami Technology, Inc. generates revenue primarily through its Internet Software & Services segment, which brought in $297.36 million. The company's solutions cater to digital banking needs within the United States.

Alkami Technology has shown robust revenue growth, with a 21.4% annual increase forecasted, outpacing the broader US market's 8.8%. Their recent Q2 results reported $82.16 million in sales, up from $65.76 million a year ago, while net loss narrowed to $12.32 million from $17.76 million last year. The company is heavily investing in innovation; R&D expenses were significant but necessary for advancing their digital banking solutions and fraud prevention technologies. Alkami's implementation of credential stuffing protection enhances security for financial institutions amid rising cyber threats, reflecting their commitment to proactive fraud mitigation strategies compliant with WCAG 2.1 Level AA standards for accessibility. Additionally, the company's partnership extension with Mountain America Credit Union underscores the value of Alkami’s digital banking platform and data solutions in improving user experience and operational efficiency for regional financial institutions.

- Click to explore a detailed breakdown of our findings in Alkami Technology's health report.

Explore historical data to track Alkami Technology's performance over time in our Past section.

Turning Ideas Into Actions

- Investigate our full lineup of 248 US High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPF

AppFolio

Provides cloud business management solutions for the real estate industry in the United States.

Flawless balance sheet with high growth potential.