- United States

- /

- Software

- /

- NasdaqGS:ADBE

Adobe’s AI Expansion and Google Partnership Might Change The Case For Investing In Adobe (ADBE)

Reviewed by Sasha Jovanovic

- At Adobe MAX 2025, Adobe announced a sweeping set of new AI-powered tools across its Creative Cloud applications and revealed expanded partnerships with Google Cloud and YouTube to integrate industry-leading generative AI models and enable direct content publishing for creators. These updates include new AI assistants, improved video and image generation capabilities, enhanced enterprise content supply chain solutions, and the rollout of customizable, brand-specific AI models for both professionals and businesses.

- The collaboration with Google Cloud and YouTube stands out, as it brings together cutting-edge AI technology with Adobe’s creative software, offering users greater flexibility, efficiency, and access to a wider ecosystem of advanced generative models.

- We'll examine how Adobe's integration of Google’s advanced AI models into its creative apps could reshape the company's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Adobe Investment Narrative Recap

To be an Adobe shareholder, you need to believe that the company's rapid AI innovation, especially the integration of third-party models through Creative Cloud, will help Adobe maintain its leadership as creators' needs evolve. The recent Adobe MAX updates, such as new partnerships with Google Cloud and YouTube, showcase Adobe's focus on expanding its ecosystem and product reach. However, in the short term, the biggest catalyst remains continued product adoption among professionals and enterprises, while execution complexity in integrating multiple AI models is an ongoing risk. At this stage, these announcements do not appear to materially change the company’s most immediate risks or catalysts.

The expanded partnership with Google Cloud, giving Adobe customers access to powerful generative AI models directly in their preferred apps, stands out as especially relevant. As organizations seek to create more content across channels, this collaboration could help streamline creative workflows and improve adoption of Adobe’s new subscription offerings, an area closely linked to growth catalysts. The impact will depend on how smoothly Adobe can blend partner models with its core products without adding friction for users or operational complexity behind the scenes.

But, while AI might unlock new opportunities, investors should be aware that increased reliance on external partners can also...

Read the full narrative on Adobe (it's free!)

Adobe's outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This projection is based on a 9.0% annual revenue growth rate and a $1.8 billion increase in earnings from the current $6.9 billion level.

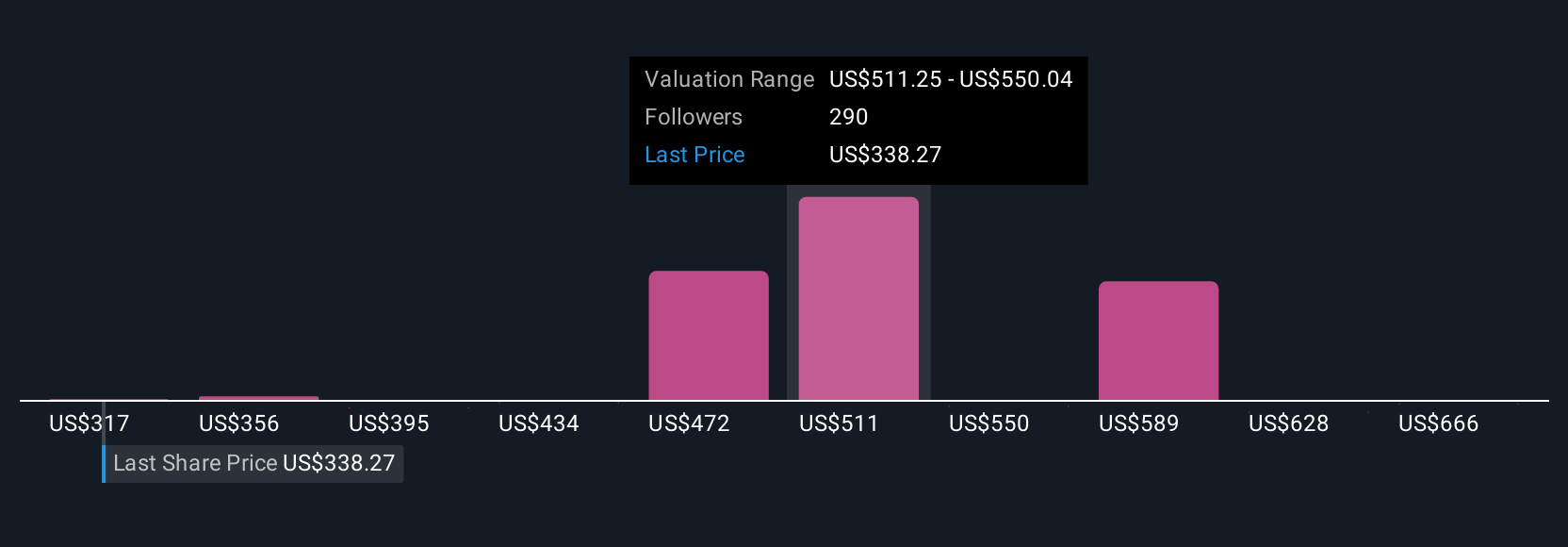

Uncover how Adobe's forecasts yield a $456.18 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Some of the lowest analyst forecasts before this news expected Adobe’s revenue to grow just 7 percent annually and profit margins to drop slightly. These analysts are far more cautious about risks around AI execution and user adoption, so it’s worth exploring how much your own views align with their more reserved expectations, and considering if the latest product launches might change those assumptions.

Explore 87 other fair value estimates on Adobe - why the stock might be worth as much as 83% more than the current price!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

No Opportunity In Adobe?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives