- United States

- /

- Semiconductors

- /

- NYSEAM:INTT

inTEST (INTT) Discounted Sales Multiple Contrasts With Persistent Losses, Tempering Bullish Narratives

Reviewed by Simply Wall St

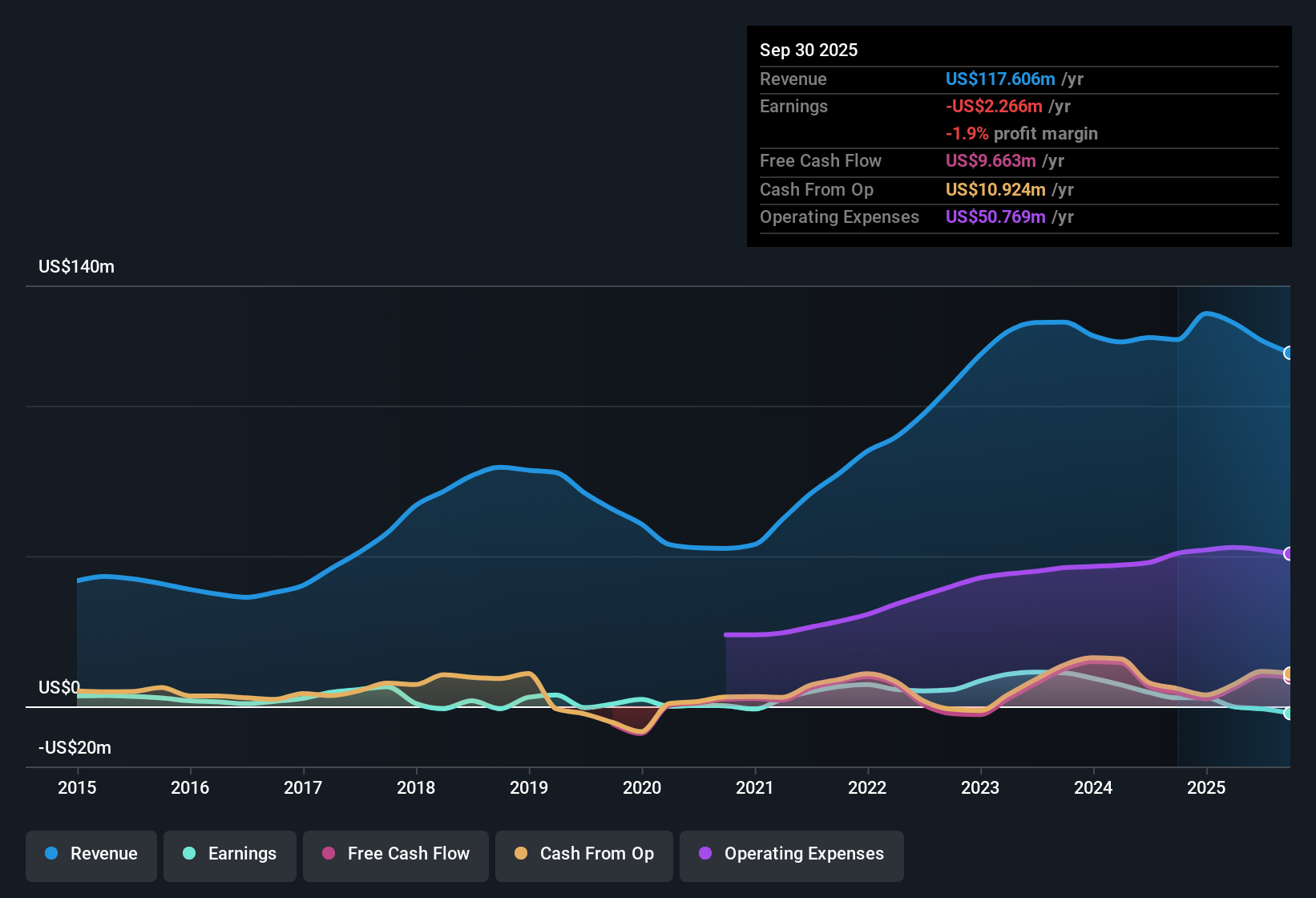

inTEST (INTT) remains in the red, not posting a positive net profit margin this period, but has managed to trim annual losses by 1.4% per year over the past five years. Revenue is forecasted to rise at a 6% annual rate, trailing the broader US market’s 10.5% pace. Analysts project the company will stay unprofitable over the next three years. The key backdrop for investors is that growth is moderate and profitability continues to lag. However, a discounted sales multiple could intrigue value-focused buyers.

See our full analysis for inTEST.Next, we put these fresh results head-to-head with the most widely held narratives about INTT to see what the numbers confirm and where the story starts to shift.

See what the community is saying about inTEST

Margins Firm Up Despite Losses

- Gross margin improved sequentially by 110 basis points in the most recent quarter, even as net profit margin stayed negative and the company was not yet profitable.

- According to analysts' consensus view, operational efficiencies, along with geographic expansion such as the Malaysia facility, are expected to help drive margin improvement and future revenue growth.

- This latest margin uptick supports consensus that enhanced production capabilities and cost controls can strengthen long-term profitability, even if unprofitability persists for now.

- However, temporary cost savings may reverse as scaling up resumes. This is a potential risk if top-line growth does not materialize as anticipated.

To see how consensus is shaping up as INTT navigates these changes, check out the latest complete view in the community narrative: 📊 Read the full inTEST Consensus Narrative..

Value Case: Sales Multiple at 0.8x

- INTT is trading at a Price-to-Sales Ratio of 0.8x, which is less than half its peer group average of 1.8x and significantly below the US semiconductor industry average of 4.9x.

- Analysts' consensus observes that despite this deep discount, the current trading price of $8.35 sits above the DCF fair value of $6.02 and below the consensus target of $11.00.

- This creates an unusual tension. Value-focused investors see relative upside on a sales multiple basis, but only if ongoing losses eventually reverse and revenue momentum meets expectations.

- On the other hand, persistent unprofitability or weaker-than-expected revenue growth could keep the stock stuck below both industry averages and bullish analyst targets.

Geographic & Market Diversification Progress

- Recent and planned expansion in Malaysia and Europe is designed to help inTEST capture cost efficiencies, hedge against tariffs, and reduce dependence on cyclical semiconductor demand.

- Analysts' consensus points out that diversification into defense, automotive/EV, life sciences, and security markets is yielding more stable orders and reduces cyclicality.

- Progress here aligns with consensus hopes for increased revenue resilience and higher-margin growth, particularly if capital spending picks up in these new verticals.

- Conversely, if core end-markets like semiconductors remain weak and diversification efforts stall, the story could quickly shift towards risk rather than reward.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for inTEST on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from a different angle? Take a few minutes to turn your perspective into a unique story of your own. Do it your way

A great starting point for your inTEST research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While INTT’s discounted valuation is appealing, persistent unprofitability and uneven revenue growth raise concerns about its ability to deliver steady long-term returns.

If you want more predictable performance, use stable growth stocks screener (2074 results) to focus on companies with consistent revenue and earnings expansion regardless of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if inTEST might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:INTT

inTEST

Provides test and process technology solutions for use in manufacturing and testing in automotive, defense/aerospace, industrial, life sciences, security, and semiconductor markets in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives