- United States

- /

- Semiconductors

- /

- NYSE:Q

Qnity Electronics (Q): Assessing Valuation After Strong Q3 AI-Driven Sales Growth and Updated Guidance

Reviewed by Simply Wall St

Qnity Electronics (Q) grabbed attention after announcing estimated third-quarter results that showed double-digit sales growth and rising profitability, supported by a surge in AI-related demand. The company also raised its full-year sales estimate.

See our latest analysis for Qnity Electronics.

The backdrop for Qnity Electronics includes a recent quarterly dividend announcement and a delay in SEC filings, but market focus remains firmly on the company’s strong AI-driven results and raised sales outlook. Even so, the share price return year-to-date is down 21.4%, showing sentiment is still recovering as investors weigh new growth potential against ongoing risks. Momentum could build if operational follow-through matches these upbeat numbers.

If you’re watching Qnity’s momentum shift, this could be an ideal time to discover other dynamic tech and AI stocks through our curated list: See the full list for free.

With shares still down sharply despite improved results, investors now face a pivotal question: does Qnity Electronics represent an undervalued play on future AI demand, or has the market already priced in its best days?

Price-to-Earnings of 19.8x: Is it justified?

Qnity Electronics trades at a price-to-earnings (P/E) ratio of 19.8x, considerably lower than both the U.S. semiconductor industry average and direct peers. This suggests the market is pricing in uncertainty or slower growth expectations despite Qnity’s recent financial improvements.

The price-to-earnings ratio is a standard market measure of how much investors are willing to pay for a company’s earnings. For tech and semiconductor firms, where future earnings growth is often the main draw, a lower P/E can indicate skepticism around sustainability or outlook, especially when contrasted against industry norms.

Qnity’s P/E ratio sits well below the industry average of 34.1x and the peer average of 39.5x. This highlights a sizeable valuation gap and raises the question of whether the market is overlooking Qnity’s recent momentum or correctly discounting future growth concerns. If the company delivers on its profitability improvements and AI-driven demand, its P/E could potentially trend closer to sector levels.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.8x (UNDERVALUED)

However, several risks remain, including ongoing regulatory delays and the market’s continued reluctance to reward early signs of an AI-driven turnaround.

Find out about the key risks to this Qnity Electronics narrative.

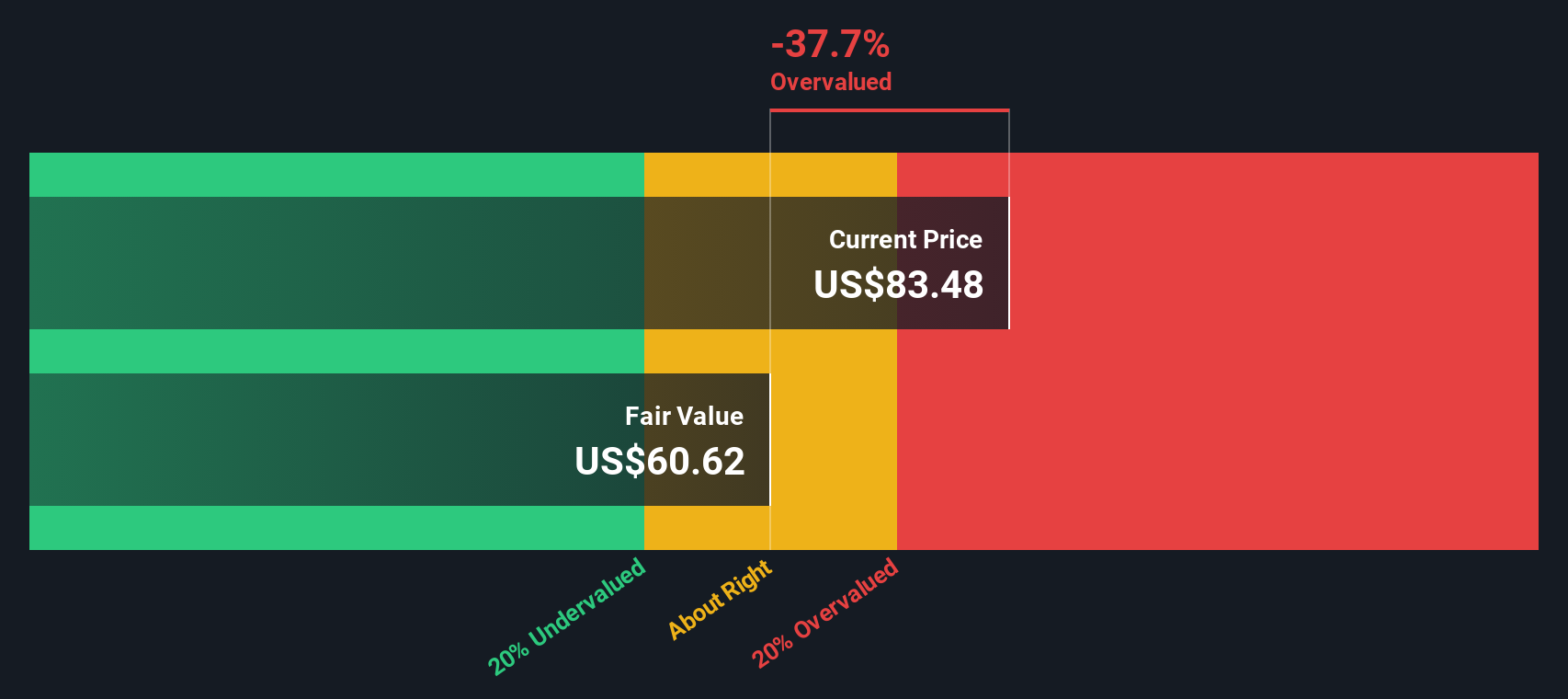

Another View: Discounted Cash Flow

Taking a different approach, our DCF model values Qnity Electronics at $62.54 per share, which is below the current price of $74.90. This suggests the stock may actually be overvalued when based on projected future cash flows rather than earnings. This raises the question of whether this challenges the optimism seen in its earnings-based valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Qnity Electronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Qnity Electronics Narrative

If you’d rather dive into the details or reach your own conclusion, you can assemble your personalized view of Qnity Electronics in just a few minutes, your way: Do it your way.

A great starting point for your Qnity Electronics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Unlock fresh stock ideas and never let the next big opportunity pass you by. Let these handpicked screens guide you to unique sectors and trends every investor is watching.

- Boost your portfolio's income potential by adding steady performers from these 16 dividend stocks with yields > 3% known for delivering robust yields above 3%.

- Tap cutting-edge medical breakthroughs and innovation by reviewing these 30 healthcare AI stocks that are transforming healthcare through artificial intelligence.

- Capitalize on emerging tech trends and stay ahead of market shifts with these 25 AI penny stocks in fast-growing AI-focused companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qnity Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:Q

Qnity Electronics

Provides materials and solutions to the semiconductor and electronics industries worldwide.

Flawless balance sheet and fair value.

Market Insights

Community Narratives