- United States

- /

- Semiconductors

- /

- NYSE:JKS

Could JinkoSolar (JKS) Use Advanced Recycling Initiatives to Strengthen Its Industry Position?

Reviewed by Sasha Jovanovic

- Trinity Energy recently announced the installation of approximately 1,000 JinkoSolar EAGLE G6 solar modules at a Costco Warehouse in Richland, Washington, with the project enrolled in JinkoSolar’s EAGLE Preserve recycling program, the state's first approved solar sustainability initiative.

- This partnership highlights a significant move toward sustainable solar adoption, as JinkoSolar will collect and recycle end-of-life modules at no cost to Costco or Trinity, underscoring a growing industry focus on responsible product lifecycle management.

- Next, we'll examine how JinkoSolar’s new EAGLE Preserve recycling initiative could influence the company’s long-term growth narrative and industry positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

JinkoSolar Holding Investment Narrative Recap

To own JinkoSolar stock, an investor must believe in the company’s ability to drive profitability by improving efficiency and capitalizing on demand for advanced solar products, despite competitive pricing pressures and policy-related risks. The Trinity Energy partnership and EAGLE Preserve recycling initiative signals JinkoSolar’s commitment to responsible growth, but this news has limited immediate effect on the company’s biggest short-term catalyst, cost reduction and supply chain optimization, and does little to alleviate margin risks from U.S. trade and pricing headwinds.

Among recent highlights, JinkoSolar’s July 2025 commissioning of 21.6 MWh of Energy Storage Systems in Massachusetts connects directly to its core growth catalyst: expanding clean energy solutions and diversifying revenue globally. This reflects ongoing efforts to adapt and lead in a rapidly evolving market, supporting the company’s long-term value proposition even as near-term profitability challenges persist.

However, it’s important for investors to recognize that while these positive developments are encouraging, the company’s exposure to unpredictable U.S. policy shifts remains a key factor that could influence...

Read the full narrative on JinkoSolar Holding (it's free!)

JinkoSolar Holding's outlook anticipates CN¥124.9 billion in revenue and CN¥382.9 million in earnings by 2028. This implies a 14.6% annual revenue growth rate and an increase in earnings of about CN¥2.3 billion from the current CN¥-1.9 billion.

Uncover how JinkoSolar Holding's forecasts yield a $37.42 fair value, a 30% upside to its current price.

Exploring Other Perspectives

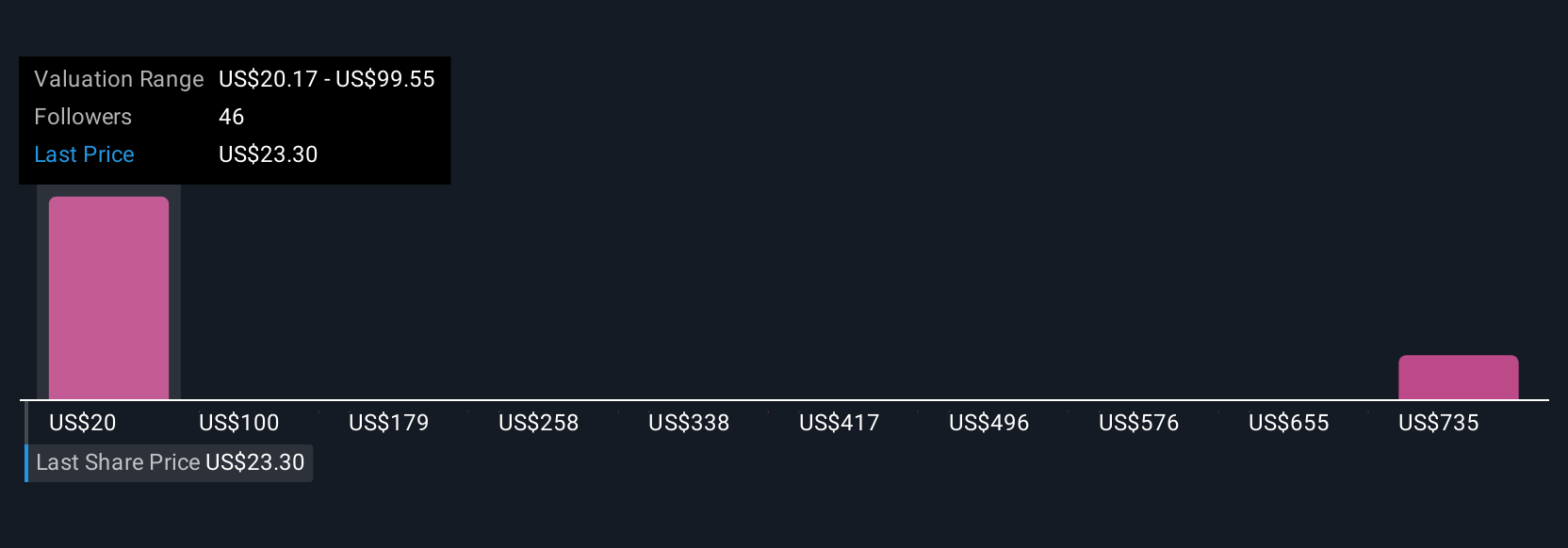

Simply Wall St Community fair value estimates for JinkoSolar range widely from US$20.17 to US$177.75 per share, based on 4 diverse opinions. Some see cost reduction and global efficiency efforts as a key driver for future performance, but investors should compare multiple perspectives to understand how profitability goals might be impacted by industry and policy shifts.

Explore 4 other fair value estimates on JinkoSolar Holding - why the stock might be worth over 6x more than the current price!

Build Your Own JinkoSolar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JinkoSolar Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JinkoSolar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JinkoSolar Holding's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives