- United States

- /

- Semiconductors

- /

- NYSE:DQ

Will Daqo New Energy's (DQ) Polysilicon Output Surge Shift Profitability Trends?

Reviewed by Sasha Jovanovic

- Daqo New Energy released its third quarter 2025 results in late October, reporting a polysilicon production volume of 30,650 MT and quarterly sales of US$244.6 million, alongside updated guidance for fourth quarter and full-year 2025 output.

- An interesting detail is that while the company significantly ramped up production and narrowed net loss compared to the previous year, overall sales for the first nine months fell versus the prior period, and it remained unprofitable.

- We’ll now explore how Daqo’s increased production outlook and narrowed losses impact its overall investment narrative and future growth prospects.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Daqo New Energy Investment Narrative Recap

To be a shareholder in Daqo New Energy, you need to believe that global solar demand and regulatory support can eventually restore balance in the polysilicon market, enabling the company to monetize its rising production. The recent Q3 results, while indicating improved production and narrowed net losses, do not materially shift the immediate risks, most notably, persistent industry overcapacity and weak selling prices remain the biggest hurdles in the short term.

Among the latest updates, Daqo’s revised fourth quarter and full-year 2025 polysilicon production guidance stands out: management now expects between 121,000 MT and 124,000 MT for the year. This continued ramp-up underscores the importance of industry-wide supply discipline as a catalyst for improving utilization rates and eventual margin recovery. Despite these operational improvements, investors should also be mindful of the potential impact if excess global capacity lingers...

Read the full narrative on Daqo New Energy (it's free!)

Daqo New Energy's outlook projects $2.4 billion in revenue and $226.9 million in earnings by 2028. This scenario is based on analysts expecting a 58.5% annual revenue growth rate and an increase in earnings of $616 million from the current level of -$389.2 million.

Uncover how Daqo New Energy's forecasts yield a $28.53 fair value, a 13% downside to its current price.

Exploring Other Perspectives

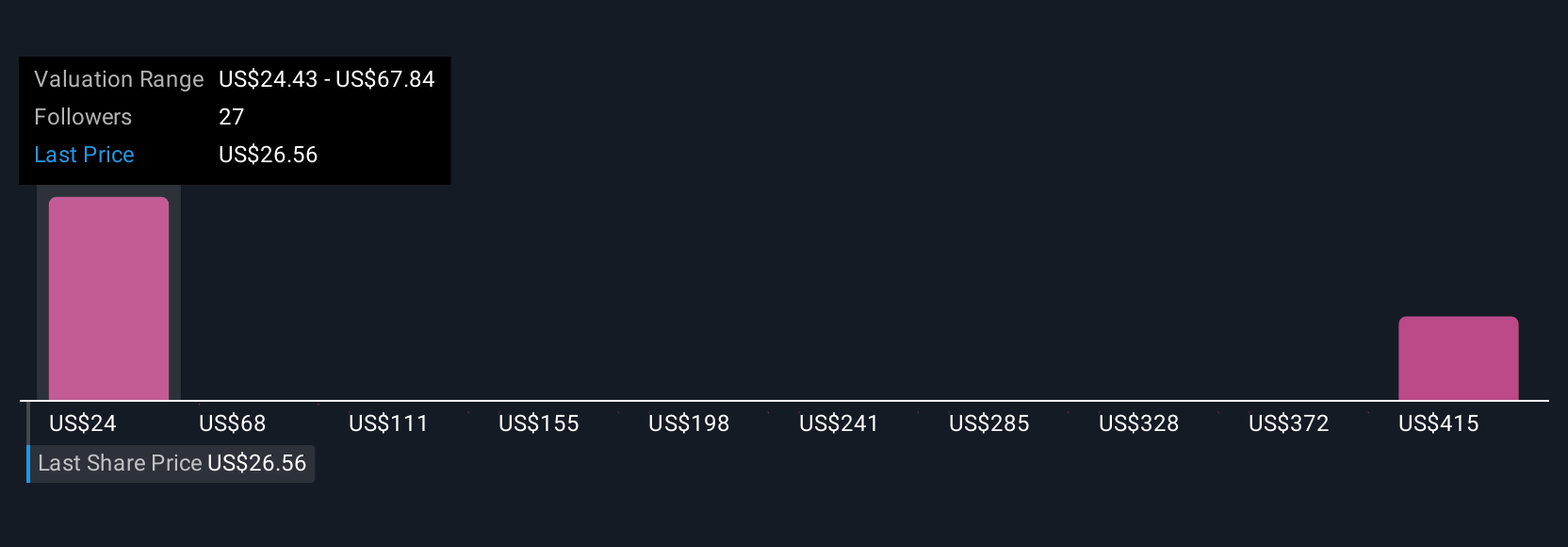

Four individual estimates from the Simply Wall St Community place Daqo’s fair value anywhere between US$28.53 and US$466.80 per share. With such contrasts in opinion, keep in mind that ongoing industry overcapacity remains a key issue as you consider these diverse viewpoints.

Explore 4 other fair value estimates on Daqo New Energy - why the stock might be worth 13% less than the current price!

Build Your Own Daqo New Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daqo New Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Daqo New Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daqo New Energy's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DQ

Daqo New Energy

Manufactures and sells polysilicon to photovoltaic product manufacturers in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives