- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

Could Summit Wireless Technologies, Inc.'s (NASDAQ:WISA) Investor Composition Influence The Stock Price?

The big shareholder groups in Summit Wireless Technologies, Inc. (NASDAQ:WISA) have power over the company. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

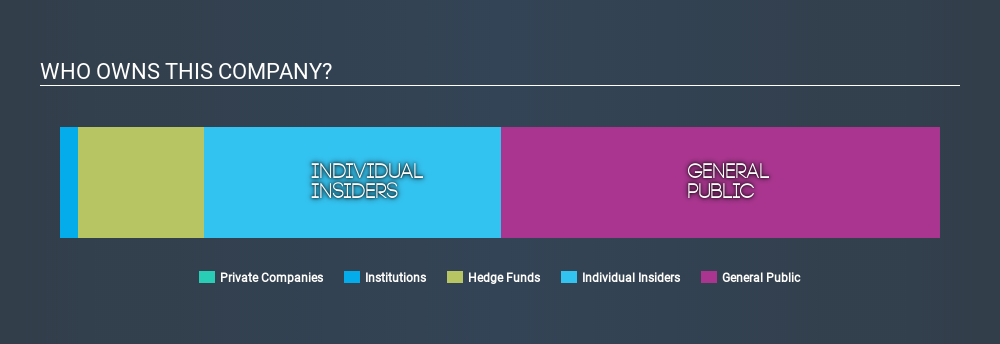

With a market capitalization of US$9.0m, Summit Wireless Technologies is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions are not really that prevalent on the share registry. We can zoom in on the different ownership groups, to learn more about Summit Wireless Technologies.

View our latest analysis for Summit Wireless Technologies

What Does The Institutional Ownership Tell Us About Summit Wireless Technologies?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

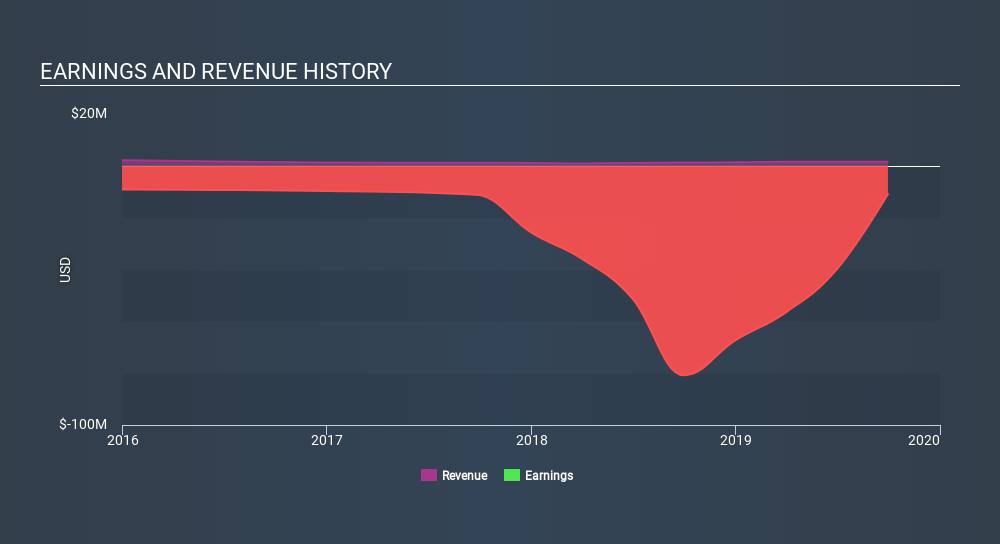

Since institutions own under 5% of Summit Wireless Technologies, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

It would appear that 14% of Summit Wireless Technologies shares are controlled by hedge funds. That catches my attention because hedge funds sometimes try to influence management, or bring about changes that will create near term value for shareholders. Looking at our data, we can see that the largest shareholder is Lisa Walsh with 23% of shares outstanding. The second and third largest shareholders are Medalist Partners LP and Carl Berg, holding 8.2% and 6.5%, respectively.

A closer look at our ownership figures suggests that the top 20 shareholders have a combined ownership of 50% implying that no one share holder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There is some analyst coverage of the stock, but it could still become more well known, with time.

Insider Ownership Of Summit Wireless Technologies

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board; and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board, themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of Summit Wireless Technologies, Inc.. Insiders own US$3.0m worth of shares in the US$9.0m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 50% ownership, the general public have some degree of sway over WISA. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Summit Wireless Technologies better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Summit Wireless Technologies (of which 3 don't sit too well with us!) you should know about.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives