- United States

- /

- Semiconductors

- /

- NasdaqGS:TXN

Texas Instruments (TXN) Valuation in Focus After Q3 Results and Updated Guidance

Reviewed by Simply Wall St

Texas Instruments (TXN) caught attention after releasing its third-quarter financial results, which showed sales growth and stable net income year-over-year. The company also shared earnings and revenue forecasts for the upcoming quarter, which will likely shape investor sentiment.

See our latest analysis for Texas Instruments.

Despite recent upbeat earnings and new guidance, Texas Instruments’ share price has continued to lose ground. The stock has fallen 10.5% over the past month and is down 13.6% year-to-date. While long-term total shareholder return remains positive, recent momentum has clearly faded.

If you want to spot more compelling opportunities in semiconductors and tech, now is an ideal time to discover See the full list for free.

Given Texas Instruments’ recent results and tempered outlook, investors may be weighing whether the current dip signals an undervalued opportunity or if the market has already factored in every bit of foreseeable growth.

Most Popular Narrative: 15.2% Undervalued

With the fair value pegged at $190.31, Texas Instruments is trading notably below the narrative forecast, compared to its last close at $161.46. The valuation debate heats up as analysts reflect on the company’s resilient financials and disciplined operating strategy.

Strategic investment in U.S.-based 300mm wafer fabs and a diversified global manufacturing footprint uniquely position TI to benefit from evolving supply chain localization and customer preferences for geopolitically resilient suppliers. This advantage is likely to help win incremental business, strengthen preferred supplier status, and improve long-term gross margins and pricing power.

Curious what’s fueling this premium? The narrative leans heavily on certain forward projections about TI’s revenue momentum and margin trajectory. Think you know which numbers tip the scale? See the underlying trends and assumptions shaping this bold fair value outlook.

Result: Fair Value of $190.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure and rising competition could undermine the optimistic outlook if demand fails to rebound as quickly as expected.

Find out about the key risks to this Texas Instruments narrative.

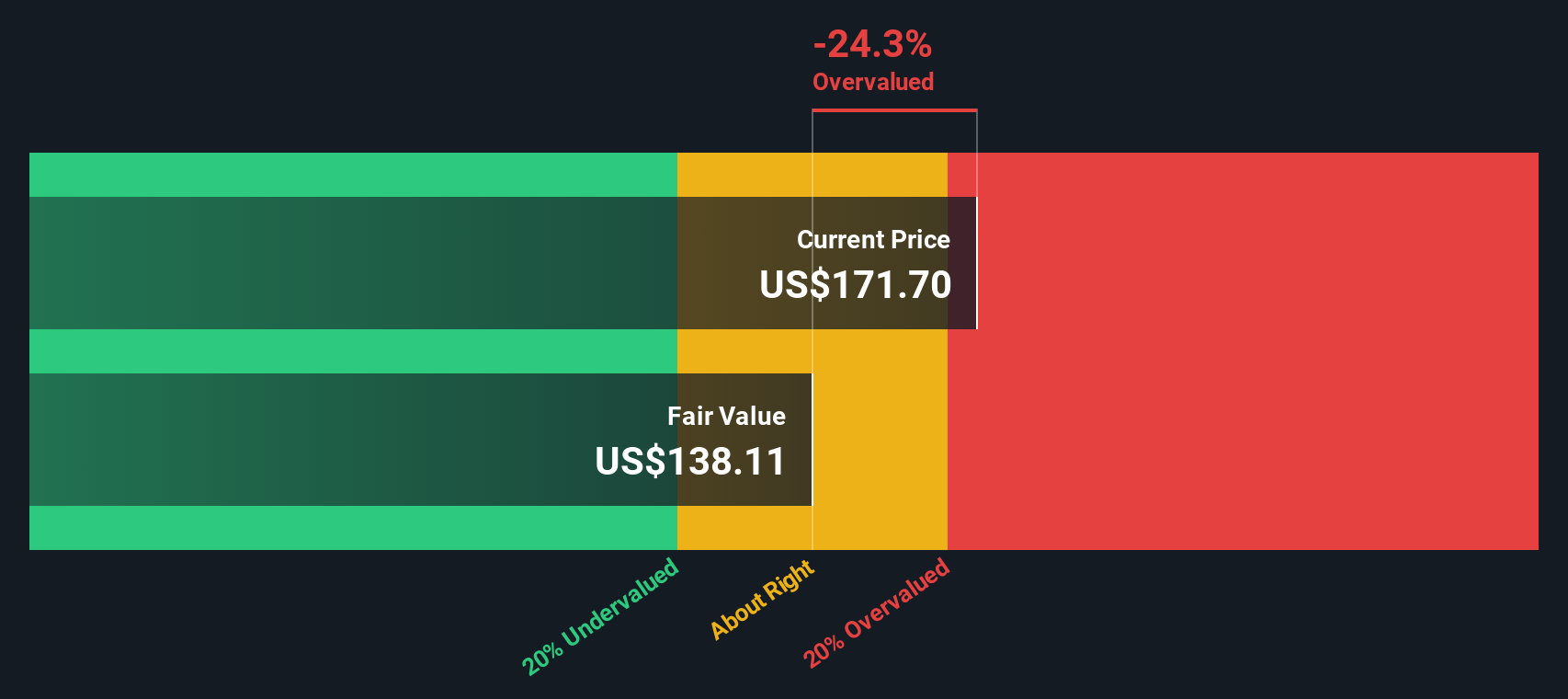

Another View: SWS DCF Model Insight

Not all valuations point in the same direction. Our SWS DCF model offers a different perspective by estimating future cash flows and discounting them to the present. According to this method, Texas Instruments currently trades above our model's fair value. Could the market be overestimating its comeback potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Instruments Narrative

If you want a different angle or prefer hands-on analysis, you can dig into the data and shape your own narrative in minutes. Do it your way

A great starting point for your Texas Instruments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Smarter Investment Moves?

Confidently grow your portfolio by tapping into handpicked stock ideas most investors never see. Don’t let the best opportunities slip by; get ahead with fresh picks now.

- Boost your income potential and start building wealth today with these 22 dividend stocks with yields > 3% offering attractive yields above 3%.

- Uncover the future powerhouses of artificial intelligence by checking out these 26 AI penny stocks poised for rapid growth as the AI revolution accelerates.

- Step into the next wave of finance and innovation by exploring these 81 cryptocurrency and blockchain stocks transforming global markets with blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXN

Texas Instruments

Designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States, China, rest of Asia, Europe, Middle East, Africa, Japan, and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives