- United States

- /

- Semiconductors

- /

- NasdaqCM:TGAN

Revenues Tell The Story For Transphorm, Inc. (NASDAQ:TGAN)

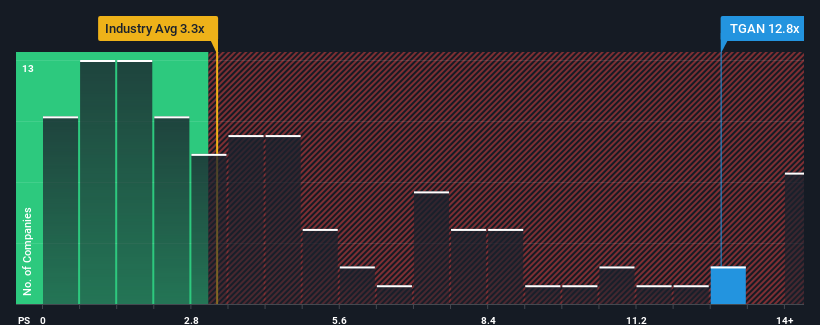

When close to half the companies in the Semiconductor industry in the United States have price-to-sales ratios (or "P/S") below 3.3x, you may consider Transphorm, Inc. (NASDAQ:TGAN) as a stock to avoid entirely with its 12.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Transphorm

What Does Transphorm's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Transphorm's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Transphorm's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Transphorm's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 3.4%, the company is positioned for a stronger revenue result.

With this information, we can see why Transphorm is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Transphorm's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Transphorm maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Transphorm (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of Transphorm's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Transphorm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TGAN

Transphorm

A semiconductor company, develops, manufactures, and sells gallium nitride (GaN) semiconductor components for high voltage power conversion applications in Mainland China, Hong Kong, Taiwan, the United States, Japan, South Korea, India, and Europe.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives