- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Synaptics (SYNA): Assessing Valuation After New Earnings and Forward Guidance Reveal Operational Progress

Reviewed by Simply Wall St

Synaptics (SYNA) just released its first quarter results, showing higher sales and a narrower net loss compared to last year. Alongside the report, management issued new guidance for the coming quarter.

See our latest analysis for Synaptics.

Synaptics shares have seen a bit of a rebound recently, notching a 1-month share price return of 10%. However, the year-to-date performance tells a more challenging story with shares still down 17%. Even with the steady flow of news, including earnings, fresh guidance, and the recent shelf registration filing, investors appear to be weighing the company’s improved sales against lingering longer-term headwinds. This is reflected in the 1-year total shareholder return of -13% and an even steeper three-year decline.

If Synaptics’ latest moves have you watching the semiconductor space, consider expanding your search and check out See the full list for free. for more growth stories in the tech sector.

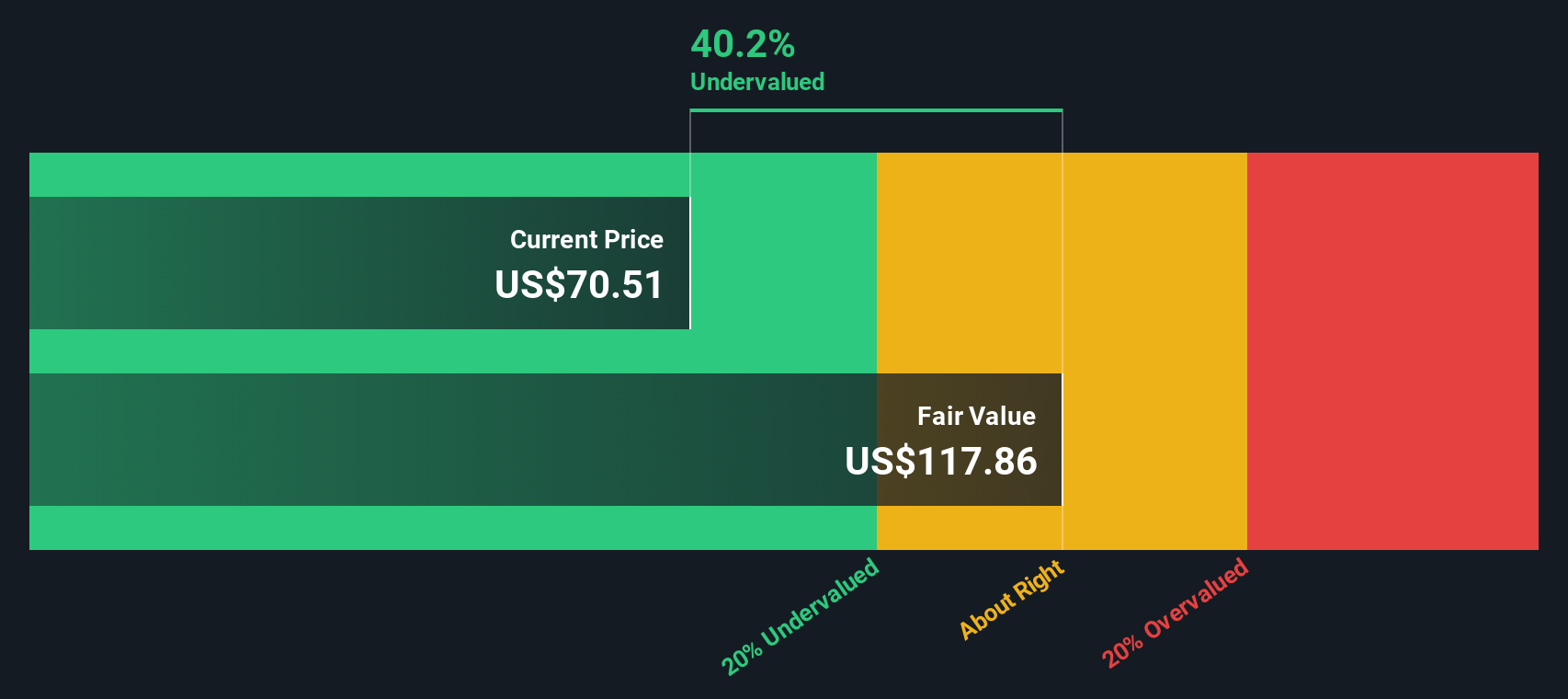

With analyst price targets pointing to possible upside while Wall Street consensus hovers at Hold, the question becomes whether Synaptics could be undervalued after its recent slide, or if the outlook is already factored into the share price.

Most Popular Narrative: 17.1% Undervalued

The prevailing narrative sees Synaptics’ fair value at $82.25, meaning the stock’s previous close around $68 suggests notable upside. Here is what is driving that projection and what it could mean for future expectations.

Synaptics' accelerated focus on Core IoT, evidenced by 53% YoY growth in FY25 and a strong pipeline of Wi-Fi 7 and Edge AI products, positions the company to benefit from the expanding proliferation of connected devices across industrial, enterprise, and consumer markets. This expansion should boost top-line revenue and reduce dependency on legacy markets.

The launch and initial customer traction of native Edge AI processors (Astra family, featuring Google Research collaboration and neural transformer support) targets the growing shift toward on-device processing for AI workloads. This could establish Synaptics as a key supplier for next-generation IoT applications and improve both revenue growth and product differentiation.

Curious why analysts see so much promise here? The most influential driver is a roadmap betting on new tech, bigger margins, and high-value customers. Find out which future leaps and bold financial assumptions are packed into the full valuation game plan to see what sets this narrative apart from the usual price targets.

Result: Fair Value of $82.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential divestitures or slower customer ramp-up could hinder Synaptics’ growth expectations and prompt a reassessment of the current bullish outlook.

Find out about the key risks to this Synaptics narrative.

Another View: Discounted Cash Flow Tells a Different Story

While analysts see upside based on earnings potential and market multiples, the SWS DCF model suggests Synaptics may actually be overvalued at current prices. According to this method, the fair value lies below the current share price. This raises the question: could analyst optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Synaptics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Synaptics Narrative

If you want to chart your own path or have a different take on Synaptics, you can craft your own view using the latest information in just a few minutes. Do it your way

A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing toolkit beyond Synaptics and take action on smarter opportunities you might be missing. These featured lists can help you target your next winner:

- Boost your income by targeting reliable yields. Start with these 16 dividend stocks with yields > 3% for stocks delivering over 3% returns.

- Seize the momentum in artificial intelligence and gain an edge with the inside track on these 24 AI penny stocks shaping tomorrow’s tech landscape.

- Tap into breakthrough innovations and emerging leaders by screening for these 28 quantum computing stocks pushing the boundaries of computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives