- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Does Recent Semiconductor Optimism Present an Opportunity in Synaptics Stock for 2025?

Reviewed by Bailey Pemberton

- Curious whether Synaptics stock is undervalued, overhyped, or hiding an opportunity most investors are missing? You are not alone; plenty of people are wondering the same thing.

- The stock has had a choppy ride lately, slipping 2.6% in the last week but gaining 4.5% over the past month, and is still down 16.8% year-to-date. These swings hint at shifting perceptions around growth and risk.

- Recent news in the semiconductor space, such as industry consolidation and fresh optimism about AI-powered devices, has added fuel to debates about Synaptics’ future. While headlines might boost short-term sentiment, they can also increase volatility as investors try to gauge long-term potential.

- On our 6-point value assessment, Synaptics scores a 6 out of 6 for undervaluation, meaning it passes every value check we run. Let’s break down how we get to that number and why a smarter approach to valuation awaits you at the end of this article.

Find out why Synaptics's -8.1% return over the last year is lagging behind its peers.

Approach 1: Synaptics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting those back to today’s value. This approach helps investors look beyond current earnings or market sentiment and instead focus on long-term fundamentals.

For Synaptics, we begin with its latest twelve-month Free Cash Flow (FCF) of $40.8 Million. Analysts forecast rapid growth, projecting FCF to reach $156.7 Million in 2026 and $233.3 Million by 2027. Beyond 2027, cash flow projections are extrapolated, reaching an estimated $581.4 Million by 2035. All values are in US dollars.

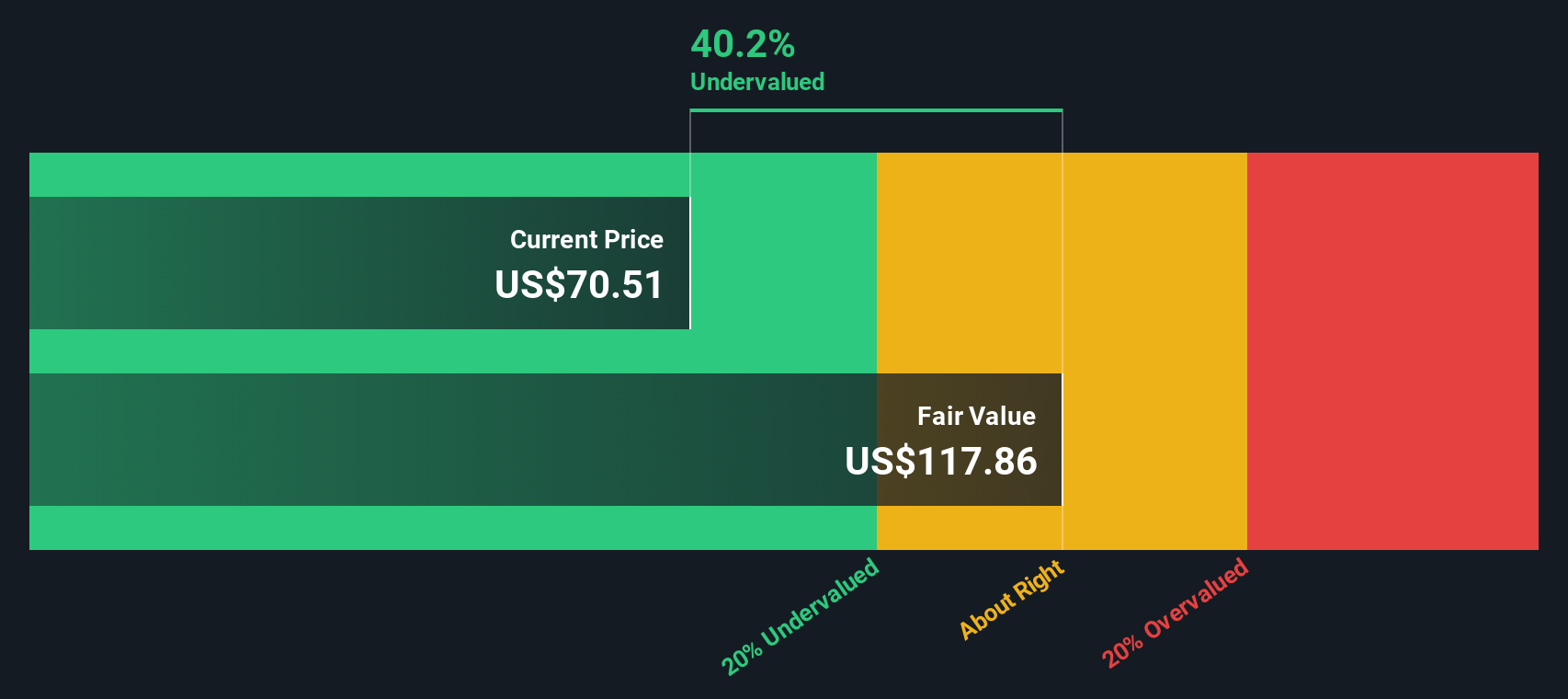

Based on these projections, the DCF model calculates a fair value per share of $109.48. Compared to the current share price, this represents a 37.3% discount. This signals that Synaptics stock may be significantly undervalued from a cash flow perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synaptics is undervalued by 37.3%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Synaptics Price vs Sales

The price-to-sales (P/S) ratio is a popular valuation metric because it allows investors to gauge how much they are paying for every dollar of a company’s sales. This multiple is especially helpful for growing tech companies like Synaptics, where profits can fluctuate due to heavy R&D investment and market cycles. Revenue often provides a more stable indicator of underlying business momentum.

Growth expectations and risk play key roles in what investors consider a “normal” or “fair” P/S ratio. High-growth companies typically command higher P/S multiples, reflecting optimism about future expansion and profitability. Conversely, if the outlook is uncertain or risk is elevated, investors usually demand a discount.

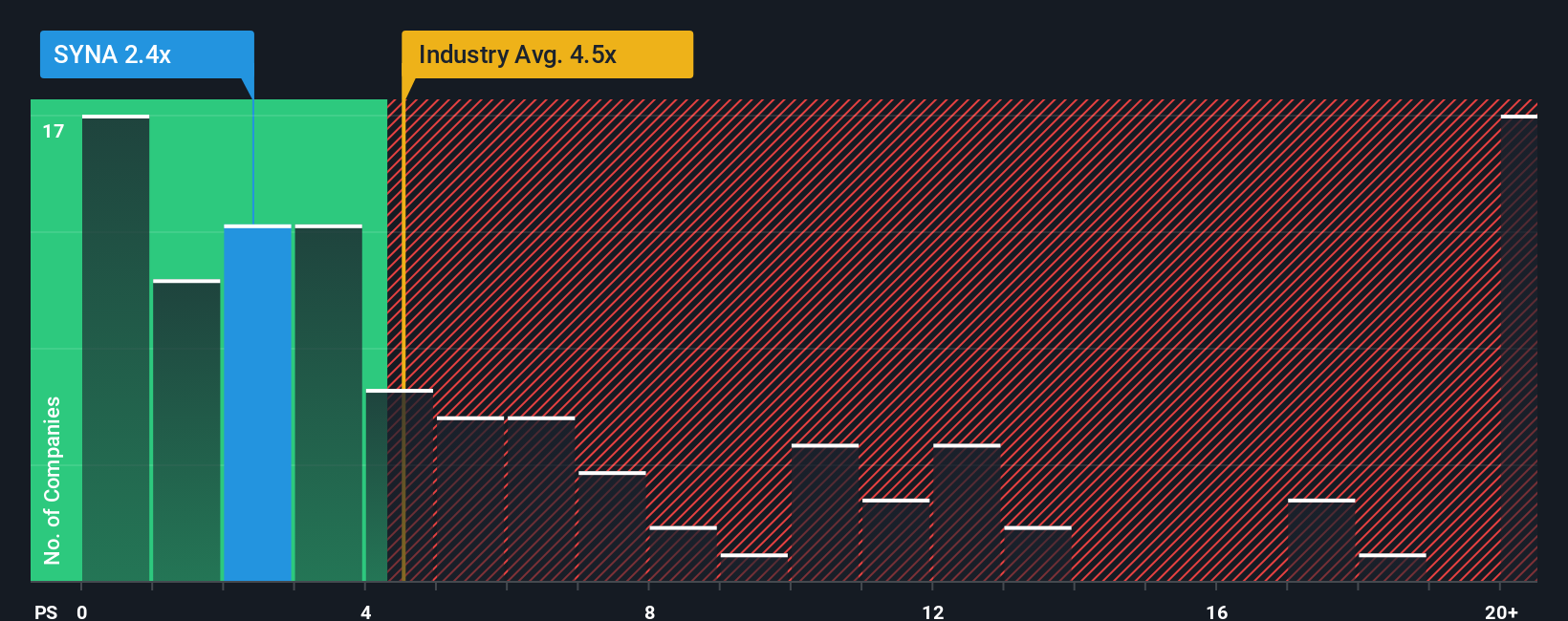

Currently, Synaptics trades at a P/S ratio of 2.49x. This is notably lower than both the semiconductor industry average of 4.44x and the average of key peers at 4.02x. This suggests the market may be discounting Synaptics’ prospects relative to its competitors.

Instead of simply comparing these static multiples, Simply Wall St’s Fair Ratio provides a more nuanced benchmark. The Fair Ratio for Synaptics stands at 3.09x, reflecting not only its growth and profit margin, but also its size, industry dynamics, and unique business risks. Because this proprietary measurement weighs relevant company-specific factors, it offers investors a better guide than raw peer or industry averages.

When comparing Synaptics’ current P/S of 2.49x to the Fair Ratio of 3.09x, the stock appears undervalued by this measure. This may suggest that the market is overlooking some of its strengths or long-term potential.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synaptics Narrative

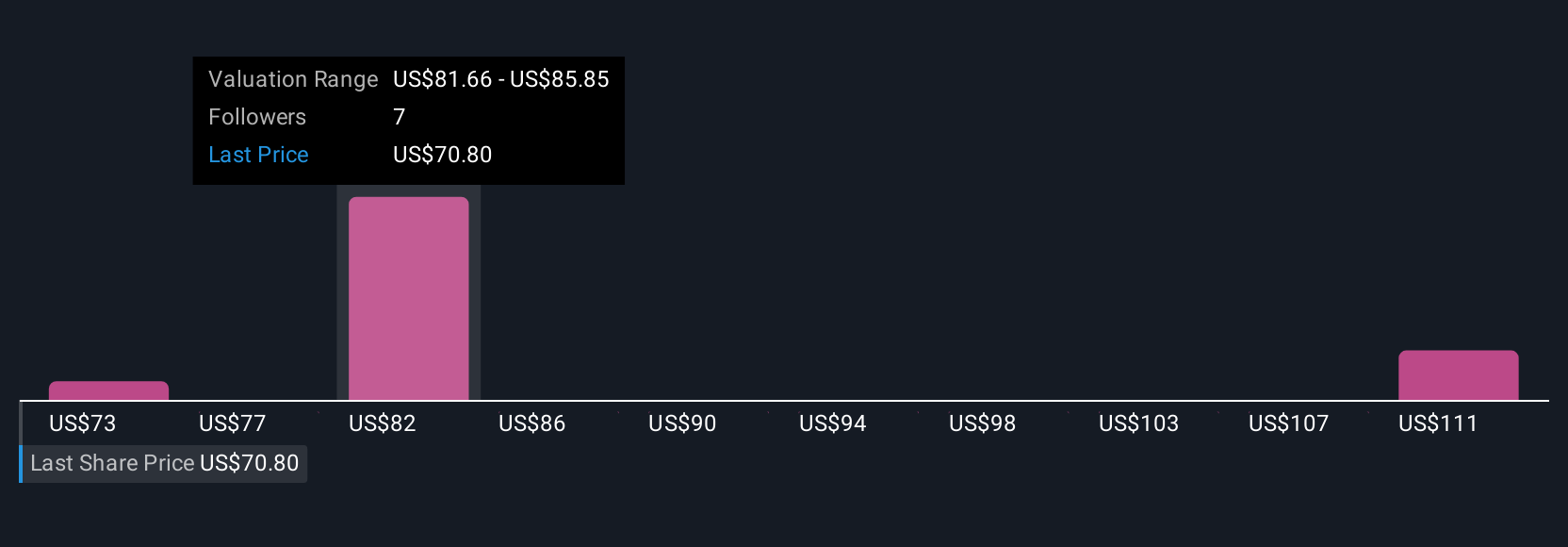

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you believe about a company’s future, blending your assumptions about revenue growth, profit margins, and key business drivers to arrive at your own fair value for the stock.

Unlike static models, Narratives link Synaptics’ evolving business context directly to a financial forecast and then to what you consider a reasonable price. This helps you make better buy or sell decisions based on your outlook. Narratives are designed to be accessible and easy to use, right inside the Community page on Simply Wall St, where millions of investors share and update their views in real time.

Because Narratives are dynamic, they automatically adjust when new information arises, like earnings releases or industry news, so your investment thesis is always relevant. This means you can quickly compare your fair value to the current price and see, at a glance, if market sentiment matches your outlook.

For example, some investors believe Synaptics could reach $95.0 per share on the back of strong IoT and Edge AI momentum. Others see challenges that might pull fair value down to $65.0. What you believe will inform your Narrative and your decisions.

Do you think there's more to the story for Synaptics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives