- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Skyworks Solutions (SWKS): Evaluating Valuation Following Launch of Next-Gen Clock Fanout Buffers for AI and 5G Markets

Reviewed by Simply Wall St

The recent launch of the SKY53510/80/40 clock fanout buffer family from Skyworks Solutions (SWKS) has attracted the attention of tech investors focused on the pace of infrastructure upgrades. These devices are designed to meet the evolving requirements of next-generation platforms, including PCIe Gen 7, 5G/6G wireless, and AI-focused data centers, by offering low-jitter, scalable timing precision. With production-ready samples now available, Skyworks is positioning itself as a primary supplier for hardware designers looking to keep pace with rapid technology cycles and emerging connectivity standards.

In terms of stock performance, Skyworks Solutions has experienced some momentum in recent weeks, with the share price rising 8% over the past month and 4% over the past three months. However, over the past year, shares remain down about 26%, even as the pace of product introductions has increased. Over longer periods, the trend is similar, with the stock underperforming broader semiconductor peers and showing a return of -17% over three years and -40% over five years. Despite the positive news, investors appear unconvinced that the company’s initiatives will quickly change its growth profile.

It remains to be seen whether this recent rally is an early indication that the market is recognizing Skyworks' long-term potential, or if there is still room for upside as these new products gain adoption.

Most Popular Narrative: 6.6% Overvalued

According to community narrative, Skyworks Solutions is considered slightly overvalued with the analyst consensus price target coming in below the current share price, based on future profit and margin projections.

Ongoing optimization of the manufacturing footprint, notably the Woburn facility closure and consolidation into Newbury Park, is expected to improve fab utilization, lower fixed costs, and expand gross margins over time. This is anticipated to bolster net income and free cash flow. Sustained strategic investment in R&D for next-generation RF modules supports Skyworks' technological edge, increasing design win momentum. This enables the company to capture a premium in high-value markets, positively impacting revenue growth and long-term operating leverage.

Curious about the big assumptions powering this valuation? Discover the crucial forecasts for revenue, profit margins, and future profit multiples that underpin analysts’ view. There is a crucial calculation that flips the script on Skyworks’ prospects. Want to know the numbers behind the narrative?

Result: Fair Value of $72.47 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a single customer and slow progress in diversifying beyond mobile remain serious risks that could challenge Skyworks' growth expectations.

Find out about the key risks to this Skyworks Solutions narrative.Another View: Discounted Cash Flow

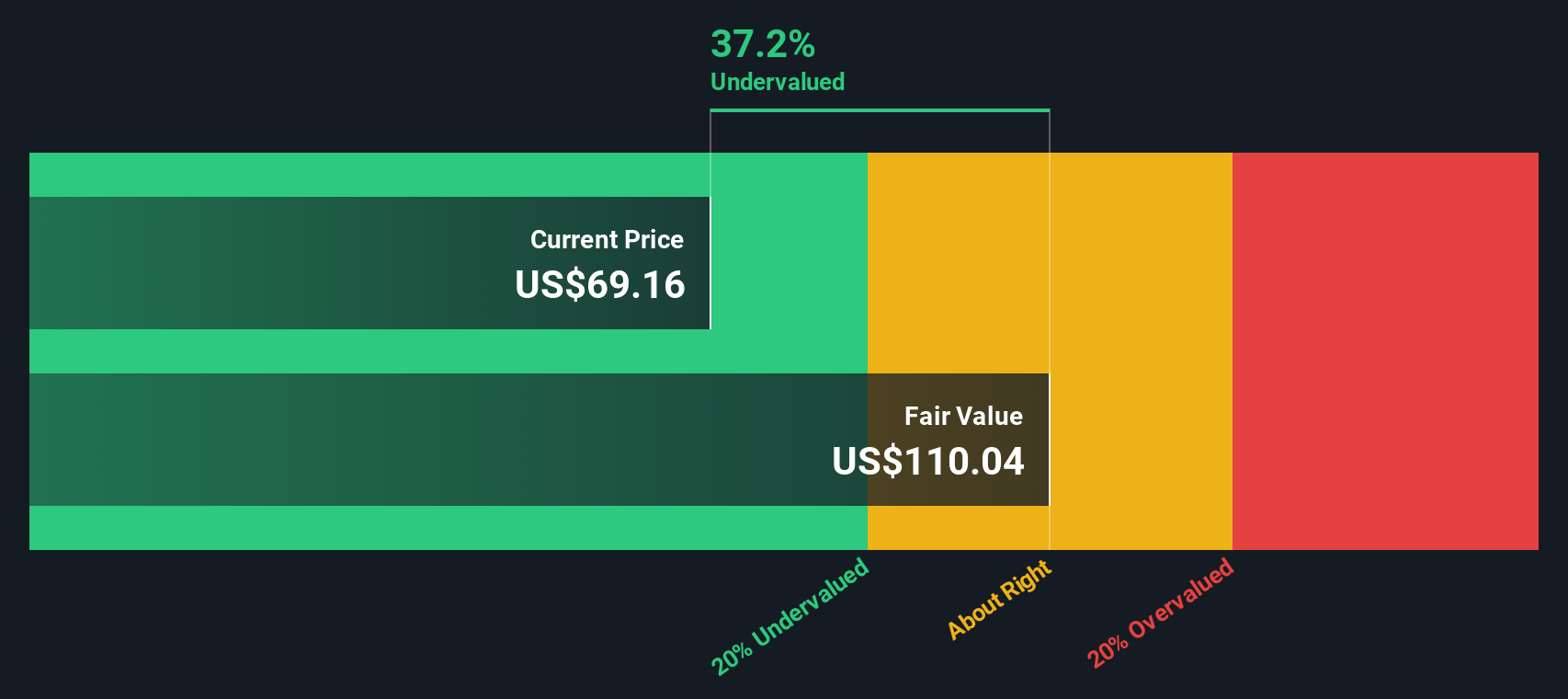

Looking at the numbers from a different angle, our DCF model suggests Skyworks Solutions is undervalued. This method projects future cash flows and provides another perspective to the debate about the company’s true worth. Which view will prove right in time?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Skyworks Solutions Narrative

If you have a different perspective or want to investigate the numbers firsthand, you can easily build your own narrative in just a few minutes. So why not do it your way?

A great starting point for your Skyworks Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investment strategy and uncover new opportunities that match your style. Don’t settle for ordinary stocks when unique, high-potential companies are just a click away. Amplify your portfolio with these tailored stock ideas before others catch on. You could be early to the next big winner.

- Capture income potential as you uncover shares offering dividend stocks with yields > 3% that could strengthen your cash flow from day one.

- Accelerate your portfolio with access to AI penny stocks leading advancements in intelligent automation and the next wave of technology innovation.

- Position yourself at the forefront of finance by researching cryptocurrency and blockchain stocks shaping the future of digital transactions and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Designs, develops, manufactures, and markets semiconductor products in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and the rest of Asia-Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives