- United States

- /

- Semiconductors

- /

- NasdaqGS:SLAB

Silicon Labs (SLAB): High Growth Forecasts Meet Profitability Challenges as Earnings Season Approaches

Reviewed by Simply Wall St

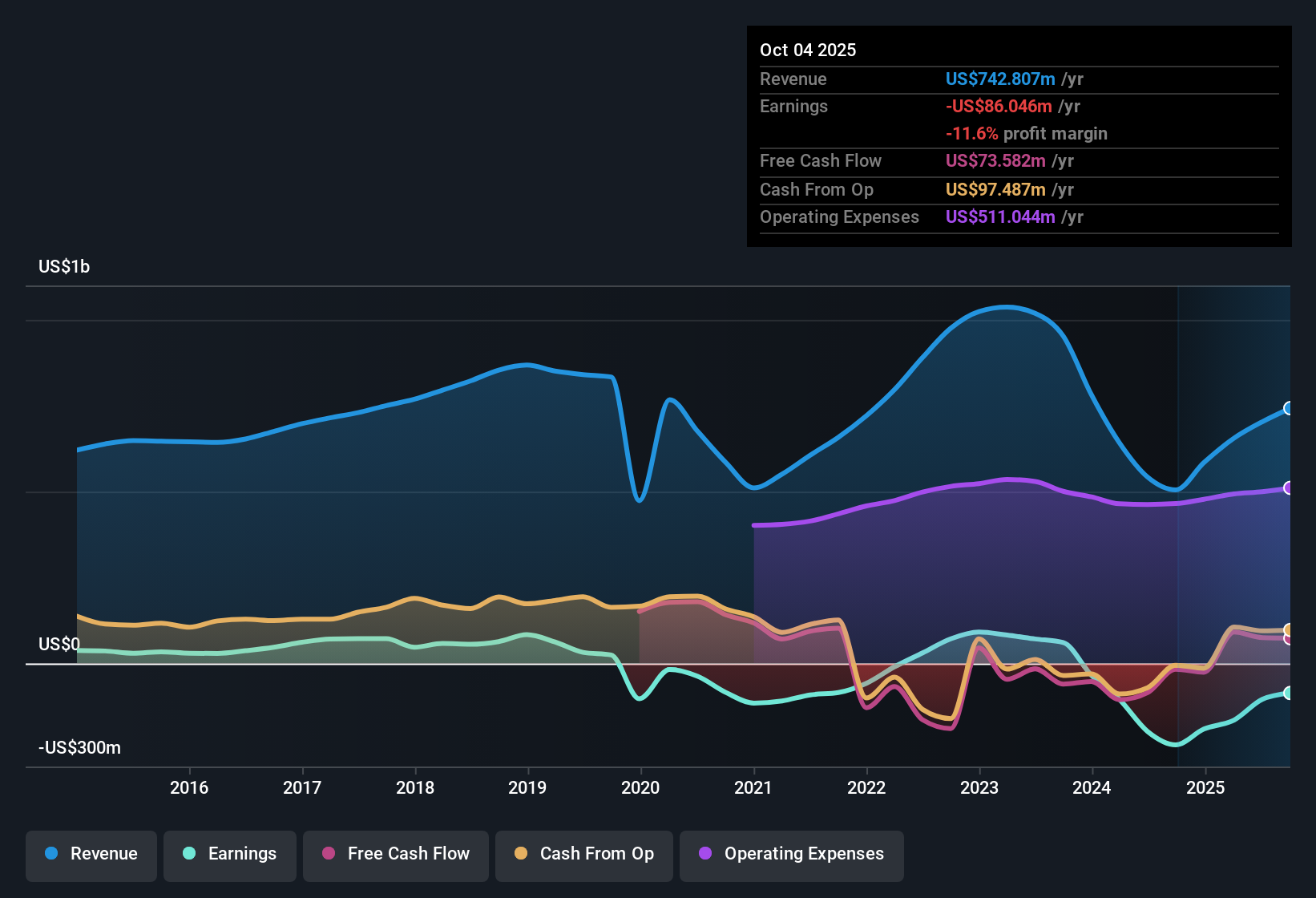

Silicon Laboratories (SLAB) remains unprofitable, with losses expanding at an average rate of 17.3% per year over the last five years. Shares currently trade at $126.77, a premium to the estimated fair value of $66.29. The Price-to-Sales ratio stands at 5.6x compared to an industry average of 5.3x. Looking ahead, investors are eyeing the impressive forecast for both revenue and earnings growth, with profitability expected within the next three years.

See our full analysis for Silicon Laboratories.Now we will set these headline numbers against the prevailing narratives to see where expectations and reality diverge.

See what the community is saying about Silicon Laboratories

Operating Margins Forecast to Swing Positive

- Consensus narrative notes that profit margins are predicted to recover from -14.9% today to 1.2% within the next three years, a turnaround that would mark the end of Silicon Labs' five-year streak of annual losses climbing by 17.3% per year.

- Heavily supporting the consensus case, analysts point to:

- Expected profit margin expansion and anticipated earnings growth of 106.96% per year. Together, these factors could end Silicon Labs’ run of negative net results.

- The company’s repositioning around high-margin, secure IoT products is seen as essential to not only hitting these aggressive milestones but also withstanding growing industry competition and shifting customer needs.

- For those watching closely, this margin lift remains the linchpin for Silicon Labs to fulfill optimism in the balanced outlook. Analysts call out execution risk if operating leverage does not materialize as sales ramp. 📊 Read the full Silicon Laboratories Consensus Narrative.

Price-to-Sales Premium Raises Bar for Performance

- Silicon Labs is trading at a Price-to-Sales ratio of 5.6x, which is higher than the US semiconductor industry average of 5.3x and far above the DCF fair value of $66.29. This places pressure on management to deliver the forecasted revenue and margin improvements.

- According to the analysts' consensus narrative:

- Peers are generally valued at lower multiples relative to their future profit potential. Silicon Labs’ high pricing reflects expectations for outsized earnings and revenue growth, making any slip-up in execution a likely catalyst for re-rating.

- The consensus price target sits at $151.00, which provides a 19.1% premium over the current share price. This signals belief in the recovery story but also underscores that the company must consistently outperform cautious industry expectations to justify this markup.

IoT-Driven Revenue Pipeline Faces Competitive Headwinds

- Analysts estimate that Silicon Labs’ annual revenue growth will average 19.2% over the next three years, outpacing both its recent history and the broader US market growth projection of 10.5% per year. This growth is fueled by design wins in smart home, healthcare, and industrial IoT markets.

- The balanced narrative highlights persistent challenges:

- Surging demand for battery-powered and energy-efficient wireless IoT solutions is expected to drive both market share and higher average selling prices. However, critics highlight the risks of intensified competition from larger rivals and the potential erosion of long-term margins as basic connectivity becomes commoditized.

- Analysts caution that industry-wide margin compression or slower-than-expected IoT adoption could invalidate the upbeat scenario, especially as limited product diversification and regulatory changes make future gains less certain.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Silicon Laboratories on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Put your viewpoint into action and shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

See What Else Is Out There

Despite Silicon Labs’ growth story, its premium valuation and lingering losses present risks if profit margins do not rebound as forecasted.

If you want to avoid overvalued picks and focus on better-priced opportunities, our these 843 undervalued stocks based on cash flows can help you zero in on companies with more attractive valuations and untapped upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLAB

Silicon Laboratories

A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives