- United States

- /

- Semiconductors

- /

- NasdaqGS:SLAB

Investors Appear Satisfied With Silicon Laboratories Inc.'s (NASDAQ:SLAB) Prospects As Shares Rocket 26%

Silicon Laboratories Inc. (NASDAQ:SLAB) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.0% in the last twelve months.

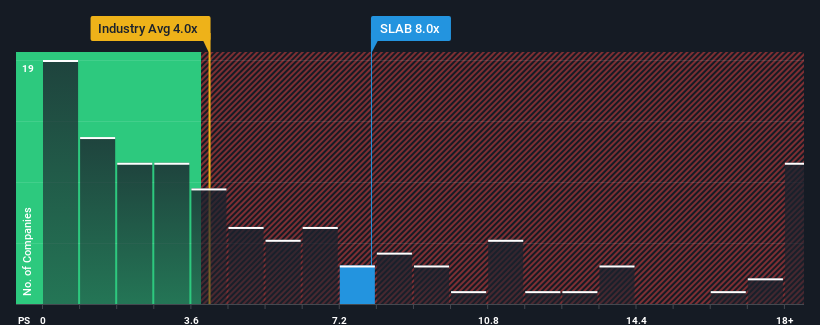

After such a large jump in price, Silicon Laboratories may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 8x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4x and even P/S lower than 1.6x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Silicon Laboratories

What Does Silicon Laboratories' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Silicon Laboratories' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Silicon Laboratories' future stacks up against the industry? In that case, our free report is a great place to start.How Is Silicon Laboratories' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Silicon Laboratories' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 47% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 23% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 48% as estimated by the nine analysts watching the company. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Silicon Laboratories' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Silicon Laboratories' P/S Mean For Investors?

Silicon Laboratories' P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Silicon Laboratories' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Silicon Laboratories has 1 warning sign we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLAB

Silicon Laboratories

A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success