- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

Why Investors Shouldn't Be Surprised By SkyWater Technology, Inc.'s (NASDAQ:SKYT) 25% Share Price Plunge

SkyWater Technology, Inc. (NASDAQ:SKYT) shares have had a horrible month, losing 25% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

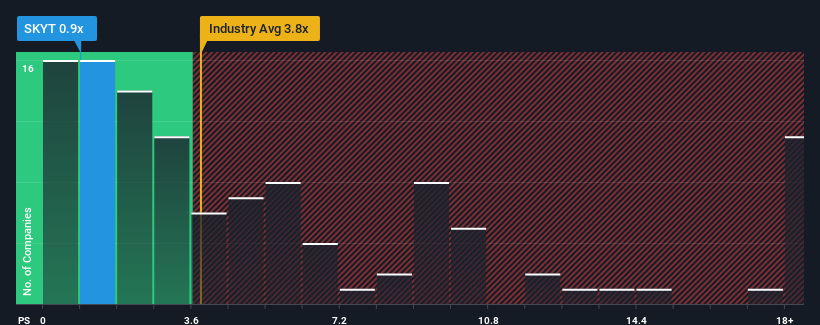

Since its price has dipped substantially, SkyWater Technology may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.9x, considering almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 3.8x and even P/S higher than 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for SkyWater Technology

What Does SkyWater Technology's Recent Performance Look Like?

Recent times haven't been great for SkyWater Technology as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on SkyWater Technology will help you uncover what's on the horizon.How Is SkyWater Technology's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like SkyWater Technology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 30%. The latest three year period has also seen an excellent 98% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 10.0% per year over the next three years. That's shaping up to be materially lower than the 27% per annum growth forecast for the broader industry.

With this information, we can see why SkyWater Technology is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On SkyWater Technology's P/S

Shares in SkyWater Technology have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of SkyWater Technology's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for SkyWater Technology that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives