- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

SkyWater Technology (SKYT): Evaluating Valuation After Quantum Collaboration With Silicon Quantum Computing

Reviewed by Simply Wall St

SkyWater Technology (SKYT) recently caught attention after announcing a collaboration with Silicon Quantum Computing. The companies are teaming up to push hybrid quantum-classical computing, bringing advanced quantum processors into the mainstream semiconductor world.

See our latest analysis for SkyWater Technology.

Momentum has been building for SkyWater Technology, with the partnership news arriving after a stretch of notable events, including a director share sale and the achievement of record revenues in its quantum segment. The past year has seen a share price return of 3.64%. What really stands out is the impressive 62.33% total shareholder return over the same period, revealing long-term growth potential that is catching investors’ attention, even with some recent 7-day and 30-day pullbacks after a prior surge. All of this comes amid a broader market conversation about new computing frontiers and risk perception for semiconductor players.

If you’re exploring where next-generation tech meets real market opportunity, now is the perfect time to see the full range of companies driving innovation with our See the full list for free.

With shares now trading at a sizable discount to analyst targets even after substantial gains, investors face a pivotal question: Is SkyWater Technology an undervalued leader with more room to run, or has the market already priced in its growth ambitions?

Most Popular Narrative: 30.8% Undervalued

According to the most widely followed narrative, SkyWater Technology's fair value is set at $20.17 per share, significantly above its last close of $13.96. This suggests an optimistic outlook tied to major company milestones and shifting growth assumptions.

SkyWater's expansion into quantum computing and advanced packaging, including the upcoming rollout of a superconducting platform and Florida advanced packaging operations, positions the company at the forefront of high-growth technology segments. These segments are supported by national security and industrial policy trends, laying the foundation for above-market revenue growth and long-term margin expansion.

Curious what powers that big gap between price and value? There is a bold growth target factored in here, plus a surprising profit forecast that is not what you might expect from a typical semiconductor player. Want to know the one future assumption that changes everything for this company's fair value? Dive in to uncover the real driver.

Result: Fair Value of $20.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt from recent acquisitions and ongoing reliance on volatile government contracts could pressure profitability and test SkyWater’s growth story if trends shift unexpectedly.

Find out about the key risks to this SkyWater Technology narrative.

Another View: What About the DCF Model?

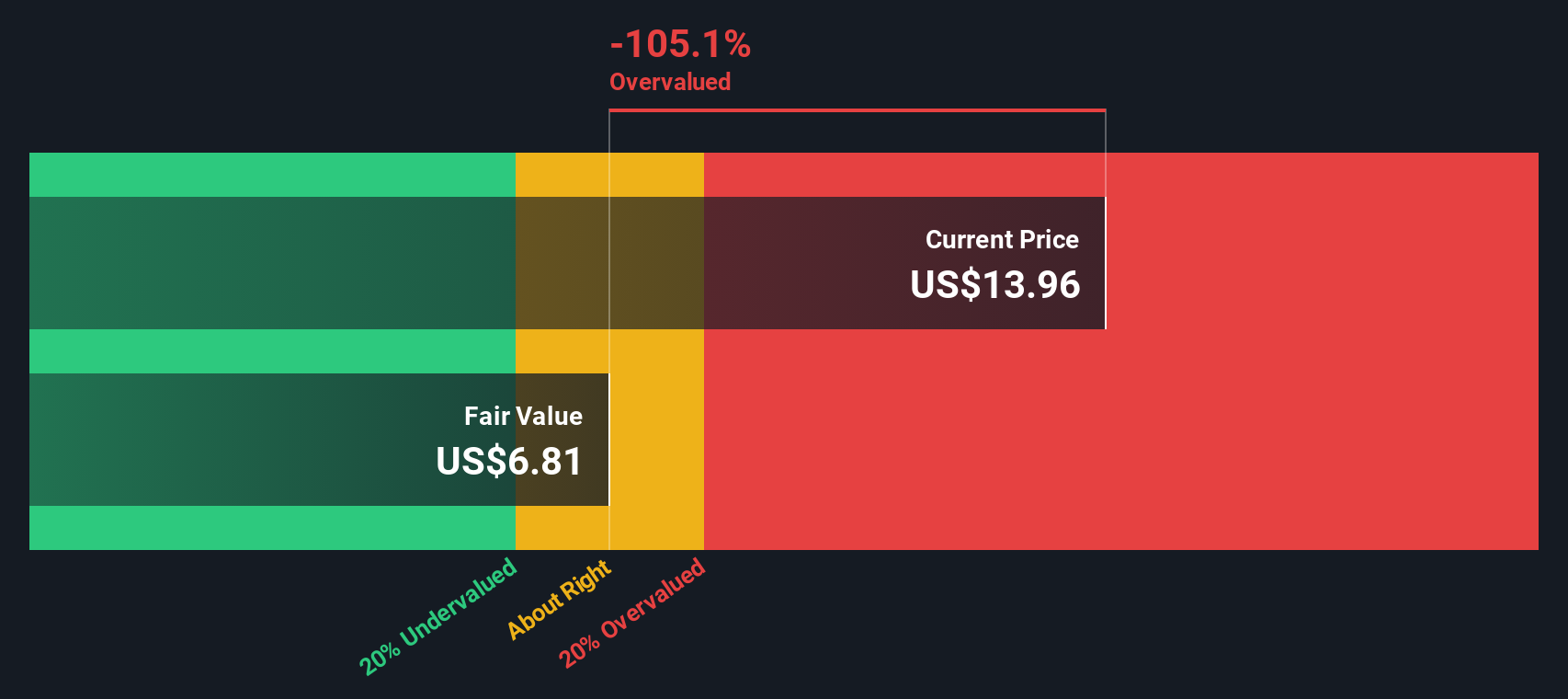

While analyst consensus points to SkyWater Technology being 30.8% undervalued, our SWS DCF model tells a different story. According to this approach, SkyWater is actually trading above its estimated fair value, which challenges the bold upside narrative. Can a company succeed when two major valuation methods speak so differently?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SkyWater Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SkyWater Technology Narrative

Not convinced by either side or want to dig into the numbers for yourself? Craft your own perspective and see where the data leads. Start your own narrative today in just minutes. Do it your way

A great starting point for your SkyWater Technology research is our analysis highlighting 4 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on other high-potential opportunities well beyond SkyWater Technology. Use these targeted screens to fast-track your next smart investing move:

- Access unbeatable value by screening for companies with impressive cash flow potential using these 919 undervalued stocks based on cash flows. This can help you get ahead of the market curve.

- Uncover emerging innovators harnessing artificial intelligence for real-world impact with these 26 AI penny stocks. Position yourself at the frontline of tomorrow’s trends with this approach.

- Enhance your portfolio with income-generating stocks by searching these 15 dividend stocks with yields > 3% offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives