- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

SiTime (SITM): Exploring Valuation After This Week’s Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for SiTime.

Despite the recent dip, SiTime’s long-term momentum remains impressive, with the 1-year total shareholder return at 20% and a three-year total shareholder return of nearly 149%. Short-term share price returns have softened, which suggests sentiment is cooling a bit after a strong earlier run.

If you’re wondering where the next wave of growth might come from, it is a great moment to broaden your horizons and discover See the full list for free.

With shares currently trading below analyst targets and strong historical returns, the key question for investors is whether the recent pullback has created an undervaluation or if the market has already factored in SiTime’s future growth potential.

Most Popular Narrative: 27% Undervalued

SiTime’s most widely followed valuation narrative sees a fair value notably above the current share price, fueling optimism among investors hunting for upside. Last close was $252.76, while the narrative places fair value around $346. This ambitious gap has the market's attention.

Expansion of SiTime's content per device, particularly through customized clocks and clocking systems for AI, networking, and hyperscale platforms, enables increased dollar content per design win. This directly supports top-line growth and improves gross margins as these higher-ASP products become a greater share of sales.

Curious how ambitious product expansion fuels these projections? The narrative hinges on a forward leap in margins and a significant future revenue jump. But what bold growth assumptions are hiding beneath this headline figure? Unpack the key inputs that make this fair value tick and see how high analyst expectations really go.

Result: Fair Value of $346 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if SiTime's reliance on data center growth falters, or if rapid industry changes outpace the company's innovation and adaptability.

Find out about the key risks to this SiTime narrative.

Another View: Price-to-Sales Says Expensive

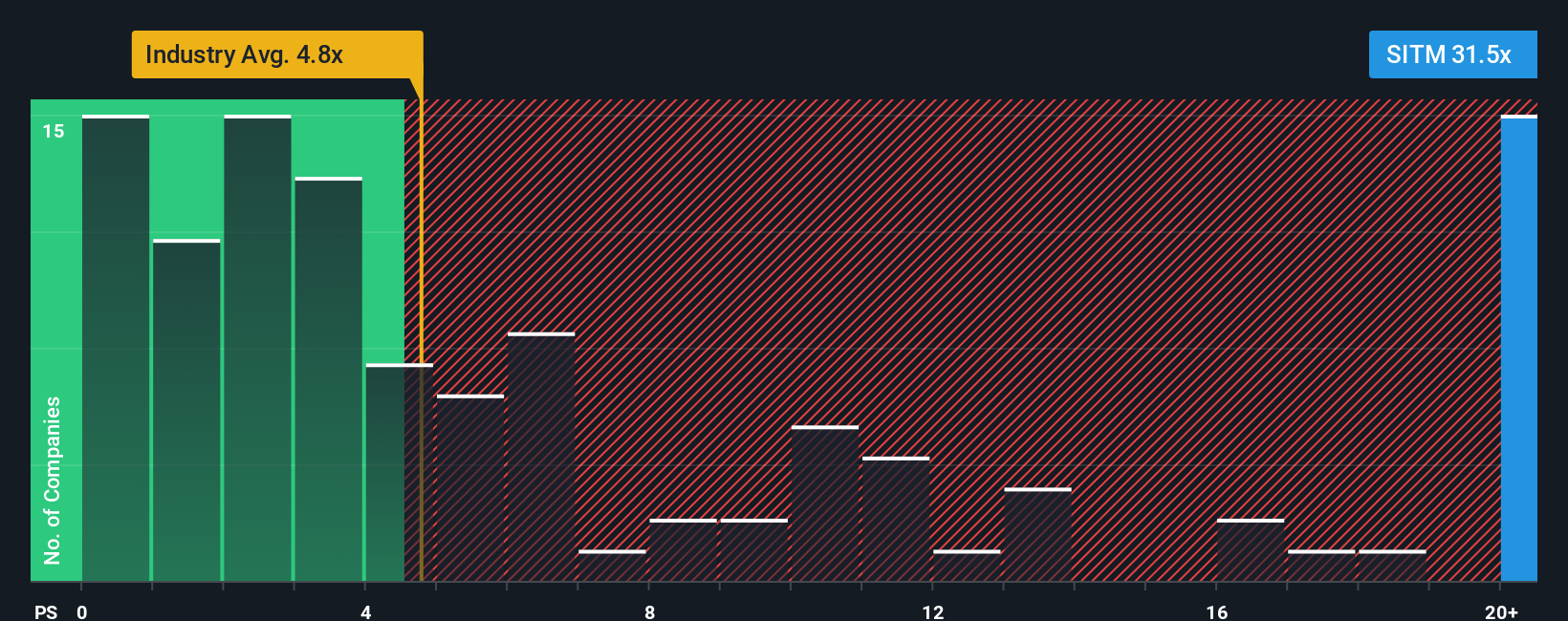

Looking at SiTime through its price-to-sales ratio raises a caution flag. At 23.4x, the stock trades well above the US Semiconductor industry average (4.2x), peers (7.4x), and even above the fair ratio of 12.7x. This sizeable gap suggests investors face significant valuation risk if sentiment changes. Can SiTime’s rapid growth keep justifying such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiTime Narrative

If you think another story could fit the facts, or want to build your own investment outlook, you can easily craft a narrative using our tools in under three minutes, and Do it your way

A great starting point for your SiTime research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunities slip past you. The right investment trends can make a world of difference for your portfolio, so take the next step with confidence!

- Tap into future healthcare breakthroughs by viewing these 30 healthcare AI stocks to see which companies are driving innovation in AI-powered treatments.

- Capitalize on the hunt for undervalued gems by targeting these 919 undervalued stocks based on cash flows. These may be poised for growth based on solid cash flow fundamentals.

- Catalyze your returns by harnessing these 81 cryptocurrency and blockchain stocks, which reveals stocks connected to cryptocurrency and blockchain advancements that could reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives