- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

SiTime (SITM): Assessing Valuation as Earnings Approach and Analyst Outlook Brightens

Reviewed by Simply Wall St

SiTime (SITM) is set to announce its Q3 2025 earnings on November 5. Recent improvements in revenue and earnings projections for the next two years have helped fuel growing optimism among investors.

See our latest analysis for SiTime.

SiTime’s share price has powered ahead in recent months, rallying over 32% in the last quarter as the company’s momentum returns and investors weigh up stronger revenue outlooks. That lift has translated into a robust 1-year total shareholder return of nearly 58%, highlighting growing confidence in both the near-term and long-term growth story.

If you’re watching SiTime’s surge and want to spot other top performers, now is a timely moment to broaden your search and discover fast growing stocks with high insider ownership

But with SiTime’s shares already near analysts’ price targets and recent upgrades fueling strong gains, investors may wonder if there is still room for upside or if the market has already priced in all of the company’s growth potential.

Most Popular Narrative: 2% Undervalued

With SiTime’s last close at $279.31 and a narrative fair value set at $285.00, the stock is trading just below the consensus estimate. This points to very slight undervaluation, driven by high growth expectations and sector tailwinds.

“Expansion of SiTime's content per device, particularly through customized clocks and clocking systems for AI, networking, and hyperscale platforms, enables increased dollar content per design win. This directly supports top-line growth and improves gross margins as these higher-ASP products become a greater share of sales.”

Curious how ambitious product launches and bold margin assumptions add up in this narrative? The story hinges on a series of rapid-fire growth drivers, blockbuster new markets, and a valuation built on confidence in SiTime’s ability to disrupt big industries. Which numbers move the needle and which bets fuel this price target? Read the full narrative to find out before the next catalyst arrives.

Result: Fair Value of $285.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, SiTime’s heavy exposure to AI data centers and rapid tech cycles means that any demand slowdown or missed innovation could quickly shift the outlook.

Find out about the key risks to this SiTime narrative.

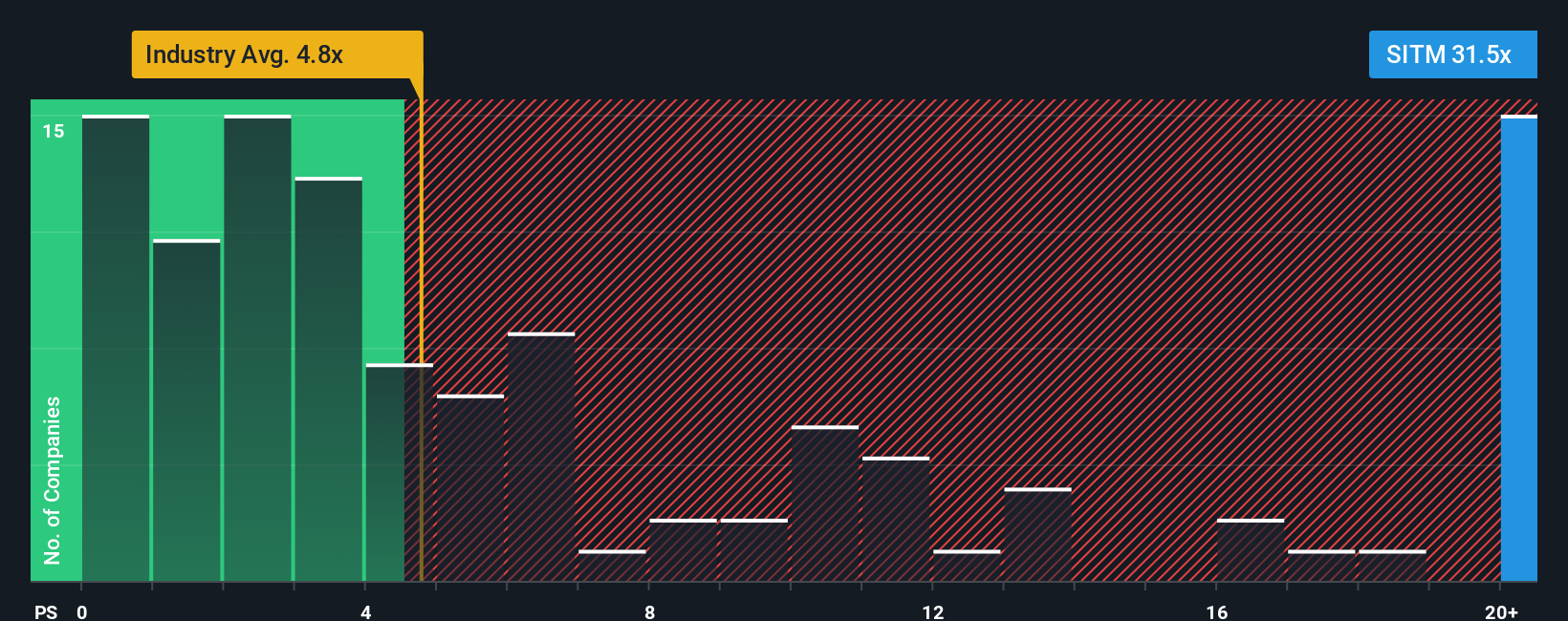

Another View: What Do Revenue Multiples Say?

While the narrative fair value suggests SiTime is slightly undervalued, our model based on its price-to-sales ratio offers a different perspective. Currently, SiTime trades at 28.4 times revenue, significantly higher than both the US semiconductor industry average of 5.3 and the market's fair ratio of 11.8. This substantial premium indicates investors are paying a high price for anticipated future growth. The key question is whether there is enough evidence to justify such expectations, or if sentiment could shift should the market call for a correction.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SiTime Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own SiTime outlook in under three minutes with Do it your way.

A great starting point for your SiTime research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level by searching for stocks with untapped potential. Don’t wait and let opportunities slip by; see what else you could be capturing right now.

- Uncover sharply undervalued picks with outstanding fundamentals when you check out these 844 undervalued stocks based on cash flows for your next smart addition.

- Target higher yields and steady income by scanning these 20 dividend stocks with yields > 3%, which features attractive payout ratios and consistency above 3%.

- Get ahead of the curve and tap into the transformative possibilities of tomorrow’s technology by reviewing these 28 quantum computing stocks, a selection already gaining investor attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives