Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:SIMO

Silicon Motion Technology Corporation (NASDAQ:SIMO) Will Pay A US$0.4975 Dividend In Four Days

Silicon Motion Technology Corporation (NASDAQ:SIMO) stock is about to trade ex-dividend in 4 days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. In other words, investors can purchase Silicon Motion Technology's shares before the 14th of November in order to be eligible for the dividend, which will be paid on the 27th of November.

The company's next dividend payment will be US$0.4975 per share, on the back of last year when the company paid a total of US$2.00 to shareholders. Based on the last year's worth of payments, Silicon Motion Technology has a trailing yield of 3.7% on the current stock price of US$54.12. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Silicon Motion Technology can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Silicon Motion Technology

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Fortunately Silicon Motion Technology's payout ratio is modest, at just 32% of profit. A useful secondary check can be to evaluate whether Silicon Motion Technology generated enough free cash flow to afford its dividend. It paid out 83% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies that aren't growing their earnings can still be valuable, but it is even more important to assess the sustainability of the dividend if it looks like the company will struggle to grow. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're not enthused to see that Silicon Motion Technology's earnings per share have remained effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Silicon Motion Technology has delivered 13% dividend growth per year on average over the past 10 years.

The Bottom Line

Is Silicon Motion Technology an attractive dividend stock, or better left on the shelf? Its earnings per share are effectively flat in recent times. The company paid out less than half its income and more than half its cash flow as dividends to shareholders. In summary, while it has some positive characteristics, we're not inclined to race out and buy Silicon Motion Technology today.

With that being said, if dividends aren't your biggest concern with Silicon Motion Technology, you should know about the other risks facing this business. For example, we've found 1 warning sign for Silicon Motion Technology that we recommend you consider before investing in the business.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SIMO

Silicon Motion Technology

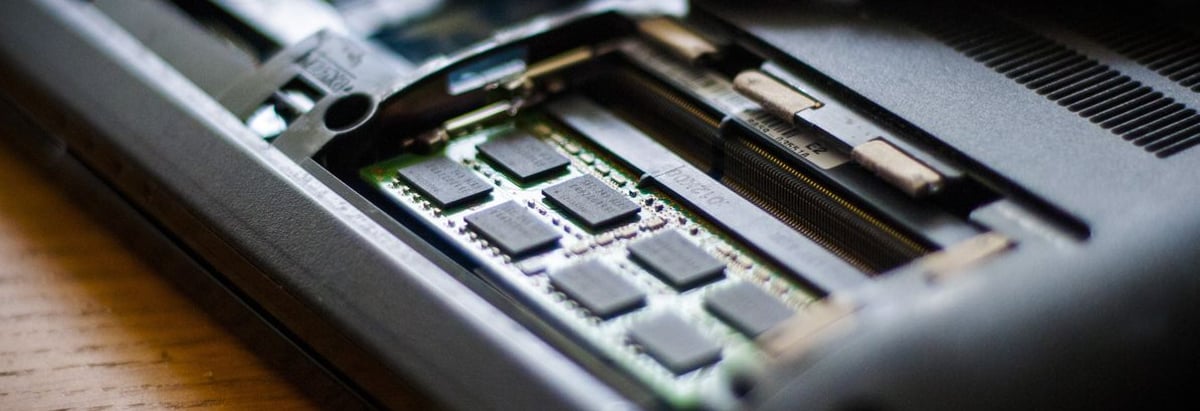

Designs, develops, and markets NAND flash controllers for solid-state storage devices in Taiwan, the United States, Korea, China, Malaysia, Singapore, and internationally.