Stock Analysis

- United States

- /

- Semiconductors

- /

- NasdaqGS:SGH

Optimism for SMART Global Holdings (NASDAQ:SGH) has grown this past week, despite five-year decline in earnings

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. For example, the SMART Global Holdings, Inc. (NASDAQ:SGH) share price has soared 114% in the last half decade. Most would be very happy with that. Also pleasing for shareholders was the 35% gain in the last three months.

Since the stock has added US$101m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for SMART Global Holdings

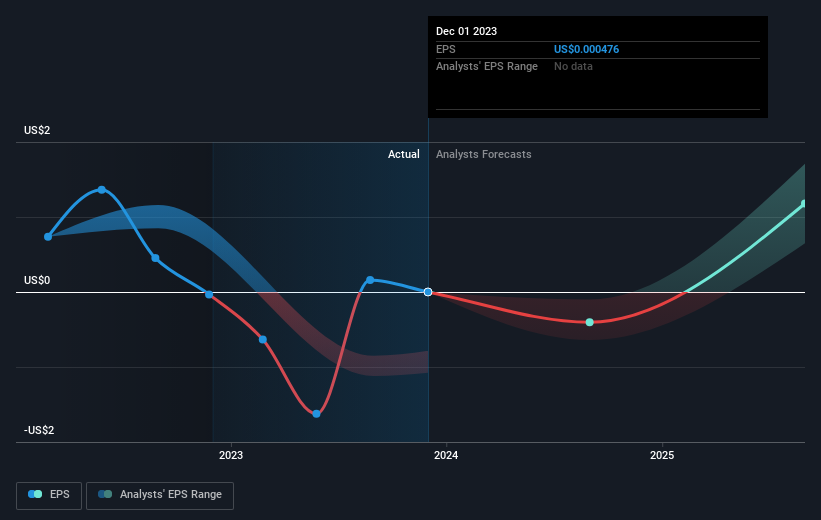

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, SMART Global Holdings became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that SMART Global Holdings has improved its bottom line lately, but is it going to grow revenue? Check if analysts think SMART Global Holdings will grow revenue in the future.

A Different Perspective

We're pleased to report that SMART Global Holdings shareholders have received a total shareholder return of 58% over one year. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - SMART Global Holdings has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

Of course SMART Global Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether SMART Global Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SGH

SMART Global Holdings

SMART Global Holdings, Inc., a memory-focused company, engages in the designing and development of enterprise solutions in the United States, China, Europe, and internationally.

Reasonable growth potential and slightly overvalued.