- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Assessing Valuation After Strong Launch of Commercial Storage Systems in Germany

Reviewed by Simply Wall St

SolarEdge Technologies (SEDG) just kicked off its first commercial battery installations in Germany, racking up more than 150 orders for its new CSS-OD commercial storage system within weeks of launch. This strong demand highlights a wave of interest from PV installers and commercial users who are seeking combined solar and storage setups in Germany’s active self-consumption market.

See our latest analysis for SolarEdge Technologies.

After a challenging stretch, SolarEdge Technologies has seen its share price rally more than 123% so far this year, even as momentum cooled in the past month. A breakout year-to-date price gain stands out against a backdrop of multi-year pain, with the one-year total shareholder return at a remarkable 208%. The stock still sits miles below all-time highs because of steep three- and five-year total return declines. With excitement building around its expansion in Germany and ongoing innovation in storage solutions, investors appear to be reassessing the company’s long-term growth potential and risk profile.

If SolarEdge’s rapid pivot in Germany has your attention, this could be the ideal moment to broaden your search and discover See the full list for free.

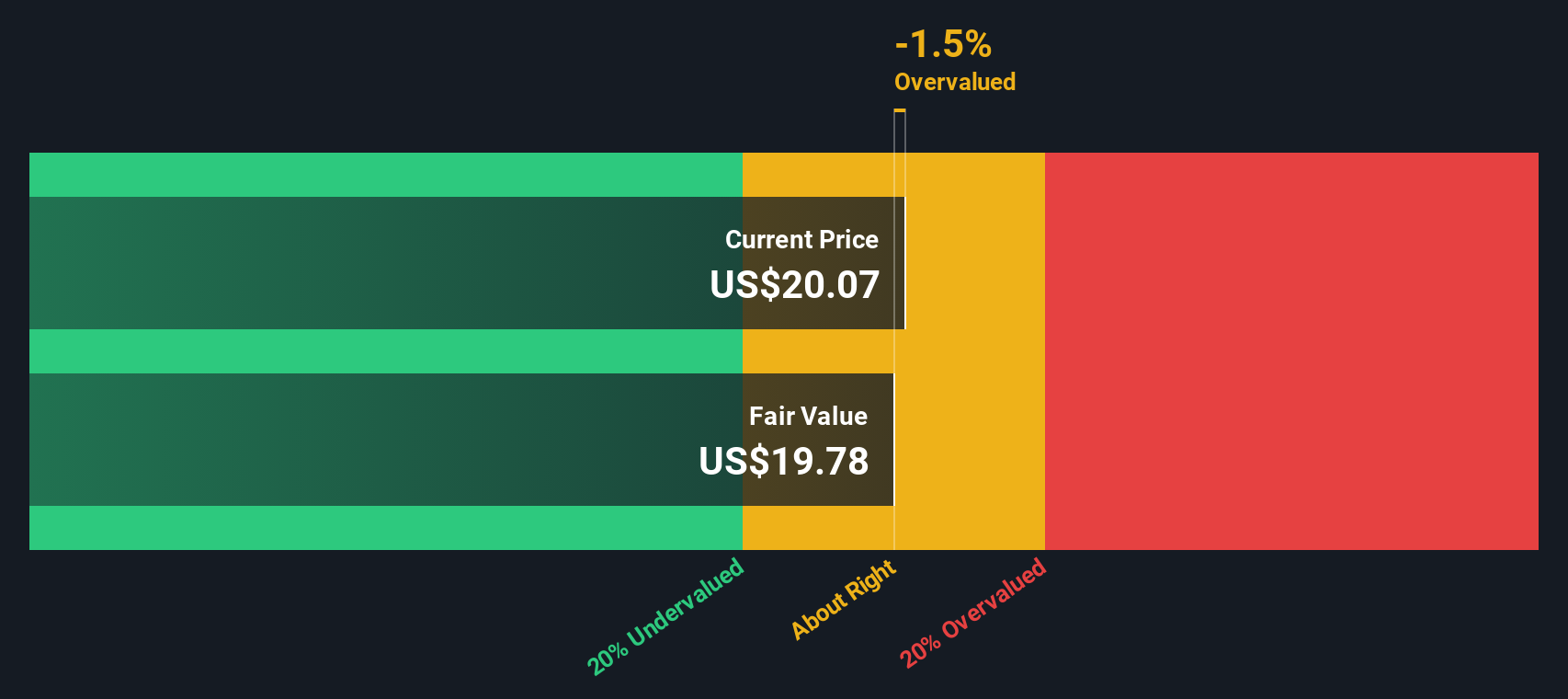

But with this sharp recovery in the share price and analyst targets sitting just above current levels, the question is whether SolarEdge Technologies is still undervalued or if the recent enthusiasm is already pricing in much of its future growth.

Most Popular Narrative: 9.5% Overvalued

With SolarEdge Technologies trading at $33.09, the most widely followed narrative sets its fair value at $30.23. This means the current price is nearly 10% above what the narrative considers justified. This perspective provides vital context for those tracking momentum and questioning the reliability of the recent surge.

The rally in SolarEdge's stock appears to be pricing in robust future revenue growth driven by U.S. policy support (extension of manufacturing and storage credits). However, risks are rising as the elimination of the 25D residential solar tax credit is expected to cause a substantial drop in U.S. residential demand in 2026. This drop is only partially offset by third-party owned (TPO) shifts, potentially constraining topline growth.

What is really fueling that premium price? The narrative’s calculation hinges on an unusually aggressive set of financial forecasts and a discounted cash flow model that assumes a smooth return to profitability. Want to know whether analyst optimism or sector uncertainty holds more weight in this valuation story? Dive deeper for the full narrative breakdown.

Result: Fair Value of $30.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a surprising extension of U.S. manufacturing tax credits or a stronger than expected uptick in battery storage adoption could quickly alter this outlook.

Find out about the key risks to this SolarEdge Technologies narrative.

Another View: This Time, the SWS DCF Model Says Undervalued

Taking a step back from narratives and multiples, the SWS DCF model suggests SolarEdge Technologies is actually undervalued. According to our DCF assessment, the shares are trading 12.9% below their estimated fair value of $38. This difference challenges the overvalued view from other approaches. Is there more room for upside, or are risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SolarEdge Technologies Narrative

If you see things differently or would rather dig into the details yourself, you can easily shape your own SolarEdge Technologies story in just a few minutes, Do it your way

A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities do not wait around. Make your next smart move by checking out unique stocks with the Simply Wall Street Screener before the market buzz gets there first.

- Uncover hidden potential with these 3592 penny stocks with strong financials, a leader in untapped markets and rapid growth stories.

- Stay ahead in technological innovation by reviewing these 26 AI penny stocks, which features pioneers leveraging artificial intelligence to transform industries.

- Secure your portfolio's future by evaluating these 16 dividend stocks with yields > 3%, offering consistent yields above 3% for reliable income even in turbulent markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives