- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge (SEDG): Losses Have Grown 80% Annually as Profitability Forecasts Face Volatility Narratives

Reviewed by Simply Wall St

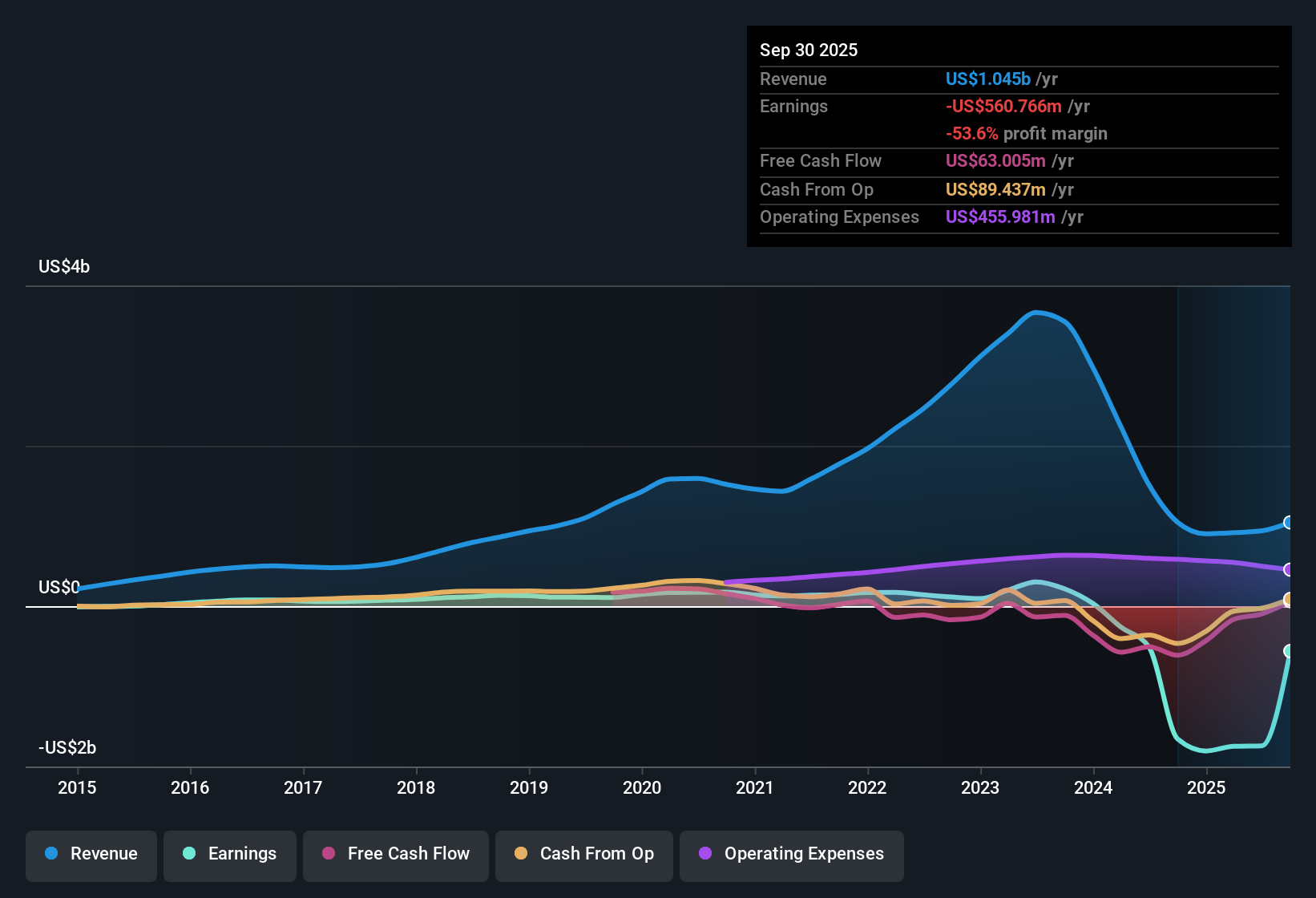

SolarEdge Technologies (SEDG) continues to report losses, with the company’s net losses having increased at an annual rate of 80.2% over the past five years and no signs yet of margin improvement or higher quality earnings. Despite this challenging backdrop, SEDG shares are trading at $41.02, well below its estimated fair value of $62.94. Valuation metrics like a Price-to-Sales Ratio of 2.6x suggest a potential discount relative to sector peers. Looking ahead, earnings are forecast to grow rapidly at 95.36% per year with profitability expected within three years, making the company’s pathway to profits and current valuation key points for investors weighing the risks of persistent share price volatility.

See our full analysis for SolarEdge Technologies.The next step is to see how these headline numbers measure up against the most widely held narratives about SolarEdge, so let’s see which stories get confirmed and which might not stand up to scrutiny.

See what the community is saying about SolarEdge Technologies

Margins Expected to Swing From Deep Losses to Thin Profits

- Analysts see SolarEdge’s profit margins jumping from today’s -185.2% to a positive 0.7% within three years, marking one of the most dramatic forecasted margin improvements in its industry.

- According to the analysts' consensus view, this sharp margin recovery is tied to expectations that US manufacturing tax credits and new storage incentives will dramatically cut costs and boost demand.

- However, there is significant debate about whether margin expansion can materialize fast enough to outpace volatile input costs and persistent headwinds from aggressive price wars, especially if current distribution challenges and inventory pressures don’t resolve as quickly as hoped.

- Consensus is growing that the company’s path to breakeven rests on policy support and the ramp-up of higher-margin commercial solutions. Yet, the looming withdrawal of the 25D residential solar tax credit in 2026 introduces real risk to the attainable margin rebound.

- To see how these swings in margin expectations are shaping SolarEdge’s long-term narrative, read the full consensus take. 📊 Read the full SolarEdge Technologies Consensus Narrative.

Valuation Discount Persists Despite Analyst Caution

- SolarEdge trades at $41.02 per share, well below its DCF fair value of $62.94 and with a Price-to-Sales ratio of 2.6x compared to a US semiconductor sector average of 5x, creating a visible value gap.

- Consensus narrative notes that while some investors may see this discount as an opportunity, analysts actually set a price target of $28.40, about 30% lower than the current share price. This reflects deep skepticism that SolarEdge can deliver the ambitious growth and margin recovery required to earn even its discounted valuation.

- While bullish investors might focus on the company’s projected 20.6% revenue growth over the next three years, most analysts are wary of overestimating the effect of recent policy tailwinds and expect stronger competition and possible declines in residential demand to weigh on actual market returns.

- The potential gap between SolarEdge’s discounted valuation metrics and more cautious analyst targets means investors may need to look beyond simple peer comparisons and focus on what needs to go right for the stock’s current price to be justified.

Revenue Growth to Lag Market Slightly, With Risks to Upside

- Annual revenue is projected to grow at 10.2%, just below the overall US market forecast of 10.4%, despite company guidance and some forecasts pointing to a more ambitious 20.6% three-year trajectory.

- Analysts' consensus view points out the tension here, as SolarEdge is banking on commercial and battery storage adoption and more supportive policies to drive upside. Analysts highlight that growth may be dampened by lost market share, weaker distribution networks in Europe, and macro uncertainties that cloud the path to accelerating sales.

- Forecasts for a boost from commercial and battery storage attach rates may be too aggressive, as slower-than-anticipated normalization in channels and shifting policy incentives could hold back revenue growth below management’s more optimistic targets.

- The difference between the company’s and analysts’ revenue outlooks makes this a key battleground for the next few quarters, as investors weigh announced initiatives versus real sell-through and market dynamics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SolarEdge Technologies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique angle on the data? Use your insights to shape the story and craft your own narrative in a matter of minutes. Do it your way

A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

SolarEdge faces deep margin losses, skeptic analyst targets, and uncertain revenue recovery. Its profit turnaround is highly dependent on policy support and market stabilization.

If you want more reliable growth and fewer earnings surprises, focus your next search on stable growth stocks screener (2079 results) to find companies delivering consistency across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives