- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

Can SolarEdge’s (SEDG) Growing VPP Programs Signal a Shift in Its Long-Term Growth Story?

Reviewed by Sasha Jovanovic

- SolarEdge Technologies recently announced that it has surpassed 500 MWh of residential battery storage enrolled in Virtual Power Plant (VPP) programs spanning 16 U.S. states and Puerto Rico, collaborating with leading utilities and partners.

- This milestone highlights SolarEdge's expanding role in distributed energy and grid services, with its VPP portfolio also scaling across Europe, Australia, and Canada.

- We'll look at how this accelerated expansion in Virtual Power Plant participation shapes SolarEdge's long-term investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

SolarEdge Technologies Investment Narrative Recap

For those considering SolarEdge Technologies, the central investment case centers on broadening adoption of distributed solar, storage, and integrated grid services driven by policy support and evolving energy needs. The announcement that SolarEdge has surpassed 500 MWh of battery storage enrolled in Virtual Power Plant (VPP) programs is encouraging for long-term growth in grid services, but has little near-term impact on the most pressing catalyst, demand shifts tied to the 2026 U.S. residential solar tax credit phase-out, and does not directly address ongoing margin and channel risks.

Of the company’s recent updates, the launch of U.S.-manufactured solar products and the ramp-up of its Salt Lake City facility stands out in relation to the VPP milestone. This advancement supports potential cost and margin improvements as production localizes and could position SolarEdge to capture additional U.S. and international demand, reinforcing the strongest near-term catalysts around gross margin recovery and policy-driven sales.

Yet, in contrast to these growth milestones, investors should be aware of unresolved risks around channel normalization and inventory management that could impact...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' narrative projects $1.6 billion in revenue and $11.8 million in earnings by 2028. This requires 20.6% yearly revenue growth and an earnings increase of $1.8 billion from current earnings of -$1.7 billion.

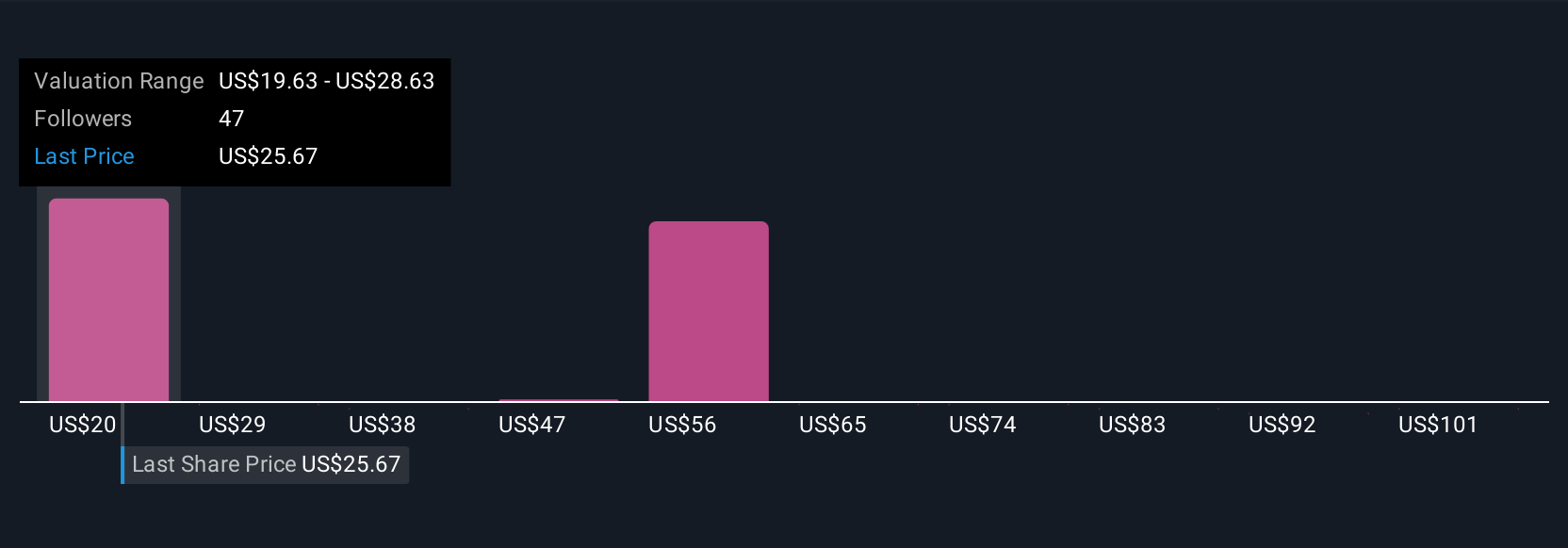

Uncover how SolarEdge Technologies' forecasts yield a $27.27 fair value, a 22% downside to its current price.

Exploring Other Perspectives

Sixteen Simply Wall St Community fair value estimates for SolarEdge range from US$27.27 to US$90.47 per share. While opinions vary widely, ongoing inventory and working capital challenges remain critical to watch for those assessing future performance.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth 22% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives