- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

Can SolarEdge (SEDG) Leverage Germany's Early Battery Demand to Boost Its Competitive Edge?

Reviewed by Sasha Jovanovic

- SolarEdge Technologies announced its first commercial battery installations in Germany, marking strong early demand for its new CSS-OD storage system with over 150 orders totaling more than 15 MWh in the initial weeks after launch.

- Alongside this momentum in European commercial storage, SolarEdge and Infineon Technologies unveiled a collaboration to develop solid-state transformer technology targeting next-generation, energy-efficient AI data centers.

- We'll explore how the rapid adoption of SolarEdge's commercial storage solution in Germany could influence its long-term market outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

SolarEdge Technologies Investment Narrative Recap

For anyone considering whether to be a shareholder in SolarEdge Technologies, the crux of the thesis is belief in growing demand for integrated solar and storage solutions, especially in commercial markets where attach rates are rising. The latest news of rapid adoption for its commercial battery in Germany confirms positive early traction in a key European market; however, the largest near-term catalyst, acceleration of inventory normalization and sustained channel improvements, remains the most important, while the main risk continues to be margin pressures from potential hardware commoditization. The Germany news supports expansion but does not materially alter these short-term drivers or risks.

Among recent company announcements, the collaboration with Infineon Technologies to develop solid-state transformer platforms aimed at next-generation AI data centers is particularly relevant. This initiative points toward broader end markets as SolarEdge addresses energy efficiency for data-heavy infrastructure, providing potential new revenue streams while reinforcing the company’s focus on integrated power solutions that align with current catalysts in storage and commercial demand.

In contrast, it's important for investors to be aware of intensifying competition and hardware commoditization risks, which could impact net margins if...

Read the full narrative on SolarEdge Technologies (it's free!)

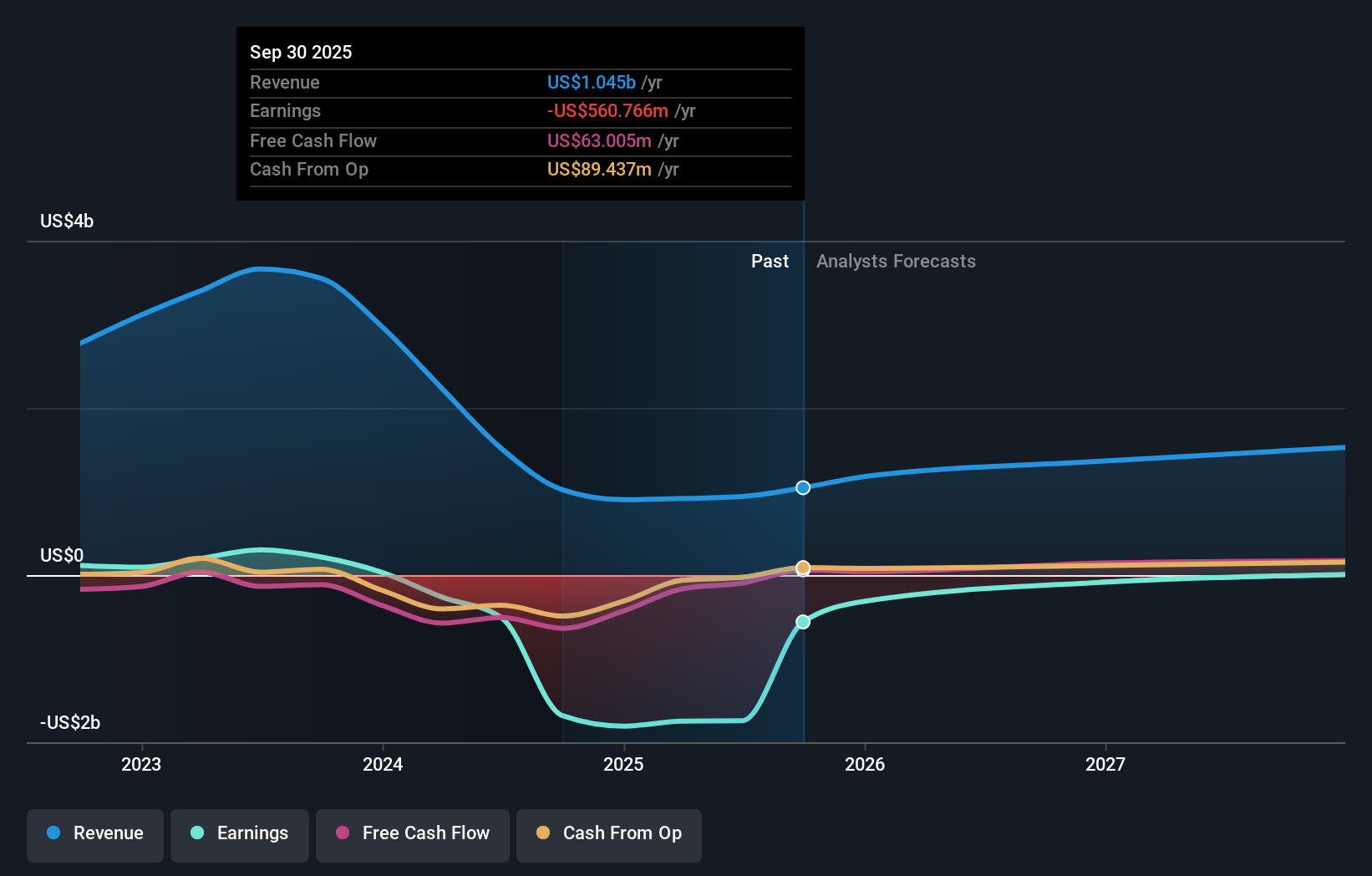

SolarEdge Technologies' outlook suggests revenues of $1.6 billion and earnings of $11.8 million by 2028. This is based on an expected annual revenue growth rate of 20.6% and an earnings increase of $1.71 billion from current earnings of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $30.23 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community estimate SolarEdge's fair value from US$30.23 up to US$90.47 per share. While many expect positive trends in commercial storage adoption, several also flag heightened industry competition as a potential headwind to stronger margins.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth 13% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives