- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Is Rigetti (RGTI) Building Durable Differentiation Through Its NVIDIA Quantum-AI Collaboration?

Reviewed by Sasha Jovanovic

- Rigetti Computing recently announced its collaboration with NVIDIA to support NVQLink, an open platform aimed at integrating AI supercomputing with quantum computers, and showcased this work at the Quantum Computing Pavilion during NVIDIA GTC in Washington, D.C.

- This partnership highlights Rigetti’s role in advancing hybrid quantum-classical computing by leveraging its superconducting-qubit technology for real-time, high-throughput system integration with AI infrastructure.

- With this technological milestone, we'll explore how Rigetti’s expanding collaborations in hybrid quantum-AI solutions shape the company’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Rigetti Computing's Investment Narrative?

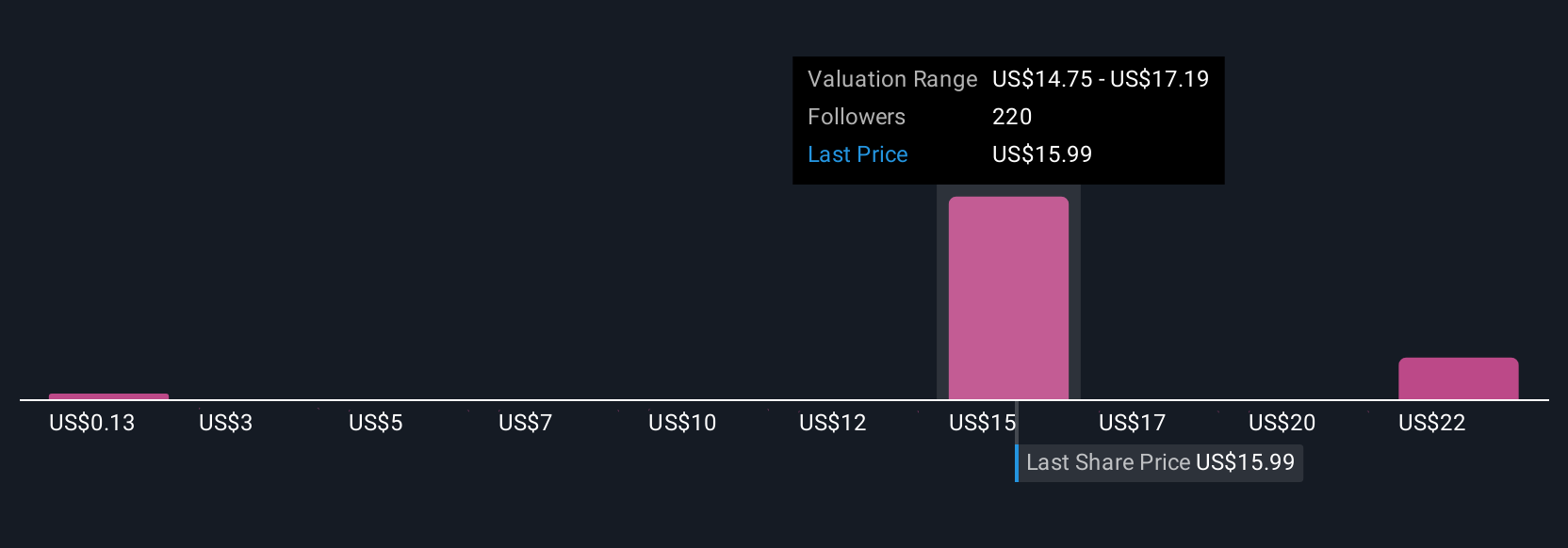

For anyone considering Rigetti Computing, it’s all about believing that quantum-classical integration will underpin the next breakthrough in computing. The recent collaboration with NVIDIA to support NVQLink puts Rigetti in a global spotlight, directly aligned with the sector’s race for usable quantum technology. This partnership may help reinforce the company’s status as an innovator, but it doesn’t fundamentally shift the most pressing near-term catalyst: solid commercial traction from hardware sales and research contracts. The big picture hasn’t changed, Rigetti’s fast revenue growth projections and government contracts remain key, while risks remain high as the company is deeply unprofitable, burning cash, and trading at lofty valuation multiples. The NVIDIA news could increase customer and partner interest, but with the stock already volatile and recently discounted relative to analyst targets, these headlines likely don’t alter the balance of short-term risks and catalysts all that much.

However, heavy share dilution in the past year is a risk investors need to keep in mind.

Exploring Other Perspectives

Explore 45 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives