- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Why Qualcomm (QCOM) Is Up 7.2% After Unveiling AI Data Center Collaboration in Saudi Arabia

Reviewed by Sasha Jovanovic

- HUMAIN and Qualcomm Technologies Inc. recently announced a collaboration to deploy advanced AI infrastructure in Saudi Arabia, unveiling the world's first fully optimized edge-to-cloud hybrid AI and targeting 200 megawatts of Qualcomm’s AI200 and AI250 solutions starting in 2026.

- This initiative not only positions Saudi Arabia as a potential global AI hub but also signals Qualcomm’s expansion into large-scale AI data center deployments alongside major industry competitors.

- We'll examine how Qualcomm’s entry into the AI data center market, underscored by its partnership with HUMAIN, could shape the company's investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

QUALCOMM Investment Narrative Recap

To be a Qualcomm shareholder today, you need to believe in the company’s ability to leverage next-generation AI and data center growth to offset headwinds in its core mobile chipset business and a maturing smartphone market. The recent HUMAIN partnership marks a highly visible step into large-scale AI deployments that could reinforce Qualcomm’s diversification story, though near-term dynamics such as competition from Nvidia and AMD remain the most important catalysts, while regulatory and legal risks continue to be the main concern. For now, the impact of the AI news is positive for sentiment but does not materially change the short-term catalyst or the legal and regulatory risks the company faces.

One recent announcement that stands out is Qualcomm’s affirmation of its quarterly cash dividend of US$0.89 per share, reflecting ongoing financial discipline and a commitment to shareholder returns. While this speaks to stability, the AI initiative in Saudi Arabia, combined with growing attention on its AI200 and AI250 chips, aligns closely with the company’s need to diversify away from a slowing smartphone market and capture new high-growth opportunities in AI infrastructure.

Yet, in contrast to these expansion efforts, investors should also be aware that regulatory and antitrust risks, especially in China, continue to...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's narrative projects $46.9 billion in revenue and $12.2 billion in earnings by 2028. This requires 2.7% yearly revenue growth and a $0.6 billion increase in earnings from $11.6 billion today.

Uncover how QUALCOMM's forecasts yield a $179.67 fair value, in line with its current price.

Exploring Other Perspectives

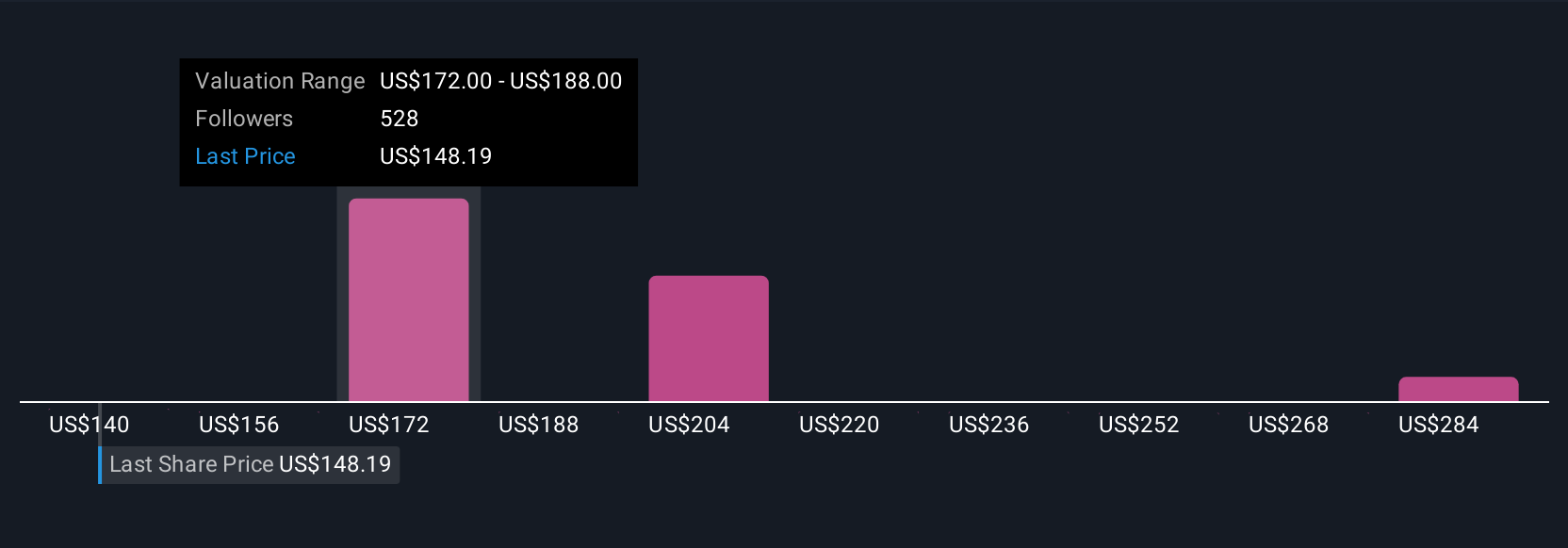

Simply Wall St Community members issued 32 fair value estimates for Qualcomm between US$140 and US$300 per share, illustrating a wide range of opinions. With so many voices, keep in mind that competition from industry giants and limits to smartphone growth are shaping the real test for the company’s future performance; consider exploring several of these viewpoints for a fuller picture.

Explore 32 other fair value estimates on QUALCOMM - why the stock might be worth 23% less than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives