- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Impinj (PI) Is Up 7.2% After Beating Revenue and EPS Estimates - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this week, Impinj reported quarterly results that exceeded analyst estimates for both revenue and earnings per share, marking a significant outperformance within the analog semiconductor sector.

- This surprise result highlights the company's execution strength in a market environment where efficiency and security demands are accelerating RFID adoption across key industries.

- Given Impinj’s strong earnings report amid robust sector demand, we will explore how this could reshape expectations for future growth and competitive position.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Impinj Investment Narrative Recap

To invest in Impinj, you need conviction in the global expansion of RFID technology for asset management, fueled by rising efficiency and security needs. The company's outsized revenue and earnings surprise this quarter adds momentum to near-term optimism, but does not eliminate concerns about ongoing exposure to supply chain disruptions and volatility from customer concentration risk. At present, the biggest catalyst remains expanded RFID adoption in logistics and data centers, while the most material risk is the impact of inventory cycles within key customer segments and underlying supply chain challenges.

The most relevant recent announcement is Impinj's upwardly revised quarterly earnings and revenue, posting both top and bottom-line beats relative to expectations. This result coincided with reports that data center RFID markets, including BFSI and IT sectors, are projected for strong growth, reinforcing the near-term catalyst of accelerating RFID deployment across key infrastructure verticals and potentially reshaping how quickly the company can achieve more diversified, recurring revenue streams.

However, while results underscore broad sector demand, investors should be aware that customer concentration risks are still very real if...

Read the full narrative on Impinj (it's free!)

Impinj's narrative projects $630.4 million revenue and $91.2 million earnings by 2028. This requires 20.6% yearly revenue growth and a $90.6 million earnings increase from $633.0 thousand today.

Uncover how Impinj's forecasts yield a $184.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

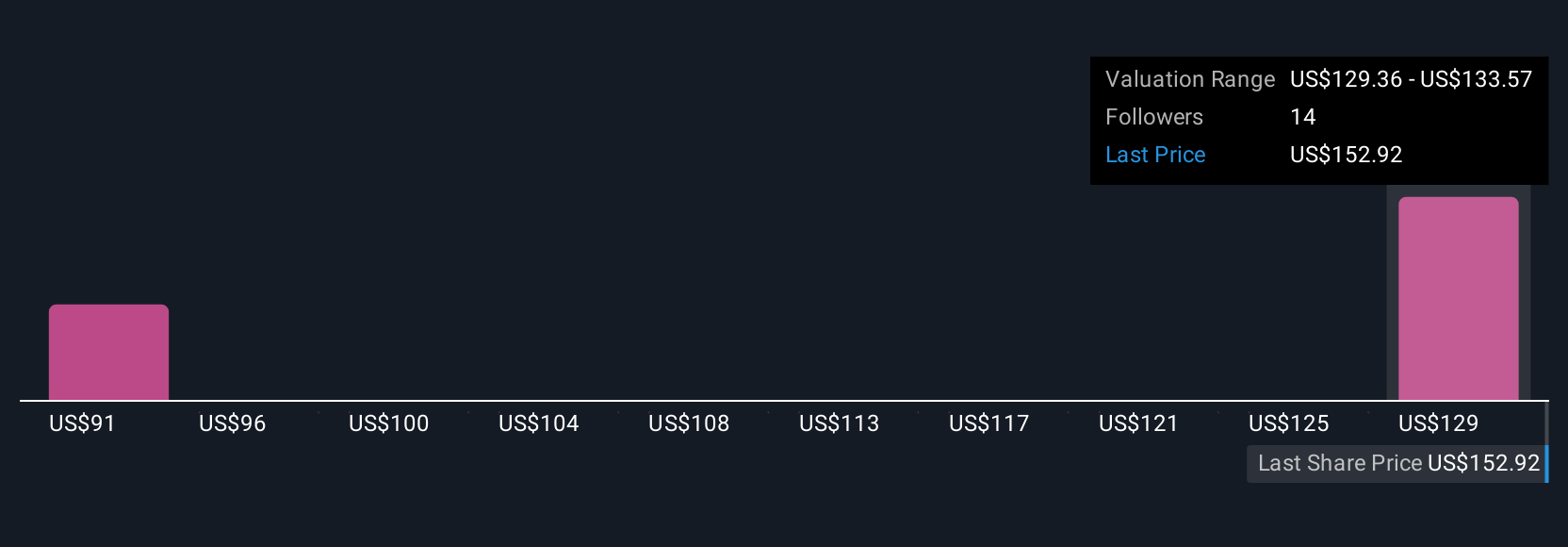

Simply Wall St Community members offered two fair value estimates for Impinj, ranging from US$80.76 to US$184 per share. Despite this wide range, the company's forward earnings growth remains a key focus for those watching for sustained sector momentum, consider how these diverse viewpoints reflect ongoing debates about timing and durability of demand.

Explore 2 other fair value estimates on Impinj - why the stock might be worth as much as $184.00!

Build Your Own Impinj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Impinj research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Impinj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Impinj's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives