- United States

- /

- Semiconductors

- /

- NasdaqGS:PENG

Is Penguin Solutions Set for Growth After Cloud Partnership and Recent 24% Share Price Dip?

Reviewed by Bailey Pemberton

- Curious about whether Penguin Solutions is really a hidden gem or just flying under the radar? Let’s get right to the heart of what makes this stock tick from a valuation perspective.

- Lately, Penguin Solutions’ share price has been anything but boring, climbing 14.9% so far this year and up 27.1% over the past 12 months, even after a recent dip of 24.2% this month.

- One big catalyst behind these price swings is the buzz around their recent strategic partnership with a major cloud computing provider. This signals investor excitement and a shift in how the company is being perceived. This move is drawing fresh attention to Penguin’s potential in the evolving tech landscape.

- On our valuation checks, Penguin Solutions scores a 2 out of 6. However, there is more to valuation than just checklists. Stick with us as we break down each method and reveal an alternative that could offer a deeper perspective at the end.

Penguin Solutions scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Penguin Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating all of Penguin Solutions’ future cash flows and then discounting them back to today’s value. This approach provides an idea of the company’s intrinsic worth. The model is particularly useful when a company’s value depends on its ability to generate steady cash over time.

Currently, Penguin Solutions reports Free Cash Flow (FCF) of $85.8 million. Analyst estimates and financial models project this figure to rise steadily, reaching about $156.2 million by 2026 and $168.2 million by 2027. Projections become less certain as the outlook extends further, but Simply Wall St extrapolates FCF to around $153.7 million by 2035. All projections are in US dollars.

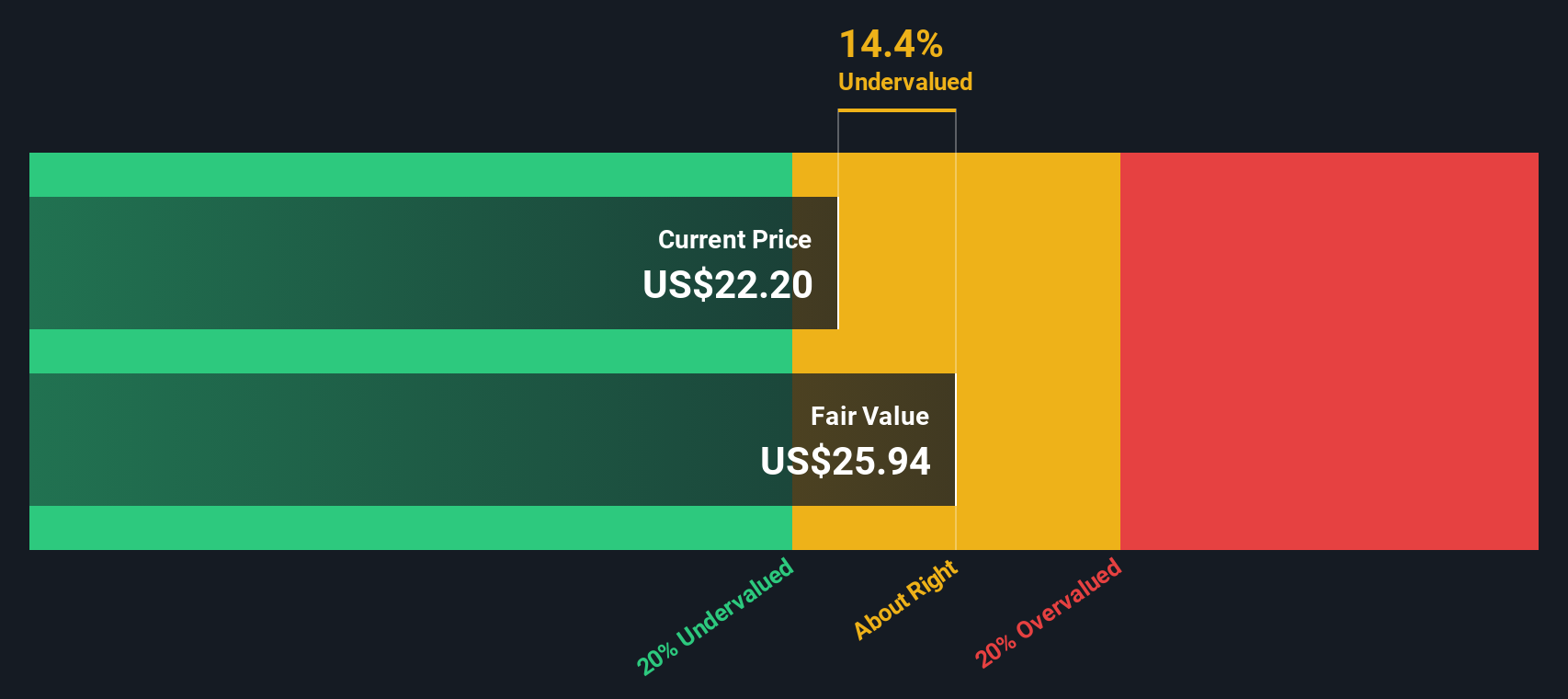

According to this DCF analysis, Penguin Solutions’ intrinsic value is estimated at $25.94 per share. This figure is roughly 14.4% higher than its current trading price, which suggests the stock is undervalued based on forecasted cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Penguin Solutions is undervalued by 14.4%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Penguin Solutions Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular benchmark for valuing profitable companies, like Penguin Solutions, because it gauges how much investors are willing to pay for each dollar of earnings. A higher PE usually reflects strong growth expectations, while a lower PE can suggest either more modest outlooks or heightened risk. What’s considered “fair” varies depending on the company’s growth prospects, profit margins, and how stable or risky its business is.

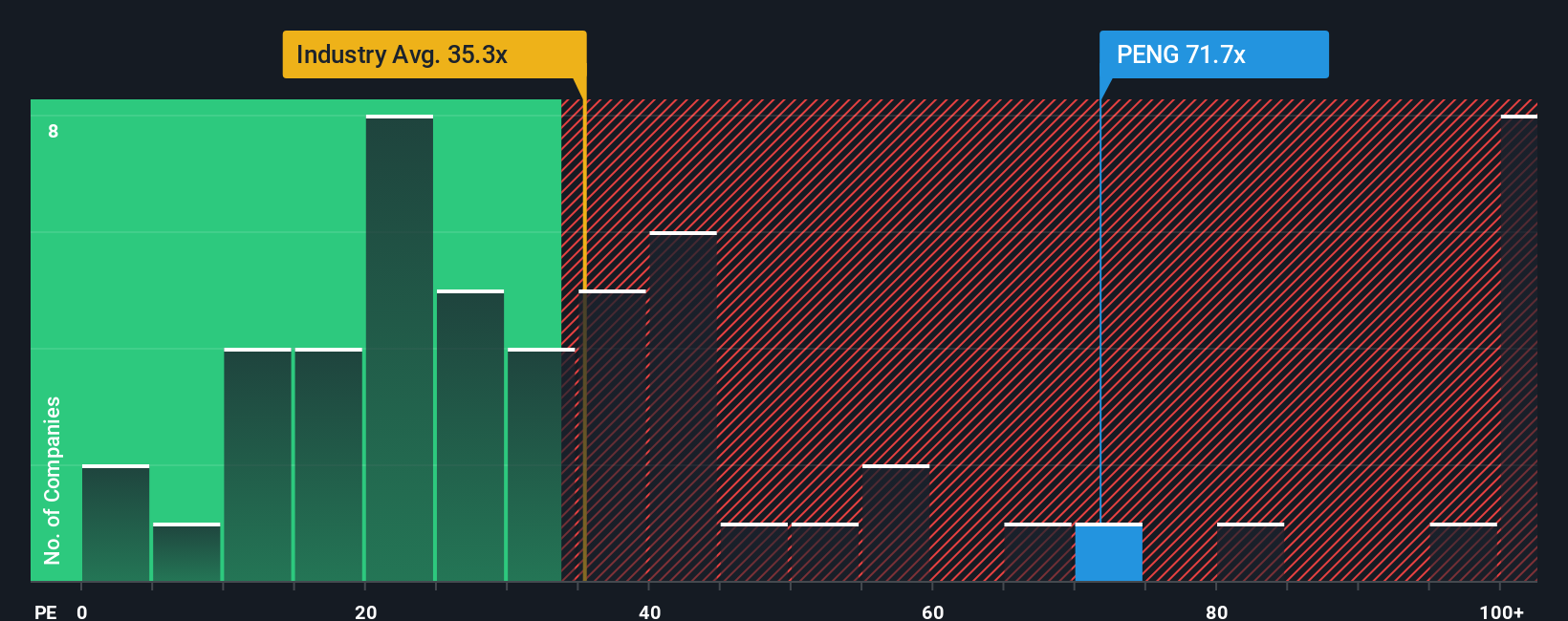

Currently, Penguin Solutions trades at a lofty 75.9x PE. That is almost double the semiconductor industry average of 36.9x and well above the average for similar peers at 40.1x. By those measures alone, the stock looks expensive. However, benchmarks like the industry and peers only go so far; they can miss crucial details about a company’s unique dynamics.

That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This metric does not just look at broad averages, but customizes a fair PE specifically for Penguin Solutions, blending its earnings growth, risk profile, profit margins, industry category, and company size. Because it takes more relevant, company-specific factors into account, it is a more insightful yardstick than any standard peer or sector comparison.

Compared to this Fair Ratio, Penguin Solutions’ current 75.9x PE is well above what would be considered reasonable, flagging the stock as likely overvalued on this metric right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Penguin Solutions Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized story about a company, connecting your view of its future, such as projected revenues, profit margins, and risks, to a financial forecast and, ultimately, a fair value.

Narratives bring investing to life by letting you decide what really matters, beyond generic ratios, as you justify your assumed fair value using your expectations about the company’s future performance. Available in the Community section of Simply Wall St’s platform and used by millions of investors, Narratives are designed to be accessible for everyone, whether you are a beginner or a pro.

The power of Narratives lies in their ability to guide action: by comparing your Narrative’s Fair Value with the current share price, you get a clear signal on whether to buy, hold or sell at any time. Even better, as new news or earnings updates emerge, Narratives are dynamically updated, keeping your perspective fresh and relevant.

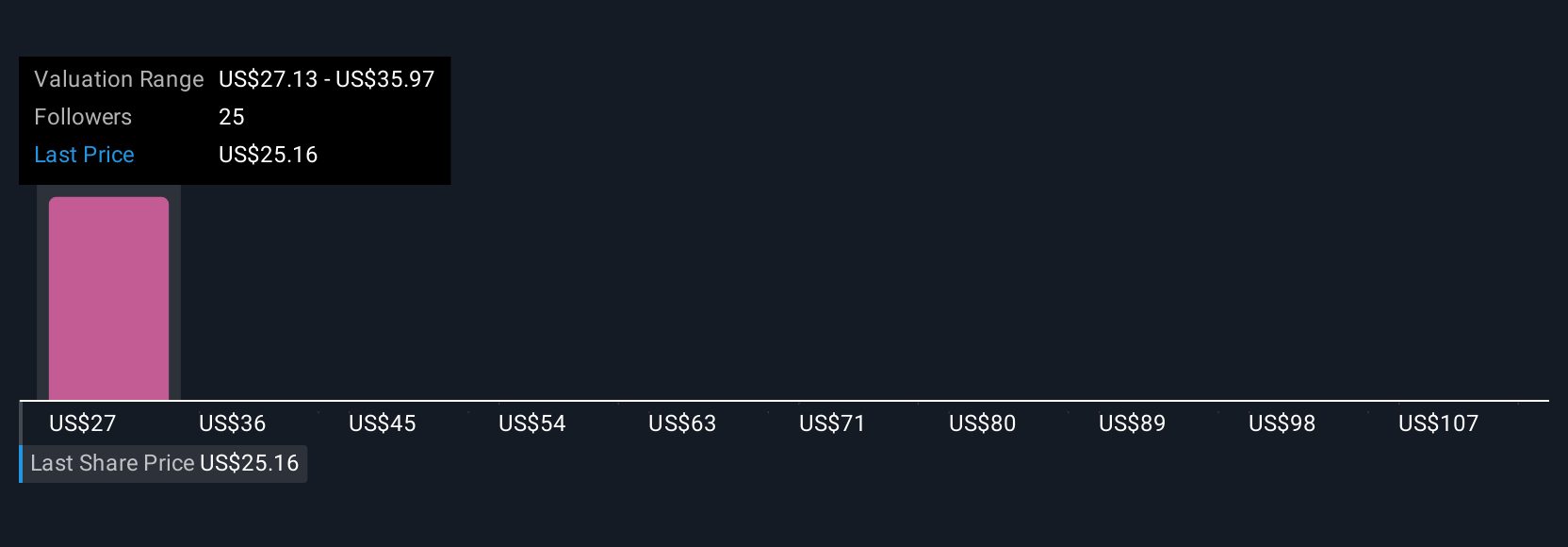

For Penguin Solutions, for example, some investors might tell a bullish Narrative based on strong AI demand and new global deals, valuing the stock at $35; others may focus on risks from lumpy project revenues or delayed R&D, leading them to a more cautious value of $23. Your Narrative lets you decide which story and fair value make sense for you.

Do you think there's more to the story for Penguin Solutions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PENG

Penguin Solutions

Designs, builds, deploys and manages enterprise solutions worldwide.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives