- United States

- /

- Semiconductors

- /

- NasdaqGS:OLED

Universal Display (OLED): Valuation in Focus After Global Expansion and Vapor Jet Printing Investment

Reviewed by Simply Wall St

Universal Display (OLED) recently made headlines as its subsidiary announced the opening of a global headquarters and R&D center in Singapore. The company also revealed plans to invest SGD 50 million in advancing its proprietary printing technology.

See our latest analysis for Universal Display.

Shares of Universal Display have felt some pressure over the past year, with a 12-month total shareholder return of -29.84%, even as the company’s expansion signals long-run growth ambitions. Despite the muted near-term price action, momentum is starting to build again. This is reflected in the recovery in the latest 90-day share price return.

If Universal Display’s latest move has you curious about where the next breakthrough might come from, it’s a great time to broaden your perspective and discover fast growing stocks with high insider ownership

Given its lagging returns and recent signs of momentum, is Universal Display’s stock an overlooked value play now that the company is making bold strategic moves, or has the market already accounted for all its growth potential?

Most Popular Narrative: 18.5% Undervalued

With Universal Display closing at $148.26 and the most popular narrative putting fair value at $181.89, there is a notable gap between the current price and narrative potential. This sets up a compelling context for what is driving those projections behind the scenes.

The rapid proliferation of connected, intelligent consumer devices (AI, 5G, always-on connectivity) is fueling global demand for high-efficiency, premium displays, directly benefiting Universal Display's energy-saving OLED materials portfolio, which should underpin further licensing and material sales growth.

Want to understand why this price target stands so far above today’s share price? The fair value rests on game-changing revenue growth assumptions, a future profit margin shift, and a premium earnings multiple rarely given outside the semiconductor elite. The narrative’s numbers may surprise you. See what it takes to get this valuation.

Result: Fair Value of $181.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and unpredictable customer demand could challenge Universal Display's revenue growth and put pressure on near-term earnings momentum.

Find out about the key risks to this Universal Display narrative.

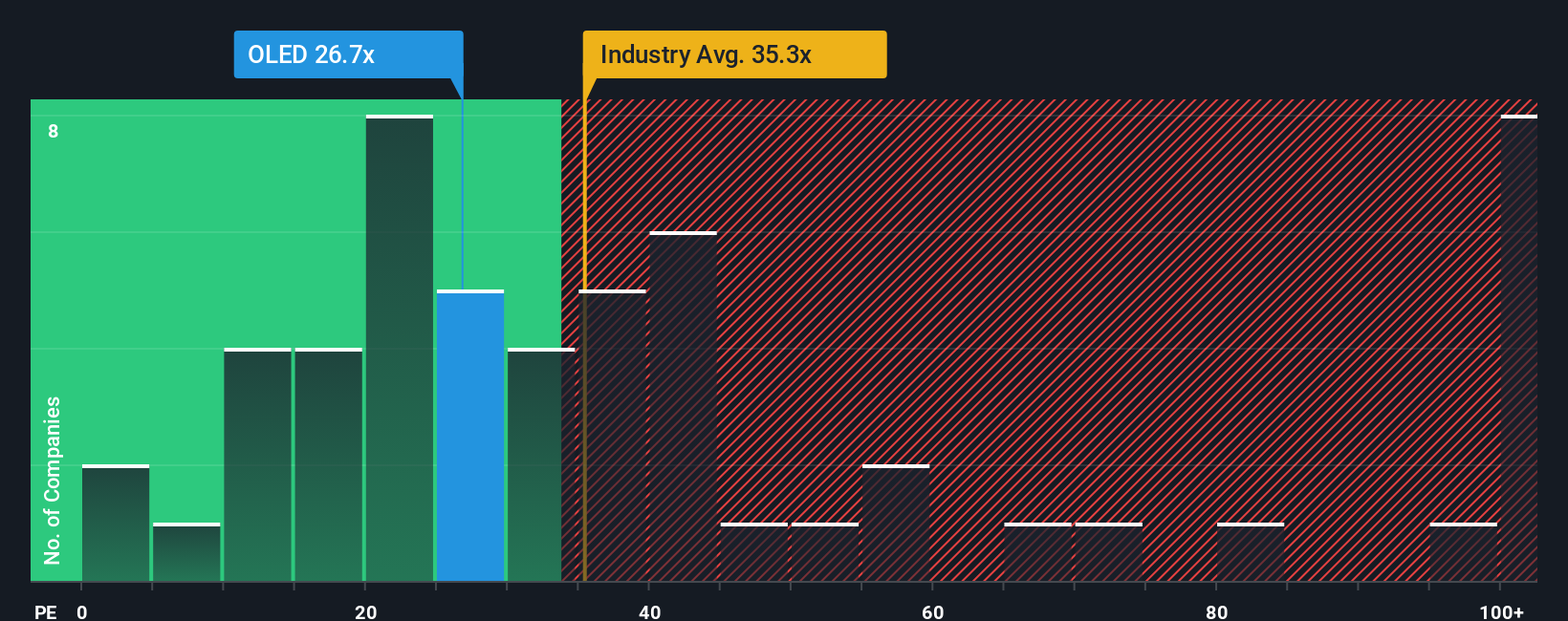

Another View: Peer Ratios Tell a Different Story

Looking at Universal Display’s price-to-earnings ratio offers another angle. At 28.8x, the company’s shares are cheaper than the US Semiconductor industry average of 40.3x and well below peers at 56.5x. However, this is still above the fair ratio of 23.7x, which could limit future upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Display Narrative

If you have your own perspective or want to dig deeper into the figures, you can build your own narrative in just a few minutes, too. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Universal Display.

Looking for More Investment Ideas?

Take charge of your financial future by uncovering potential winners in today’s fast-moving markets. Don’t wait for tomorrow’s trend when you could discover it today.

- Unleash your portfolio’s earning potential by targeting smart opportunities. Pinpoint value with these 864 undervalued stocks based on cash flows and stay ahead of the crowd.

- Tap into unstoppable momentum as artificial intelligence reshapes entire industries. Zero in on the innovators using these 26 AI penny stocks.

- Secure reliable streams of income. Hunt for generous yields from top-performing companies via these 21 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OLED

Universal Display

Engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in display and solid-state lighting applications.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives