- United States

- /

- Semiconductors

- /

- NasdaqGM:NVTS

Navitas Semiconductor (NVTS): Rapid 26.6% Revenue Growth Sets High Bar for Unprofitable, Premium-Valued Stock

Reviewed by Simply Wall St

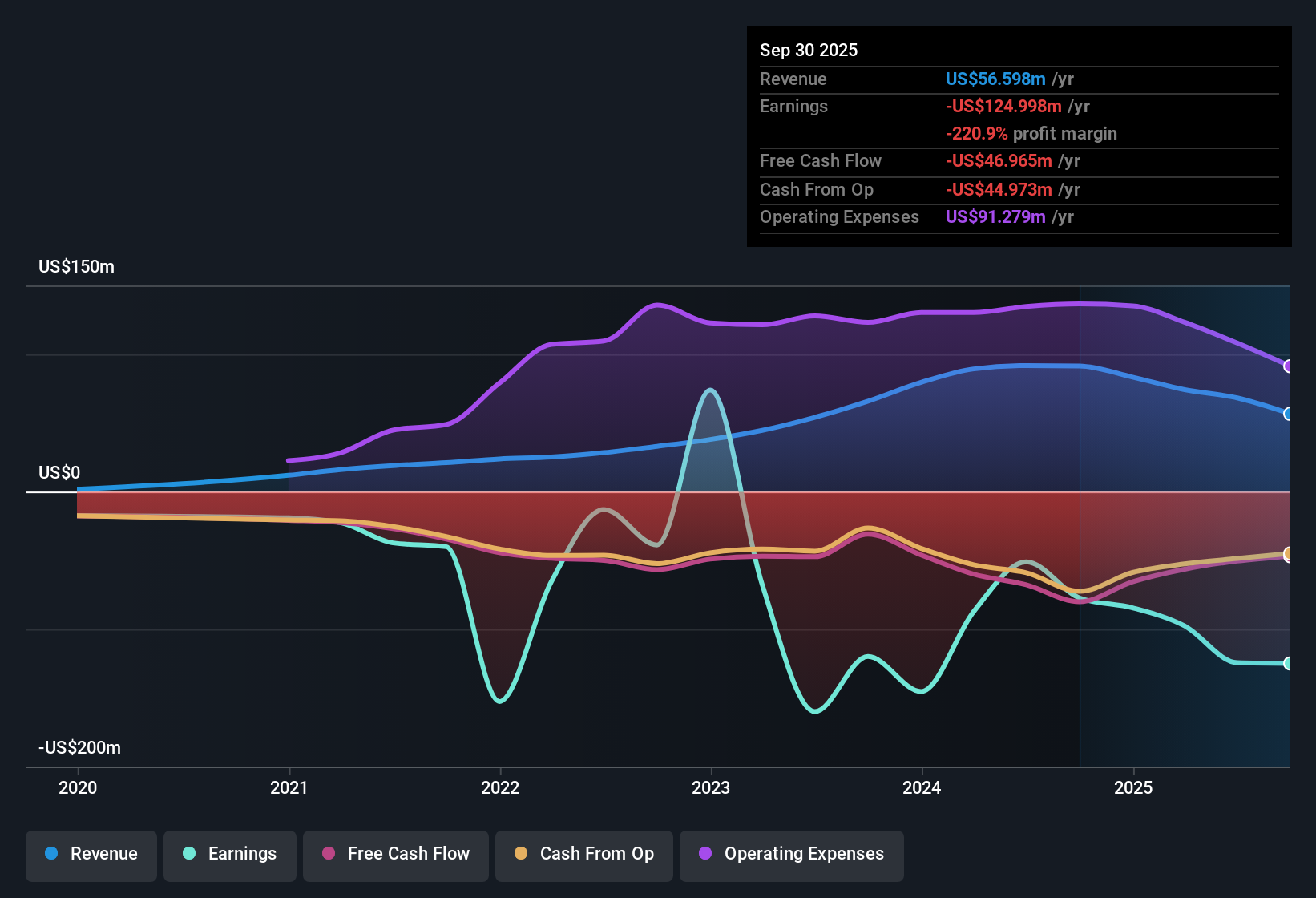

Navitas Semiconductor (NVTS) is forecasting standout growth, with revenue expected to rise 26.6% per year. This is more than double the broader US market’s 10.5% annual pace. Despite that top-line momentum, the company remains unprofitable, with losses having deepened at a rate of 22.5% per year over the past five years and no signs yet of margins improving. Investors now face the lure of rapid revenue growth, weighed against persistent unprofitability and the stock’s hefty valuation premium over industry peers.

See our full analysis for Navitas Semiconductor.Next up, we’ll look at how these headline figures compare with the major narratives driving sentiment in the NVTS community, and where the latest data might shift the story.

See what the community is saying about Navitas Semiconductor

Design Win Backlog Hits $450 Million

- Navitas reports a $450 million backlog of design wins, with this pent-up demand anticipated to flow into future revenue as automotive and data center projects ramp up through 2026.

- Analysts' consensus view highlights:

- This high win rate provides greater visibility for future revenue, but actual realization depends on seamless execution and favorable adoption, particularly as mobile and consumer sectors have recently softened.

- Bulls are encouraged by the 40 data center customer wins and a growing electric vehicle (EV) pipeline, with partnerships in place with major automakers expected to drive sustained growth as these contracts move into production.

- The consensus narrative notes that cost-reduction initiatives, including operational efficiencies and workforce cuts, are expected to improve net margins and support positive EBITDA by 2026. Execution remains key as management balances expense control with innovation spending.

- Momentum from these design wins could continue to surpass expectations if emerging industry tailwinds persist, according to the consensus view. See how consensus expectations compare to the numbers in the full narrative. 📊 Read the full Navitas Semiconductor Consensus Narrative.

Margins Under Pressure From Expense Cuts

- Gross margins have declined from the previous year, primarily due to a less favorable market mix, and net losses widened with an $11.6 million expense from a one-time distributor disengagement.

- Consensus narrative notes:

- Expense control, including operating cost reductions and post-acquisition synergies, is a key strategic priority. Management aims to improve profitability over the next several years.

- Bears caution that continued softness and inventory corrections in EV, solar, and industrial markets into early 2025 may weigh on both gross margins and top-line growth, particularly if segment weakness persists despite cost reductions.

Valuation Soars: 39.7x Price-to-Sales

- Navitas is trading at a Price-to-Sales ratio of 39.7x, well above both the wider US semiconductor industry average of 4.9x and its peer group at 4.6x, despite ongoing unprofitability.

- Consensus narrative highlights:

- With the current share price at $10.46, the gap versus sector benchmarks reflects investor willingness to bet on long-term growth potential rather than near-term profits, but it also brings higher risk if growth expectations moderate.

- Analysts set a price target of $8.15, which is 22% below today's share price. This suggests that even when factoring in future profitability and margin improvements, the current multiple reflects strong optimism for sustained revenue acceleration and execution on design wins.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Navitas Semiconductor on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from another angle? Add your perspective and craft a unique narrative in just minutes to make your voice part of the story. Do it your way

A great starting point for your Navitas Semiconductor research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite rapid revenue growth and design win momentum, Navitas remains unprofitable and trades at a steep valuation premium. This highlights the risk if market optimism fades.

If you’re seeking companies where the price better reflects their fundamentals, check out these 839 undervalued stocks based on cash flows to find investments that offer stronger value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navitas Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NVTS

Navitas Semiconductor

Designs, develops, and markets power semiconductors in the United States, Europe, China, rest of Asia, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives