- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Nvidia (NVDA): Exploring Valuation After Recent Gains and Growth Momentum

Reviewed by Simply Wall St

Nvidia (NVDA) shares have shown steady activity over the past month, with the stock returning nearly 9% as investors weigh recent financial trends. The company’s performance continues to attract attention in light of notable annual growth in both revenue and net income.

See our latest analysis for NVIDIA.

Momentum around Nvidia’s share price has been building, with a 1-month share price return of nearly 9% and a year-to-date gain of 44%. In the bigger picture, both the recent surge and Nvidia’s 1-year total shareholder return of 34% highlight continued optimism as the company’s market presence and growth story evolve.

If semiconductor market moves like Nvidia’s have you curious, now is the perfect time to check out See the full list for free.

With steady gains and strong growth figures, the big question now is whether Nvidia is still trading below its true value. Alternatively, the market may have already factored in all its future potential, leaving little room for upside.

Most Popular Narrative: 15% Undervalued

According to narrative author restinglion, the calculated fair value for Nvidia sits notably above the current market price, suggesting there is still room for appreciation. This mirrors ongoing bullishness, given Nvidia's recent close at $199.05 compared to a narrative fair value of $235.00 using a 10.09% discount rate.

"Most stockholders don't understand how NVIDIA makes its money. Not only is NVIDIA an AI chip company, NVIDIA sells their top tier software with their hardware called CUDA. CUDA is the software all companies are turning to due to its advanced integration with AI and its end-to-end software stack. This software is sold on a subscription basis, generating high earnings even after the sale of their chips. Thus, NVIDIA has positioned themselves in a way to dominate the future of AI, and with their high earnings, they will be able to continue to invest a high amount of their funds into innovation to maintain their lead over the global AI market."

Want to uncover the secrets behind this ambitious price target? The key is a bold call on future software profits and a revenue growth path that only a select few companies could dream of. What are the numbers supporting this story? Dive deeper to uncover what the narrative believes sets Nvidia up for the next big jump.

Result: Fair Value of $235.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing revenue growth or unexpected shifts in AI demand could challenge Nvidia's prospects and prompt a reassessment of its current valuation narrative.

Find out about the key risks to this NVIDIA narrative.

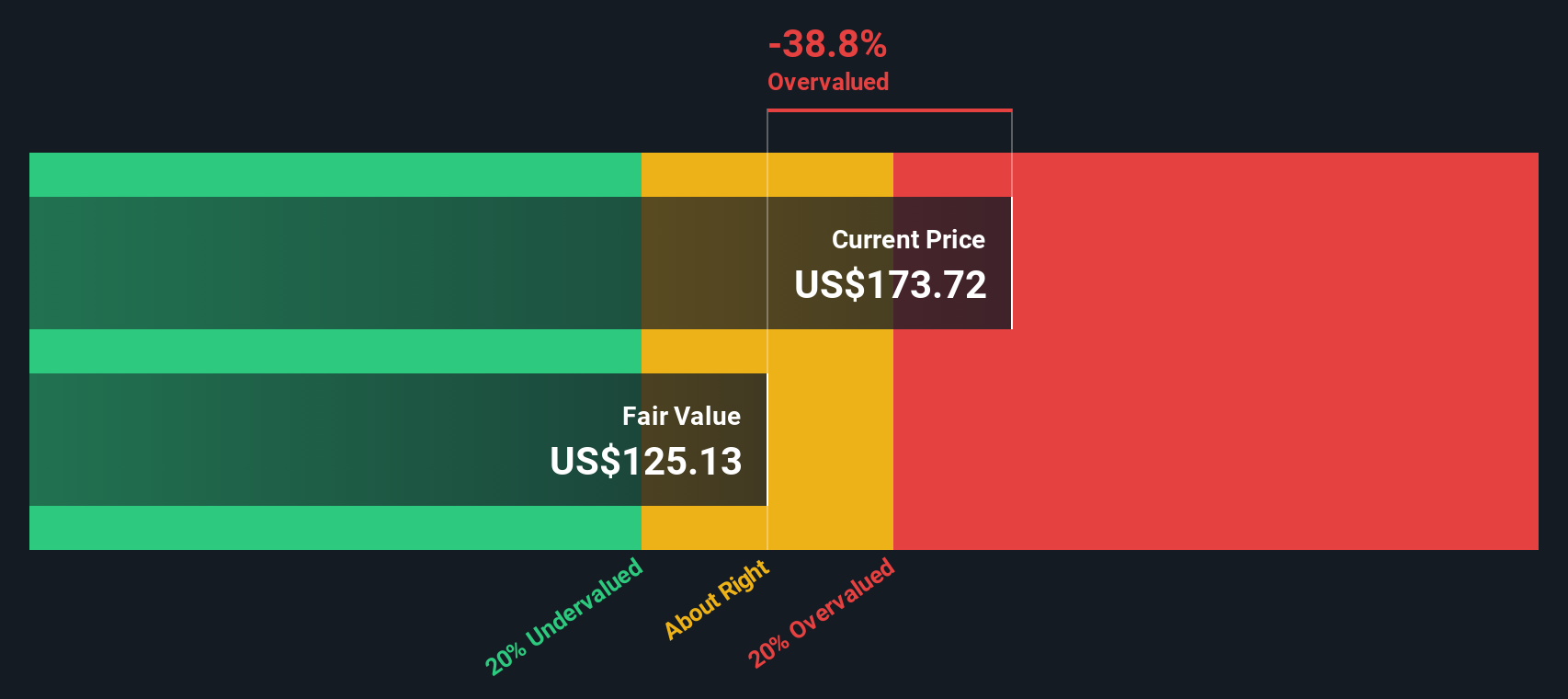

Another View: Discounted Cash Flow Tells a Different Story

While the narrative points to Nvidia being undervalued, our DCF model suggests a more cautious perspective. According to this method, Nvidia’s estimated fair value is below the current share price, which challenges the idea of upside. Can both views be right, or does one method provide a clearer signal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NVIDIA for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 864 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NVIDIA Narrative

If you see the story differently or want to draw your own conclusions, explore the data hands-on and start building your own view in just minutes. Do it your way

A great starting point for your NVIDIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunity knocks for those willing to act. Don't let your next winning idea pass you by. Use these smart tools now to discover unique stocks shaping tomorrow’s market.

- Capitalize on rising trends by scouting these 24 AI penny stocks boasting innovation at the core of artificial intelligence and automation.

- Unlock income potential by targeting these 16 dividend stocks with yields > 3% with solid yields above 3%, perfect for building resilient portfolios.

- Position yourself early in transformative tech by checking out these 28 quantum computing stocks ahead of the curve in quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives