- United States

- /

- Semiconductors

- /

- NasdaqGS:MXL

Unearthing September 2024's Top Undervalued Small Caps With Insider Activity

Reviewed by Simply Wall St

In a week marked by mixed performances across major indices and subdued trading activity ahead of the holiday weekend, value stocks have notably outperformed their growth counterparts. With inflation data showing signs of stability and consumer resilience, the environment appears ripe for identifying undervalued small-cap stocks with promising insider activity. Identifying a good stock in this context involves looking for companies that show strong fundamentals, potential for growth, and positive insider sentiment.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 3.6x | 3.6x | 23.33% | ★★★★★☆ |

| Essentra | 845.0x | 1.6x | 45.59% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 23.77% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 28.59% | ★★★★★☆ |

| Norcros | 7.6x | 0.5x | 2.02% | ★★★★☆☆ |

| Trican Well Service | 8.1x | 1.0x | 5.98% | ★★★★☆☆ |

| MYR Group | 33.8x | 0.5x | 42.69% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -93.60% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.7x | -256.98% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

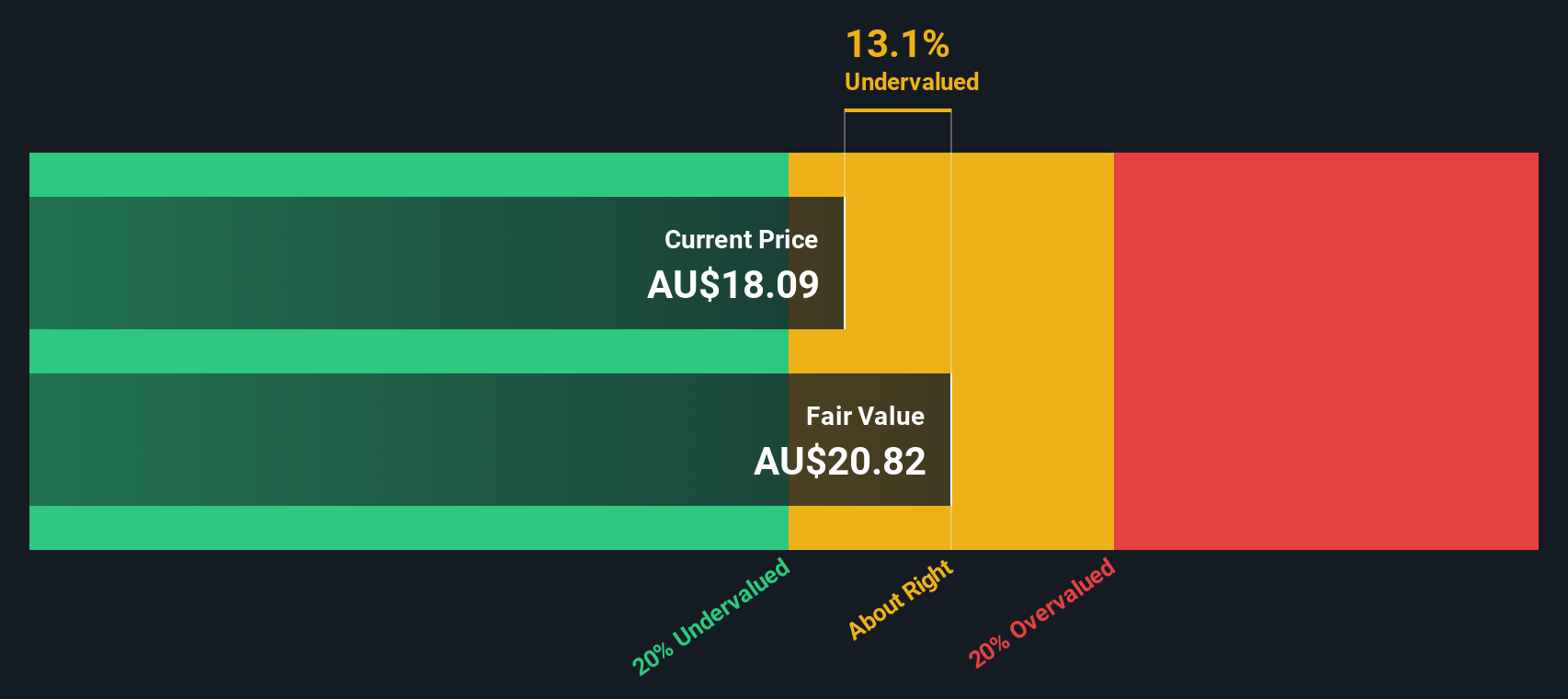

Eagers Automotive (ASX:APE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive operates as a major car retailing company in Australia with a market cap of approximately A$3.37 billion.

Operations: Car Retailing generates the majority of revenue at A$10.50 billion, with Property contributing A$41.65 million. Gross profit margin has fluctuated between 17.29% and 19.13% over recent periods, reaching 18.79% in the latest quarter ending September 2023. Net income margin peaked at 3.75% in December 2021 but was most recently reported at around 2.92%.

PE: 10.7x

Eagers Automotive, a smaller company in the automotive sector, reported sales of A$5.46 billion for H1 2024, up from A$4.82 billion last year. Despite this increase, net income dropped to A$116 million from A$137.76 million. Basic EPS fell to A$0.454 from A$0.544 a year ago. They announced a dividend of A$0.24 per share and initiated a buyback program for up to 25.8 million shares by June 2025, reflecting insider confidence in their stock's potential value.

- Click here and access our complete valuation analysis report to understand the dynamics of Eagers Automotive.

Explore historical data to track Eagers Automotive's performance over time in our Past section.

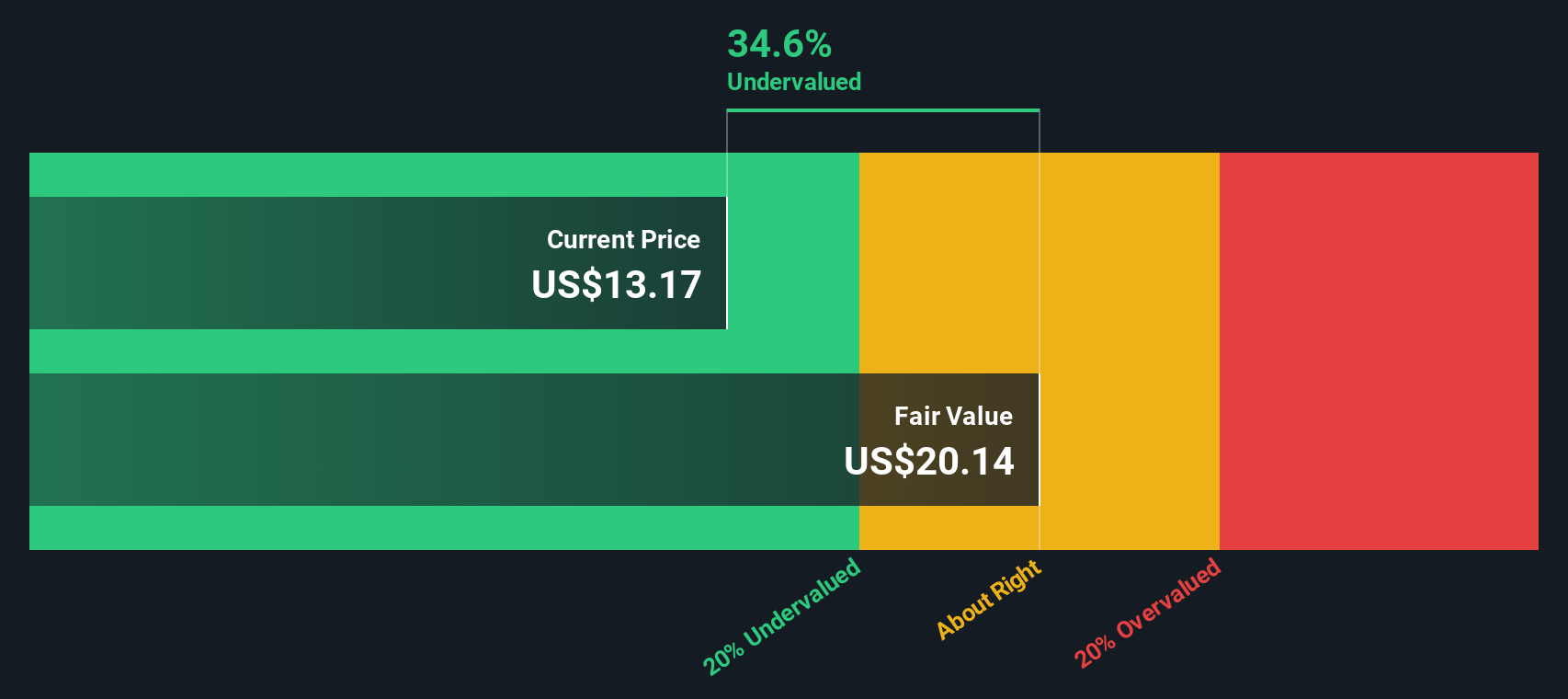

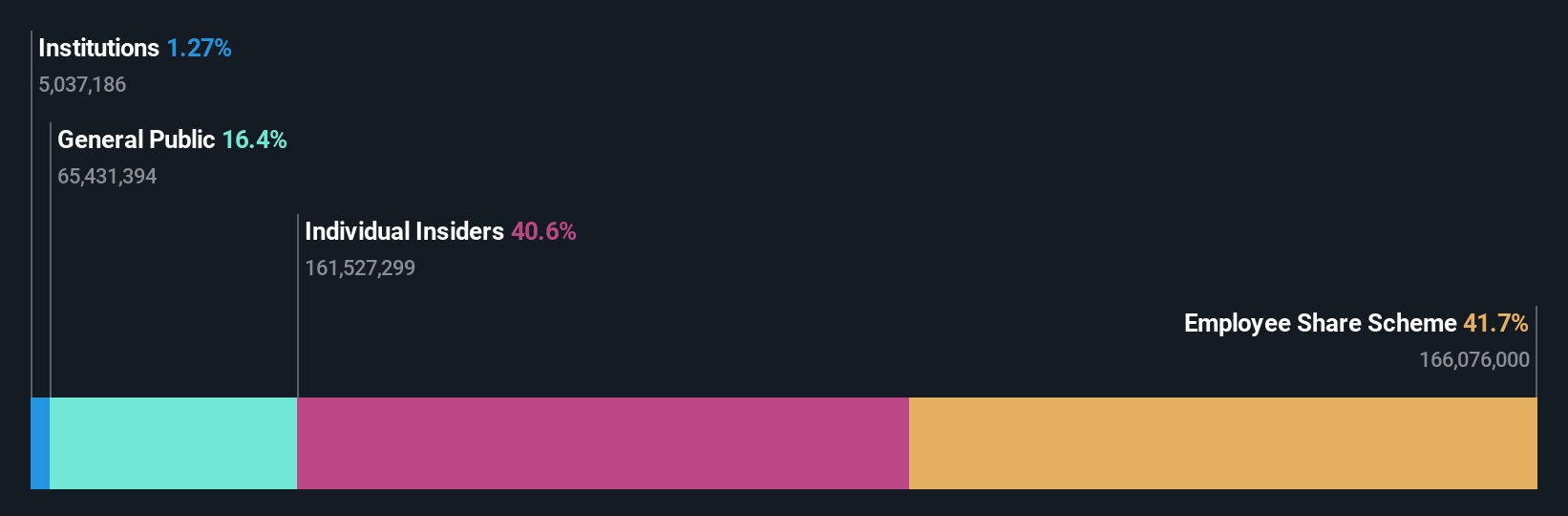

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear is a company that designs and sells semiconductors, with a market cap of $2.65 billion.

Operations: MaxLinear's revenue primarily comes from its semiconductor segment, with a recent gross profit margin of 53.99%. The company faces significant operating expenses, including R&D and general & administrative costs, which have impacted its net income margins.

PE: -6.7x

MaxLinear has been actively presenting at multiple conferences, showcasing their Panther III storage accelerator, which significantly boosts data throughput and reduces costs. Despite a challenging financial period with Q2 2024 sales dropping to US$91.99 million and a net loss of US$39.27 million, insider confidence remains high with Kishore Seendripu purchasing 108,303 shares worth approximately US$1.4 million in recent months. This suggests potential growth opportunities for this small company amidst industry challenges and evolving market dynamics.

- Delve into the full analysis valuation report here for a deeper understanding of MaxLinear.

Gain insights into MaxLinear's historical performance by reviewing our past performance report.

Shanghai Chicmax Cosmetic (SEHK:2145)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Chicmax Cosmetic is engaged in the manufacture and sale of cosmetic products with a market capitalization of CN¥8.74 billion.

Operations: The company generates revenue primarily from the manufacture and sale of cosmetic products, with recent revenue reaching CN¥6106.30 million. For the latest period, the gross profit margin was 74.96%.

PE: 18.0x

Shanghai Chicmax Cosmetic, a smaller player in the cosmetics industry, has shown significant growth recently. For the first half of 2024, they reported sales of CNY 3.5 billion and net income of CNY 401.2 million, up from CNY 1.6 billion and CNY 101 million respectively from the same period last year. Insider confidence is evident with recent share purchases by executives over the past six months. Additionally, they proposed an interim dividend of RMB 0.75 per share for H1 2024 payable on November 19th, reflecting their robust financial health and commitment to returning value to shareholders.

- Dive into the specifics of Shanghai Chicmax Cosmetic here with our thorough valuation report.

Understand Shanghai Chicmax Cosmetic's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 201 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MXL

Good value with reasonable growth potential.