- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Assessing Valuation After Strong Share Price Rally in 2024

Reviewed by Simply Wall St

See our latest analysis for Micron Technology.

This surge in share price has been fueled by both Micron’s strong earnings momentum and upbeat investor sentiment. The 31% share price return over the past month has caught particular attention. Over the past year, total shareholder return stands at 119.9%, and long-term investors have seen nearly a tripling of their investment over five years. This points to real staying power as optimism builds once again.

If this kind of momentum gets you thinking about what’s next in tech, check out the latest opportunities with our See the full list for free.

But after such a dramatic climb, is Micron still trading at an attractive valuation, or has the market already factored in all the future growth that investors hope for? Could there still be a real buying opportunity here?

Most Popular Narrative: 16.7% Overvalued

According to BlackGoat’s widely followed narrative, Micron’s fair value is estimated at $203.92 per share, noticeably lower than the current market price of $237.92. The narrative’s outlook is shaped by Micron’s exposure to transformative AI opportunities and recent growth surge. It also questions whether the stock’s rapid gains might be outpacing fundamental value.

The AI Supercycle is the most powerful catalyst. The demand for next-generation HBM is unprecedented. Micron has successfully passed NVIDIA's quality verification for its HBM3E products and has become a key supplier for the next-generation "Blackwell" AI accelerator. The company is now shipping high-volume HBM to four major customers across both GPU and ASIC platforms. With its entire 2025 production capacity already sold out, analysts project the HBM market will grow from roughly $30 billion in 2025 to a staggering $100 billion by 2030, representing a massive runway for growth.

Want to know which key drivers power this bold price target? One forecast for Micron relies on blockbuster growth in new memory technologies, plus ambitious profitability assumptions. Curious about the financial levers that could make or break this valuation? Explore the full narrative for the exact numbers supporting this call.

Result: Fair Value of $203.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the unpredictable swings of the memory market and fierce competition from Samsung and SK Hynix could quickly reshape Micron’s outlook.

Find out about the key risks to this Micron Technology narrative.

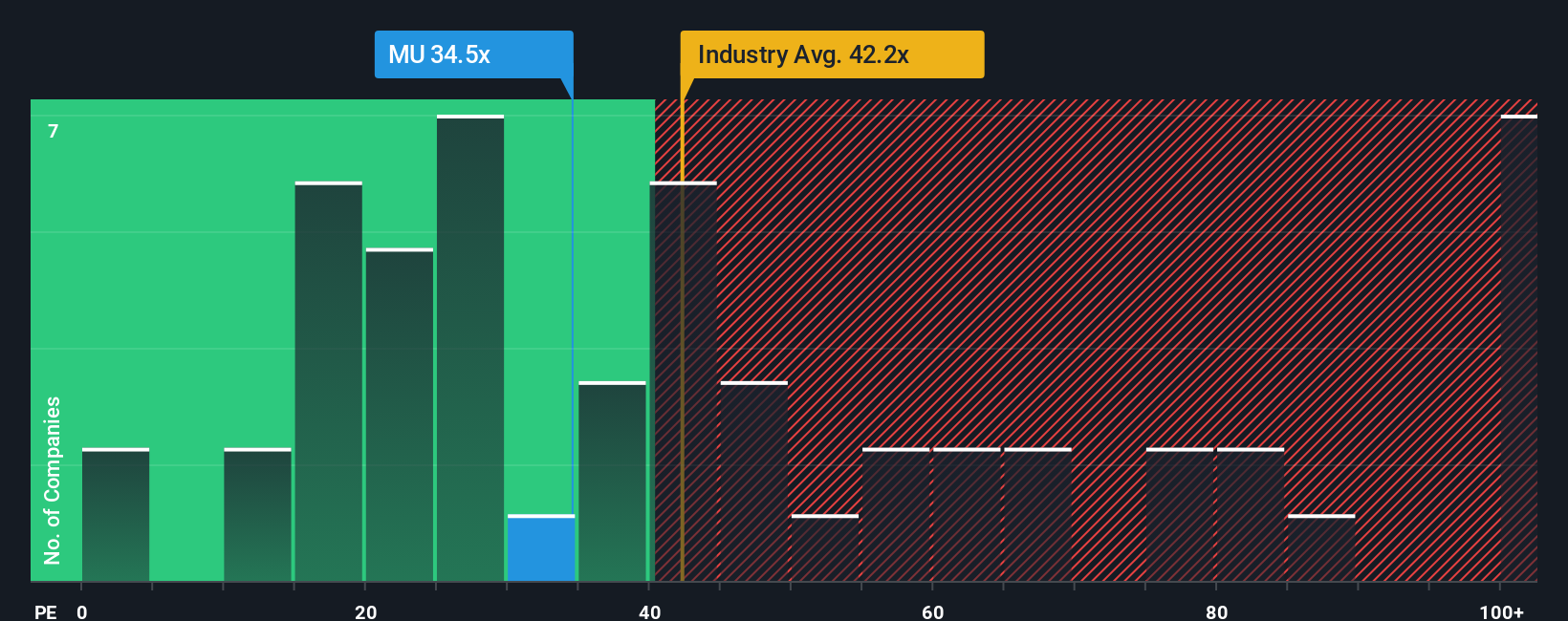

Another View: Multiples Suggest Relative Value

While user narratives and discounted cash flow models may flag Micron as overvalued, a look at price-to-earnings ratios tells a more optimistic story. Micron trades at 31.3 times earnings, which is noticeably lower than both the US semiconductor industry average of 35.4 and a peer average of 94.6. Notably, the fair ratio estimate stands even higher at 42.8. This suggests the market, in practical terms, might still be undervaluing Micron’s earnings power compared to where it could ultimately go. So, is Micron unexpectedly a value pick hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Micron Technology Narrative

If you see things differently or prefer digging into the numbers on your own, the data is all there for you. You can shape your own perspective in just a few minutes, Do it your way.

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave opportunity on the table. Let Simply Wall Street help you spot smart, actionable investments other investors might overlook. Get a head start now.

- Capture potential big returns by tracking these 3580 penny stocks with strong financials with solid financial foundations and real growth stories behind them.

- Start growing your portfolio’s yield with these 16 dividend stocks with yields > 3% offering reliable income streams and impressive dividend histories.

- Unlock emerging opportunities in AI by checking out these 25 AI penny stocks that are disrupting traditional industries with powerful innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives