- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL): Evaluating Valuation as Recent Gains Take a Breather

Reviewed by Simply Wall St

See our latest analysis for Marvell Technology.

Zooming out, Marvell Technology’s share price has pulled back from recent highs. While momentum over the past month was positive, its year-to-date loss and modest one-year total shareholder return of -2.8% suggest enthusiasm is currently taking a breather compared to its stellar past multi-year returns.

Wondering what else might deliver standout performance? Consider using this opportunity to discover See the full list for free.

With shares off their highs and recent returns looking mixed, the big question now is whether Marvell Technology is undervalued with upside ahead, or if the market is already factoring in all of its future growth potential.

Most Popular Narrative: Fairly Valued

Compared to the latest close of $90.92, the most widely followed narrative places Marvell Technology’s fair value at $90.07, virtually in line with current prices. This sets the stage for a deeper look at the key catalysts driving expectations.

"The company's success in securing multigenerational design wins with hyperscalers and ramping up a robust pipeline (over 50 new custom silicon opportunities representing $75 billion in lifetime value) positions Marvell to grow its data center market share from 13% to 20% of a fast-expanding $94B TAM by 2028, driving recurring and expanding revenue."

Think the story ends there? Guess again. This fair value is built on transformative industry shifts and ambitious market share goals only hinted at here. The underlying assumptions are bold and the projected growth path even bolder. Click through to discover which financial leaps—revenue, profits, or margins—anchor this valuation and how analysts believe Marvell could surprise the market.

Result: Fair Value of $90.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major risks remain, including potential order cuts from hyperscale cloud customers and volatility that comes from reliance on large custom chip projects.

Find out about the key risks to this Marvell Technology narrative.

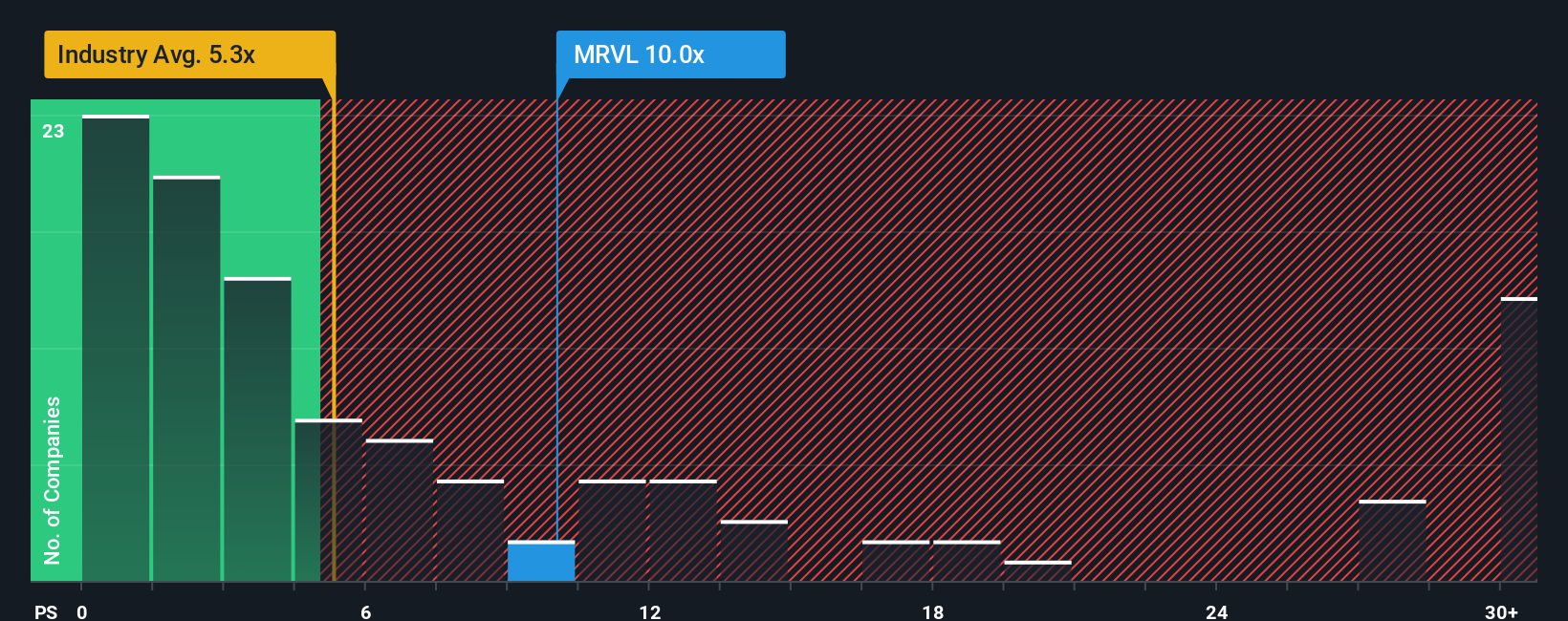

Another View: Is Marvell Really a Bargain on Sales?

Looking at Marvell Technology through a price-to-sales lens, its ratio stands at 10.8x, considerably below the peer average of 17.2x and also below the fair ratio of 11.6x that the market could eventually converge on. This presents potential value, but industry and broader market averages suggest caution is still warranted. Does this tilt the balance toward opportunity, or are risks baked in for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marvell Technology Narrative

If these conclusions do not fit with your perspective or you prefer to dig into the numbers on your own, you can craft your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Marvell Technology.

Looking for More Smart Investment Ideas?

Do not limit your portfolio to just one story. The next big winner could be hiding where most investors are not looking, so take action now.

- Boost your income prospects and get ahead of rate changes by reviewing these 16 dividend stocks with yields > 3% yielding strong returns above 3%.

- Catalyze your next move in artificial intelligence by evaluating these 24 AI penny stocks, putting groundbreaking tech at the center of rapid market shifts.

- Get an edge on undervalued gems others might miss by screening for these 875 undervalued stocks based on cash flows built on solid cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives