- United States

- /

- Semiconductors

- /

- NasdaqGS:MKSI

MKS Instruments, Inc. (NASDAQ:MKSI): A Fundamentally Attractive Investment

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Attractive stocks have exceptional fundamentals. In the case of MKS Instruments, Inc. (NASDAQ:MKSI), there's is a financially-sound company with an optimistic future outlook, not yet reflected in the share price. In the following section, I expand a bit more on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, take a look at the report on MKS Instruments here.

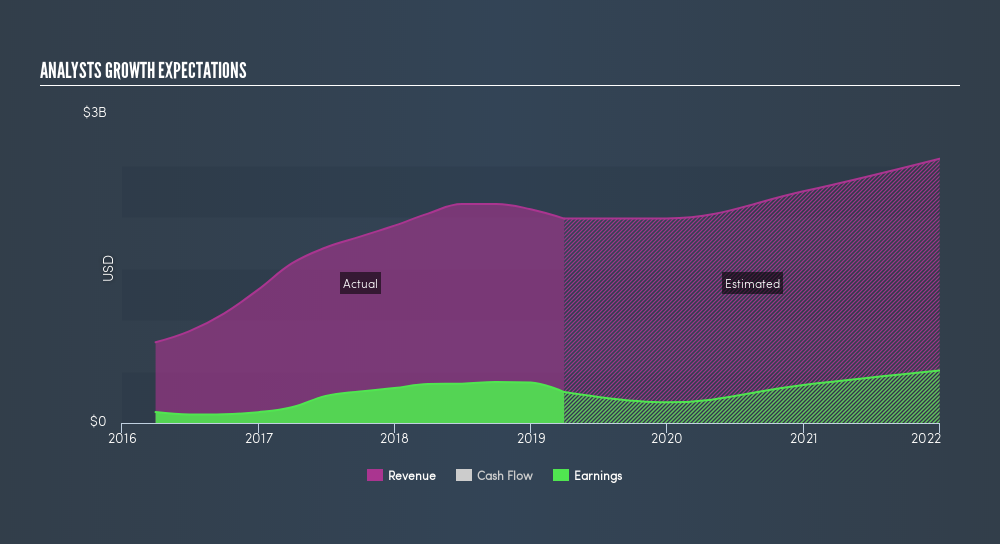

Very undervalued with reasonable growth potential

One reason why investors are attracted to MKSI is its earnings growth potential in the near future of 36%, bolstered by its impressive cash-generating ability, as analysts predict its operating cash flows will rise by 62% over the same time period. This is a sustainable driver of high-quality earnings, as opposed to pure cost-cutting activities. MKSI is currently trading below its true value, which means the market is undervaluing the company's expected cash flow going forward. Investors have the opportunity to buy into the stock to reap capital gains, if MKSI's projected earnings trajectory does follow analyst consensus growth, which determines my intrinsic value of the company. Also, relative to the rest of its peers with similar levels of earnings, MKSI's share price is trading below the group's average. This supports the theory that MKSI is potentially underpriced.

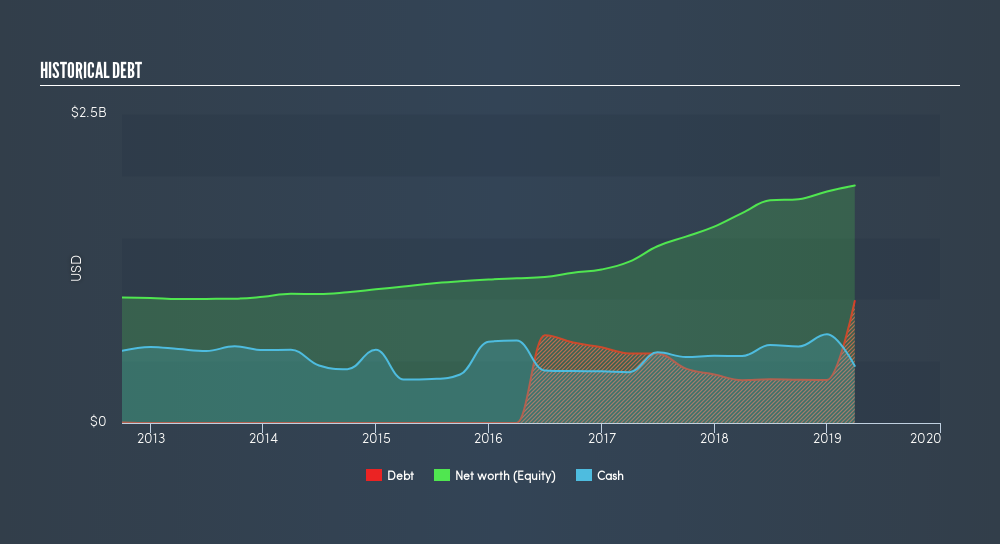

MKSI's strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This indicates that MKSI has sufficient cash flows and proper cash management in place, which is a crucial insight into the health of the company. MKSI seems to have put its debt to good use, generating operating cash levels of 0.37x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows.

Next Steps:

For MKS Instruments, I've compiled three important factors you should look at:

- Historical Performance: What has MKSI's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Dividend Income vs Capital Gains: Does MKSI return gains to shareholders through reinvesting in itself and growing earnings, or redistribute a decent portion of earnings as dividends? Our historical dividend yield visualization quickly tells you what your can expect from MKSI as an investment.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of MKSI? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MKSI

MKS

Provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, China, South Korea, Japan, Taiwan, Singapore, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success