- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Should Lam Research's (LRCX) $15.98 Billion Shelf Filing Prompt Strategic Reassessment by Investors?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Lam Research Corporation announced the filing of a shelf registration for up to US$15.98 billion in common stock, alongside a quarterly dividend affirmation, amendments to its certificate of incorporation, and voting results from its recent annual meeting.

- The substantial shelf registration filing draws attention to Lam's potential pursuit of future capital raising, which could have meaningful implications for its financial strategy and shareholder dilution.

- We will explore how the prospect of significant future equity issuance may influence Lam Research's investment outlook and key valuation drivers.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lam Research Investment Narrative Recap

To be a Lam Research shareholder today, you need to believe in the company's ability to capitalize on industry momentum from AI-driven chip demand and ongoing government incentives supporting new fab construction. The November 2025 announcement of a US$15.98 billion shelf registration may raise questions about potential future dilution, but there is no immediate material impact on current catalysts such as advanced chip architecture adoption; similarly, the main risks around China demand and customer concentration remain unchanged for now.

Among recent announcements, the board’s approval of a quarterly dividend of US$0.26 per share stands out, reflecting management’s continued focus on capital returns and possibly signaling confidence amid larger capital structure changes. This aligns with Lam’s appeal to investors seeking consistent cash flows, even as industry catalysts like AI infrastructure offer growth potential.

In contrast, risks tied to Lam’s heavy exposure to a few major customers remain a factor investors should be aware of, especially if...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $23.6 billion in revenue and $6.7 billion in earnings by 2028. This requires 8.5% yearly revenue growth and a $1.3 billion earnings increase from $5.4 billion today.

Uncover how Lam Research's forecasts yield a $158.02 fair value, in line with its current price.

Exploring Other Perspectives

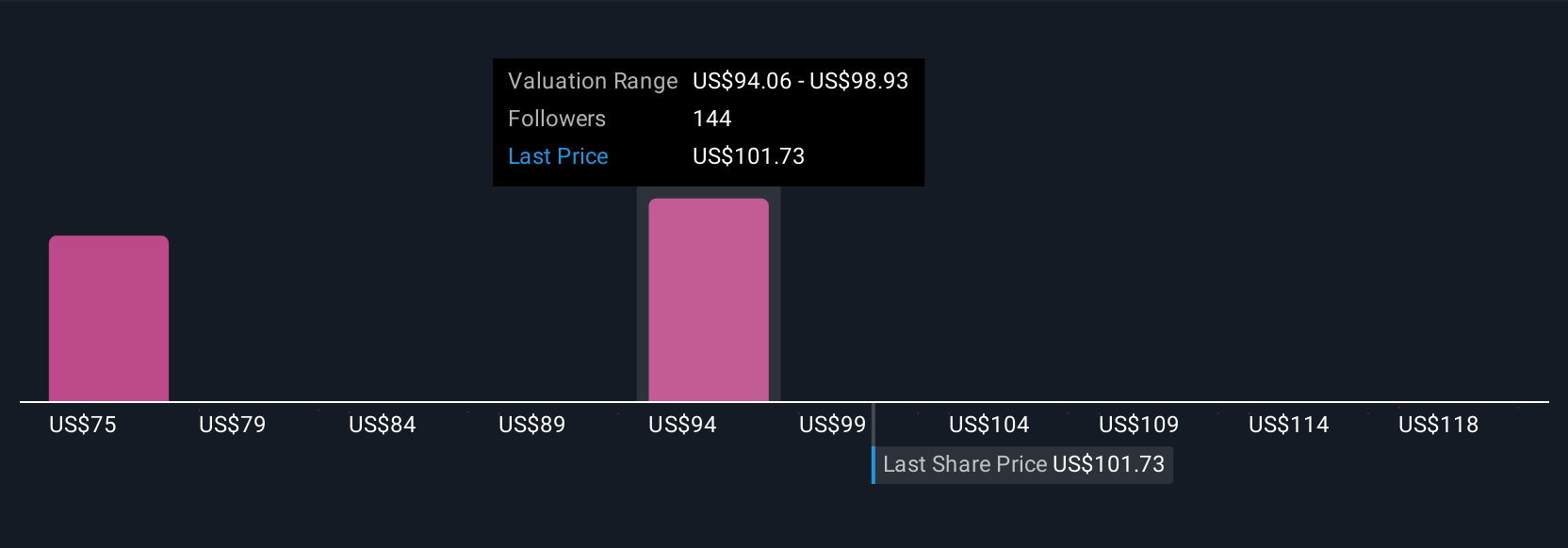

Seventeen fair value estimates from the Simply Wall St Community span from US$63.55 to US$158.02, underscoring a wide spectrum of market opinions. While community perspectives differ, the company’s exposure to fluctuating customer capital spending could be pivotal for its future performance, see how others are approaching this risk and share your own view.

Explore 17 other fair value estimates on Lam Research - why the stock might be worth less than half the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives