- United States

- /

- Semiconductors

- /

- NasdaqGS:LAES

Why SEALSQ (LAES) Is Up 27.3% After Unveiling Post-Quantum Chip Breakthroughs and Satellite Security Plans

Reviewed by Simply Wall St

- SEALSQ Corp. has announced a series of product breakthroughs, highlighted by the unveiling and commercial testing of its post-quantum chip QS7001, progress toward industry certifications, and its pivotal role in upcoming WISeSat satellite launches designed to bring quantum-resistant security to space-based communications.

- These moves underscore SEALSQ's aim to lead in quantum-ready IoT, critical infrastructure, and secure digital identity, positioning it at the intersection of hardware innovation and next-generation cybersecurity needs.

- We'll explore how SEALSQ's advancements in post-quantum hardware are reshaping its investment story in the fast-evolving cybersecurity landscape.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is SEALSQ's Investment Narrative?

For anyone considering SEALSQ, the investment story centers around whether quantum-resistant hardware can bridge its current financial challenges and future ambitions. The latest news, SEALSQ’s post-quantum QS7001 chip entering commercial trials, new steps toward top-tier industry certification, and its integration into WISeSat satellite launches, offers tangible signs of momentum on the product and partnership front. These developments could boost confidence in the company’s position as a potential leader in post-quantum security, and may quicken adoption across critical markets like IoT and secure communications. In the near term, the main catalyst remains the successful commercialization and certification of new products, but risks persist, including ongoing large net losses, a negative return on equity, and volatility in the share price. The recent breakthroughs may help bolster the investment case, but the business is still unprofitable and faces stiff competition, making it crucial to weigh headline innovation against underlying results.

But despite all these advancements, ongoing losses are still a key concern for investors.

Exploring Other Perspectives

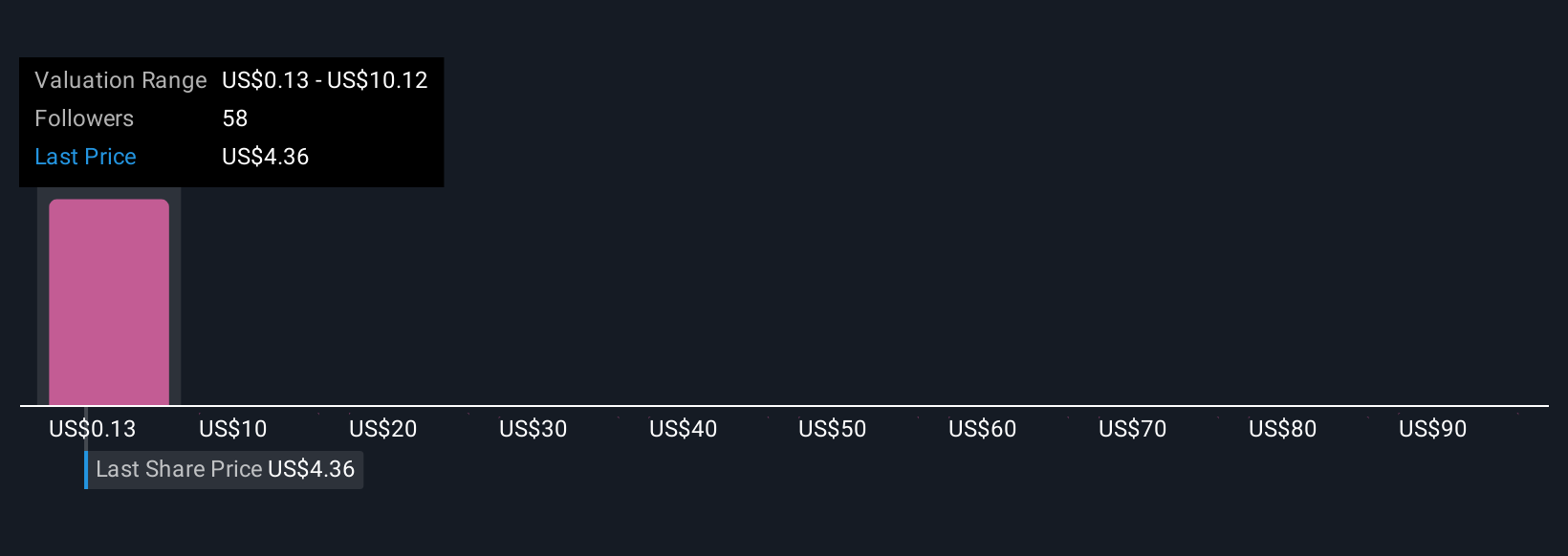

Explore 15 other fair value estimates on SEALSQ - why the stock might be worth less than half the current price!

Build Your Own SEALSQ Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SEALSQ research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free SEALSQ research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SEALSQ's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LAES

SEALSQ

Designs, develops, and markets semiconductors in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives