- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

The Bull Case for Kulicke and Soffa Industries (KLIC) Could Change Following Mixed Q4 Earnings and Share Buyback

Reviewed by Sasha Jovanovic

- Kulicke and Soffa Industries recently announced its fourth quarter and full year 2025 earnings, reporting sales of US$177.56 million for the quarter and net income of US$6.38 million, alongside updated guidance for the upcoming quarter.

- In addition to its financial performance, the company completed a buyback of 1,786,177 shares, representing 3.37% of its outstanding shares, valued at US$66.2 million under a program announced in November 2024.

- With quarterly earnings down but full-year net income turning positive, we'll examine how the new guidance shapes Kulicke and Soffa’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kulicke and Soffa Industries' Investment Narrative?

For anyone looking at Kulicke and Soffa Industries right now, the central belief you’d need as a shareholder is faith in the company’s ability to return to robust and sustainable earnings growth amid continuing volatility. The recent announcement of a positive swing to full-year profitability is a clear improvement after last year’s loss, though the quarterly numbers still reflect some near-term softness. The completion of the planned US$66.2 million buyback may act as a mild floor for the share price and signal management’s confidence, but won’t significantly shift the company’s main catalysts, which hinge on delivering against the higher revenue and earnings guidance for the coming quarter. With leadership changes set for year’s end and a product launch behind them, execution risks and margin recovery remain front and center for investors. However, keep in mind that share price performance has lagged both peers and the broader market. On the other hand, leadership transitions could introduce new uncertainty investors should keep in mind.

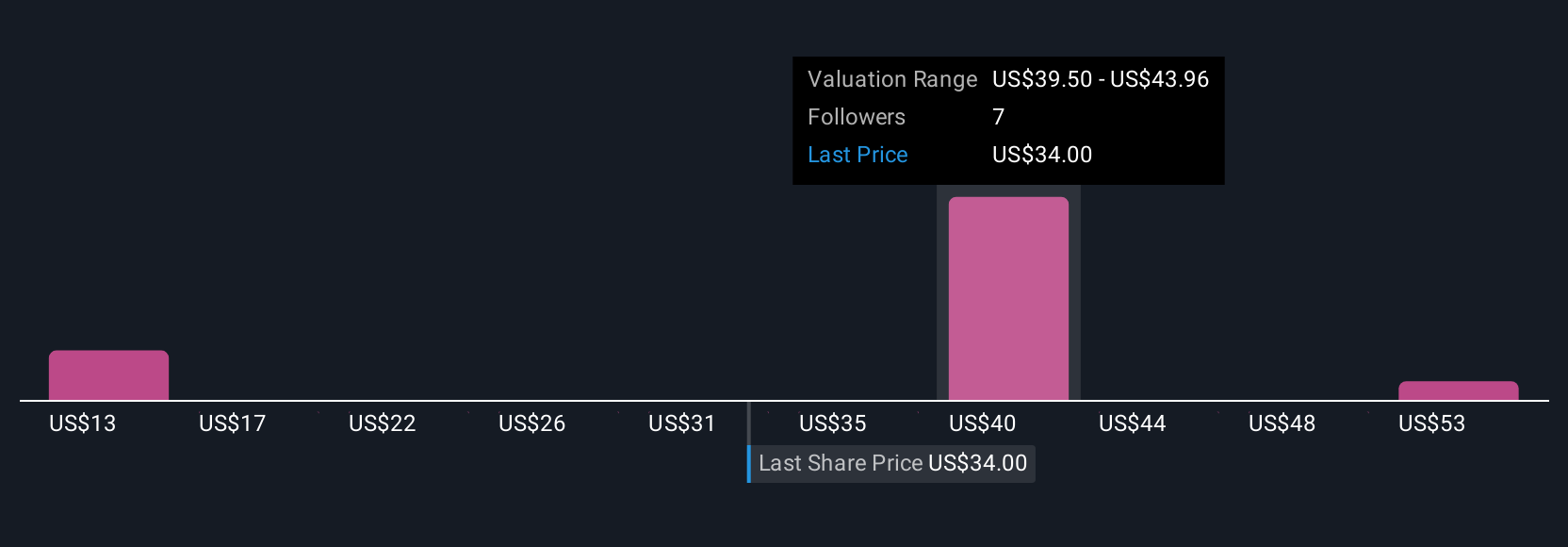

Kulicke and Soffa Industries' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth as much as 47% more than the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Engages in the design, manufacture, and sale of capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives