- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Should Kulicke and Soffa (KLIC) Investors Rethink Their Outlook After CEO Transition Announcement?

Reviewed by Sasha Jovanovic

- Kulicke and Soffa Industries announced that CEO, President, and board member Dr. Fusen Chen will retire for health reasons effective December 1, 2025, with current CFO Lester Wong stepping in as interim CEO while a search for a permanent successor begins.

- Dr. Chen will transition to an advisory role for 12 months, ensuring operational continuity as the board considers both internal and external candidates for the top position.

- We'll explore how this high-level leadership transition, especially the appointment of an interim CEO, may reshape Kulicke and Soffa's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Kulicke and Soffa Industries' Investment Narrative?

To be a Kulicke and Soffa shareholder, you have to believe the company’s semiconductor equipment will keep finding a place in new technology, as advanced packaging and AI-driven manufacturing evolve. Most eyes are on upcoming catalysts like product launches, tech partnerships, and the Q4 2025 earnings report, with Wall Street’s profit growth forecasts still looking very strong. On the risk side, lost profitability over past years and big one-off charges have made recent financials tougher to interpret. The surprise CEO transition adds a layer of uncertainty, as Lester Wong steps in as interim chief while also remaining CFO, though Dr. Chen’s year-long advisory role may help steady operations during the search for a new leader. As of now, the market’s muted reaction suggests the CEO change alone isn’t rattling investor sentiment or reshaping short-term catalysts, but it does shift focus to leadership stability. Yet, questions about Kulicke and Soffa’s ongoing leadership transition could weigh on confidence.

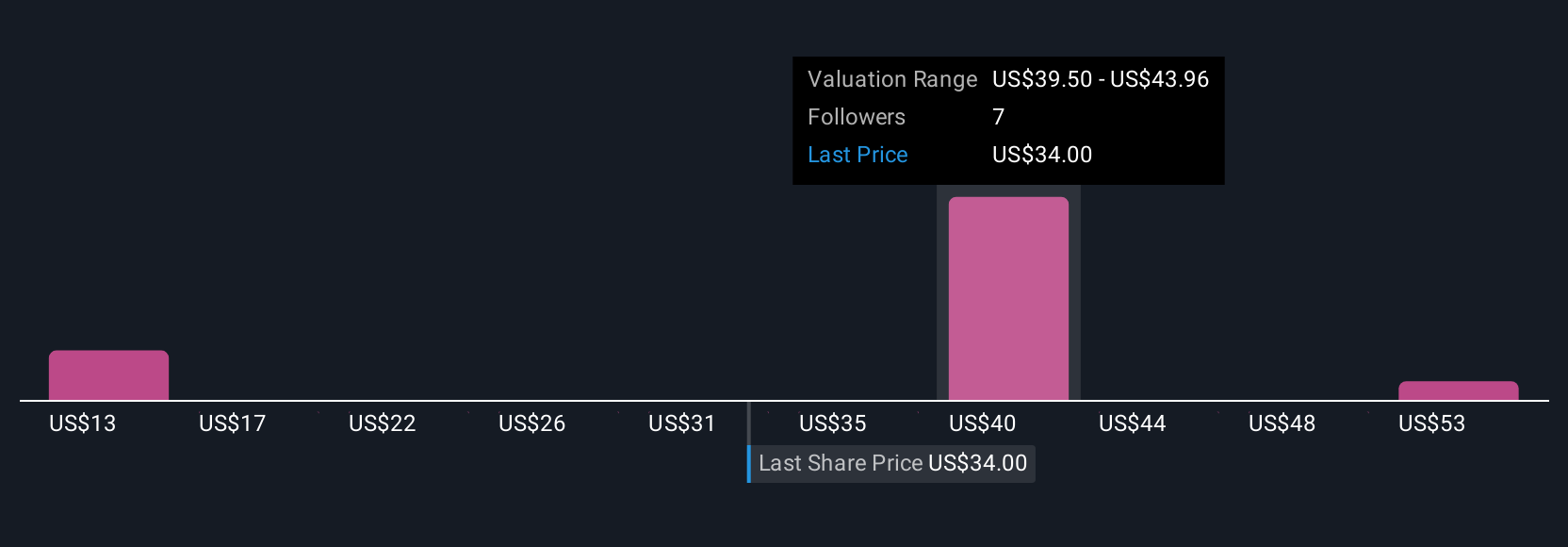

Kulicke and Soffa Industries' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Kulicke and Soffa Industries - why the stock might be worth as much as 44% more than the current price!

Build Your Own Kulicke and Soffa Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kulicke and Soffa Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kulicke and Soffa Industries' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Engages in the design, manufacture, and sale of capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives