- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Kulicke and Soffa (KLIC): Exploring Valuation After Recent Slide and Signs of Recovery

Reviewed by Simply Wall St

See our latest analysis for Kulicke and Soffa Industries.

This year’s story for Kulicke and Soffa Industries is one of fading momentum, after a sharp 1-week share price decline of 8.8% and a year-to-date slide of 24.4%. Over the longer term, the total shareholder return has been negative for three years, but stretches back to a solid 25.9% gain on a five-year view. This shows the stock’s potential to bounce back when the cycle turns.

If you’re watching moves in the semiconductor industry, it’s a good moment to see which other tech and AI names are gaining traction. See the full list for free.

With shares trading nearly 17% below analyst targets and the company showing renewed annual revenue and profit growth, is Kulicke and Soffa Industries now undervalued, or is the market already accounting for a future rebound?

Price-to-Sales Ratio of 2.8x: Is it justified?

Kulicke and Soffa Industries currently trades at a price-to-sales (P/S) ratio of 2.8x, positioning the shares as good value relative to both the US Semiconductor industry average and the company's historical context. With the last close price at $35.56, this P/S ratio is notably below industry norms.

The price-to-sales ratio reflects how much investors are willing to pay for each dollar of the company's revenue. This can be especially relevant for firms in sectors like semiconductors where earnings can swing dramatically from year to year. For KLIC, a moderate P/S ratio suggests investors are not overly pricing in future growth compared to peers, even as the company returns to profitability and revenue begins to show acceleration.

Looking closer, KLIC's 2.8x P/S ratio is substantially lower than the US Semiconductor industry average of 4.7x. It also falls below the estimated fair price-to-sales ratio of 3.8x, implying the market could be underestimating future revenue potential. This provides a possible upside, especially as sector cycles shift and business performance improves.

Explore the SWS fair ratio for Kulicke and Soffa Industries

Result: Price-to-Sales of 2.8x (UNDERVALUED)

However, slowing industry demand or unexpected competition could limit Kulicke and Soffa Industries' rebound potential. This could potentially offset recent signs of improving growth.

Find out about the key risks to this Kulicke and Soffa Industries narrative.

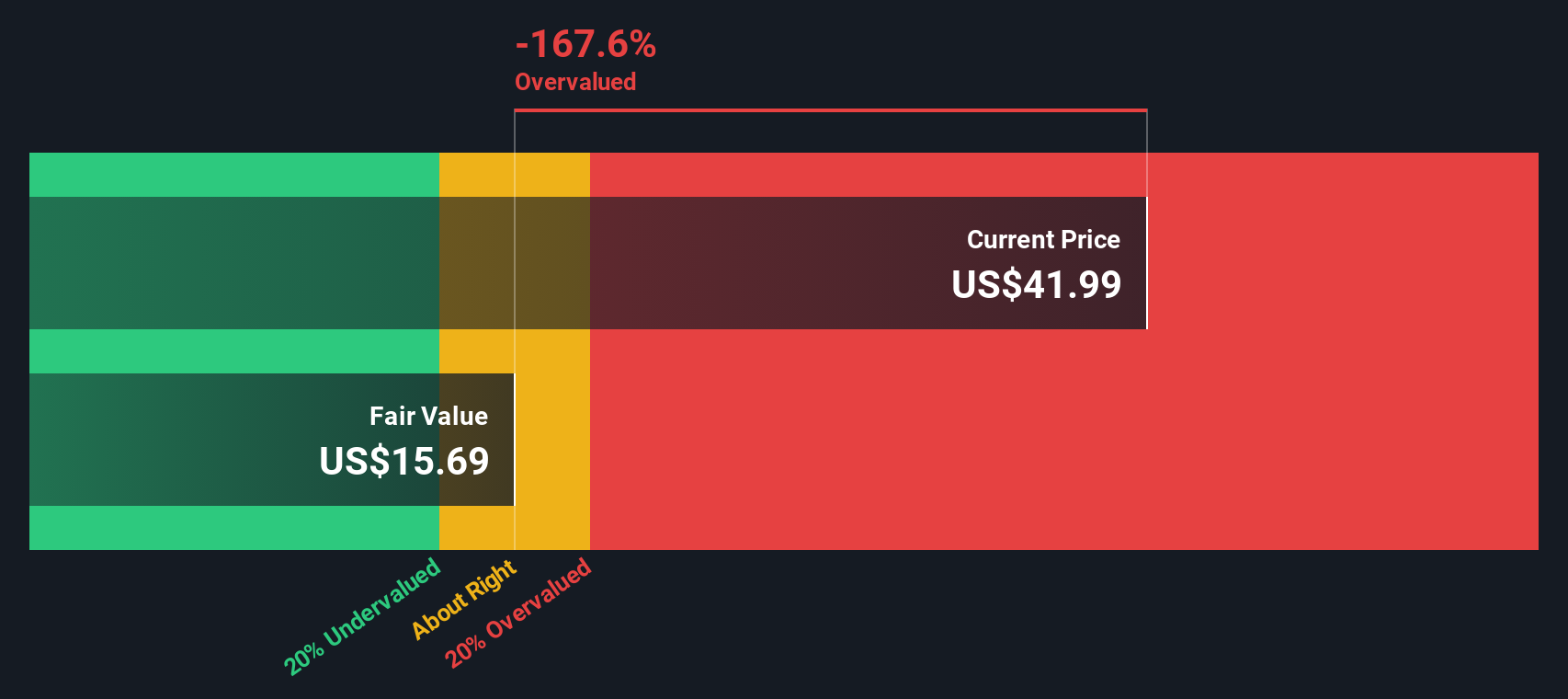

Another View: Discounted Cash Flow Model Signals Overvaluation

While the price-to-sales ratio points to undervaluation compared to industry standards, our DCF model presents a different perspective. Based on forecasted cash flows, Kulicke and Soffa Industries’ shares appear overvalued at current prices. So which valuation reflects the situation more accurately?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kulicke and Soffa Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kulicke and Soffa Industries Narrative

If you think there may be more to the story or want to dive into your own research, it only takes a few minutes to craft your perspective. Do it your way

A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the market to make its next move without you. Find new stocks to watch by tapping into smarter investment filters designed for your goals.

- Amplify your returns by targeting undervalued gems powered by robust cash flows when you select these 906 undervalued stocks based on cash flows.

- Protect your portfolio with consistent income by tapping into these 18 dividend stocks with yields > 3% offering reliable yields above 3%.

- Ride the artificial intelligence wave forward by following these 27 AI penny stocks that are leading innovation in tomorrow’s digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Designs, manufactures, and sells capital equipment and tools used to assemble semiconductor devices.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives