- United States

- /

- Semiconductors

- /

- NasdaqGS:KLIC

Assessing Kulicke and Soffa Industries (KLIC) Valuation After Recent Share Price Jump

Reviewed by Simply Wall St

See our latest analysis for Kulicke and Soffa Industries.

The recent surge in Kulicke and Soffa Industries’ share price, up more than 23% in the past week, stands out, especially given that its total return is still negative over the past year. This burst of momentum suggests that investors may be re-evaluating the company’s prospects, possibly driven by shifting market sentiment or renewed confidence in its long-term growth story.

If you’re curious what other dynamic opportunities are out there, now’s the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With strong gains over the past week and solid revenue and profit growth, the key question for investors is whether Kulicke and Soffa Industries is currently trading at a bargain or if the recent optimism already reflects upcoming growth.

Price-to-Sales of 3.5x: Is it justified?

Kulicke and Soffa Industries currently trades at a price-to-sales ratio of 3.5x. This is above the peer average and fair price estimates, suggesting the market is pricing in optimism not fully mirrored in fundamentals or relative comparisons.

The price-to-sales ratio evaluates how much investors are paying for every dollar of the company’s sales. For semiconductor businesses, this metric helps to benchmark market confidence and growth expectations, especially in periods of profit volatility or turnaround.

With KLIC’s price-to-sales standing at 3.5x, it sits well below the US Semiconductor industry average of 4.4x. This implies the stock appears relatively attractive compared to sector peers. However, the estimated fair price-to-sales ratio is 3.3x and the peer average is just 2.5x. This positions KLIC as “good value” compared to the sector, but potentially “expensive” when using alternative benchmarks, revealing mixed signals in valuation and investor sentiment. It may suggest the market could drift closer to fair or peer-level multiples if underlying performance does not accelerate further.

Explore the SWS fair ratio for Kulicke and Soffa Industries

Result: Price-to-Sales of 3.5x (ABOUT RIGHT)

However, ongoing negative returns over the past year and the discount to analyst price targets highlight lingering uncertainty, which could challenge the current optimism.

Find out about the key risks to this Kulicke and Soffa Industries narrative.

Another View: Discounted Cash Flow Model

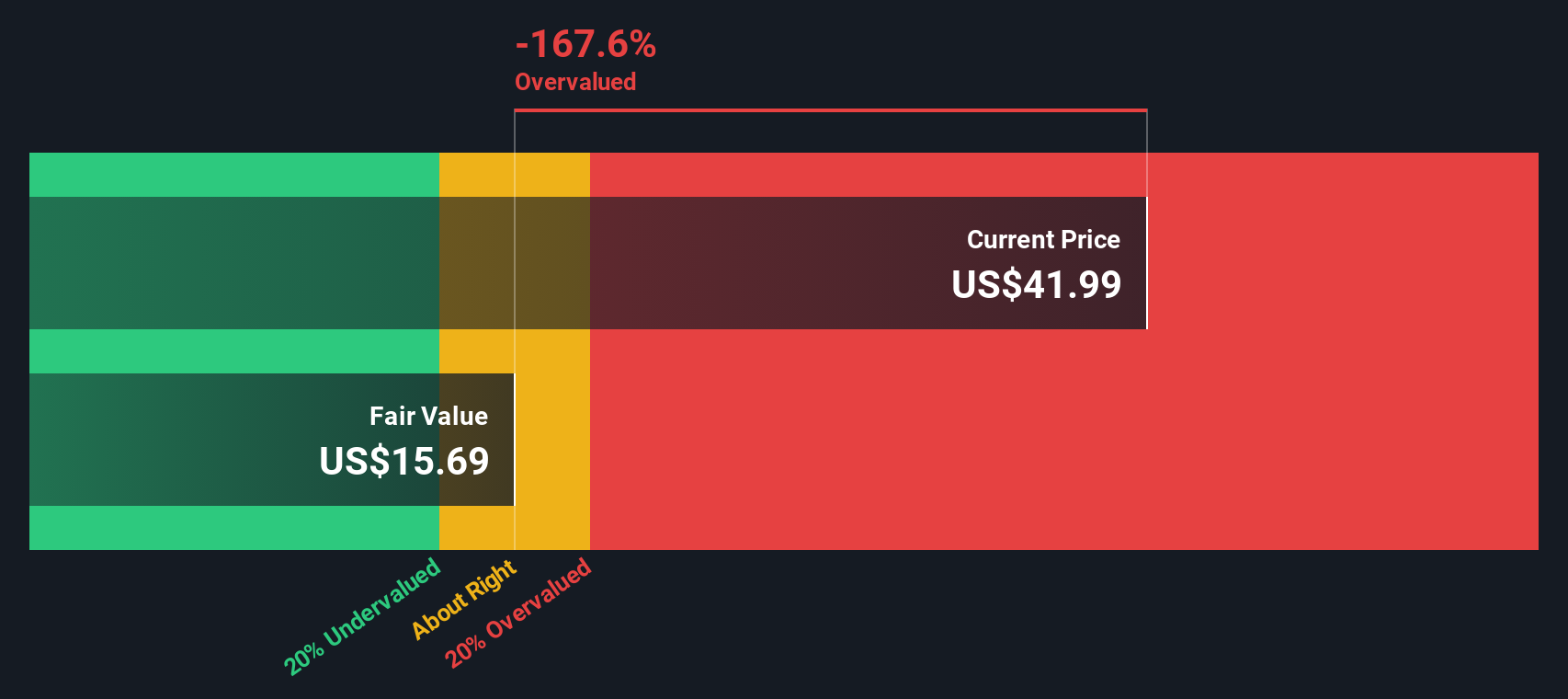

While the price-to-sales ratio paints a mixed picture, our DCF model offers a more cautious perspective. According to the SWS DCF model, Kulicke and Soffa Industries’ fair value estimate is $13.87 per share, which is significantly below the current market price. This suggests the stock could be overvalued if these projections are accurate. Which valuation is more reliable in today’s uncertain market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kulicke and Soffa Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kulicke and Soffa Industries Narrative

If you have a different perspective or want to dig into the numbers yourself, you can easily craft your own take in under three minutes. So why not Do it your way

A great starting point for your Kulicke and Soffa Industries research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Fresh Market Opportunities?

Don’t limit yourself to just one stock when dozens of exciting ideas are waiting. Uncover the kind of investment gems most people will regret overlooking.

- Supercharge your portfolio with reliable income by tapping into these 14 dividend stocks with yields > 3% which offers attractive yields above 3%.

- Ride the future of medicine by seizing early potential in artificial intelligence with these 30 healthcare AI stocks and driving breakthroughs in healthcare innovation.

- Catch explosive growth before the crowd by tracking these 3583 penny stocks with strong financials with solid financial track records and promising momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kulicke and Soffa Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLIC

Kulicke and Soffa Industries

Designs, manufactures, and sells capital equipment and consumables in China, the United States, Taiwan, Malaysia, Japan, the Philippines, Korea, Hong Kong, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success