- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

KLA (KLAC) Margin Expansion Reinforces Bullish Narrative Despite Slower Growth Outlook

Reviewed by Simply Wall St

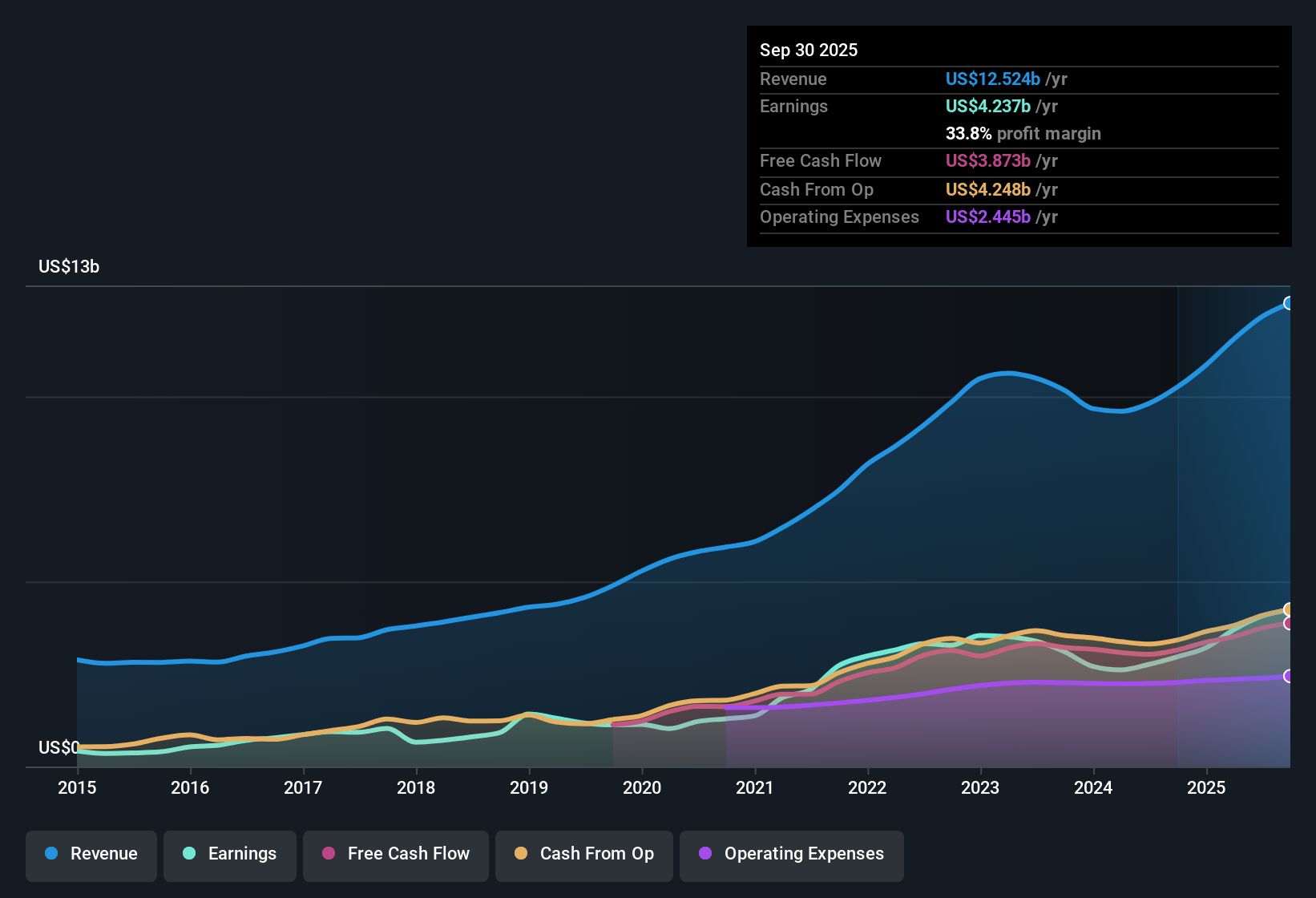

KLA (KLAC) posted a net profit margin of 33.8%, up notably from 28.9% last year, with EPS growth surging 42.8% year-over-year, which is well above its five-year annual average of 12.7%. While forward-looking forecasts point to earnings and revenue growth of 9.88% and 7.8% per year respectively, both trail broader US market expectations, setting a more tempered outlook. Investors may see this as a sign of robust operational efficiency, though the gap between KLAC’s premium share price and its estimated intrinsic value introduces a note of caution.

See our full analysis for KLA.Up next, we will see how these headline results stack up against the community narratives and whether the latest figures strengthen or challenge the dominant market story.

See what the community is saying about KLA

Margin Expansion Beats Industry Pace

- KLA’s profit margin climbed from 28.9% to 33.8%. Analyst expectations were that sector margins would hold steady or rise only mildly.

- Analysts' consensus view supports the idea that this margin strength could drive durable outperformance, as process complexity and advanced packaging contribute to higher profits.

- Consensus notes further margin expansion from 33.4% to 35.6% over three years. This supports arguments for operational leverage, even as broader semiconductor margins remain flat.

- High-quality and predictable service revenues, along with leadership in inspection platforms, reinforce this top-tier margin growth. This emphasizes KLA’s advantage in a competitive field.

Consensus expects long-term margin gains because of advanced packaging and stable service revenues. Read the full story in the consensus narrative. 📊 Read the full KLA Consensus Narrative.

Revenue Growth Trails US Tech Leaders

- Forecasts show KLA revenue is expected to grow at 7.8% annually, which is below the broader US market at 10.3% and below the sector average, even as the company benefits from demand for AI-related products.

- Analysts' consensus view highlights that while strong demand in AI and leading-edge compute is supporting sequential gains for KLA, slowing China sales and cyclical industry risks could limit outperformance.

- Diversified drivers such as advanced packaging, metrology, HBM, and logic/foundry may support above-average growth for KLA compared to peers with slower growth. However, uncertainty around China and normalization of backlog add risk to the outlook.

- Consensus expects the installed base service business to remain resilient, but top-line risks could create volatility and challenge the most optimistic expectations in the coming years.

Premium Valuation vs. DCF Fair Value

- KLA shares trade at $1,208.68, which is significantly above the DCF fair value estimate of $673.54 and also above the analyst price target of $1,271.88. This raises questions about potential upside and downside at current levels.

- Analysts' consensus view argues that recent earnings justify a premium relative to peers. KLA’s price-to-earnings ratio is 37.6x, compared with the industry at 37.7x and the peer average at 43.7x. Modest differences between the current share price and analyst targets suggest limited short-term rerating potential.

- Ongoing margin expansion and recurring revenue support the consensus narrative, but the current premium over both DCF value and recent analyst targets requires potential investors to consider longer-term upside against the risk of mean reversion.

- Consensus notes that a long-term holding thesis depends on KLA maintaining elevated margins and gaining market share as capital intensity in semiconductors continues to increase.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for KLA on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Share your outlook and craft a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding KLA.

See What Else Is Out There

KLA’s revenue growth is lagging sector leaders, and the premium share price above fair value signals potential upside limits and valuation risk.

If you’re seeking better value and growth potential, compare with these 835 undervalued stocks based on cash flows that stand out for trading well below their estimated intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives