- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Assessing KLA (KLAC) Valuation Following Strong Share Price Momentum and Long-Term Gains

Reviewed by Simply Wall St

KLA (KLAC) is coming into focus as investors keep an eye on its latest trading movements and recent performance shifts. With its share price returning almost 83% over the past year, the company has drawn attention from those tracking semiconductor sector leaders.

See our latest analysis for KLA.

KLA’s share price has been on a remarkable run, notching a 28.9% gain over the past three months and boasting an impressive 83% total shareholder return for the year. While momentum in the semiconductor space remains strong, recent short-term pullbacks are doing little to overshadow its sustained long-term performance.

If you’re interested in what’s powering the semiconductor rally, consider exploring See the full list for free..

But with shares rallying so strongly in recent months, the pressing question is whether KLA’s current valuation still leaves room for upside or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 11% Undervalued

KLA’s narrative fair value sits well above the last close, pointing to a sizeable gap between what the market is paying today and what analyst models foresee. This sets the backdrop for a pivotal viewpoint that links bold growth drivers to future valuation.

KLA is seeing continued and rising demand for its process control and metrology solutions due to accelerated AI, high-performance compute, and diverse design proliferation at advanced nodes. This is driving a structurally higher process control intensity across both logic and memory fabs, which supports above-industry-average revenue growth and margin expansion as process complexity increases.

Want to know what’s propelling this bullish outlook? The underlying financial forecasts are bolder than you might expect. Analysts are betting on expanding profit margins and aggressive bottom-line growth, but there’s one big metric they’re all watching. Find out what really drives that double-digit upside projection.

Result: Fair Value of $1,287 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, any escalation of global tariffs or a sharper downturn in China demand could quickly challenge KLA's positive outlook and long-term growth narrative.

Find out about the key risks to this KLA narrative.

Another View: What Do Market Multiples Suggest?

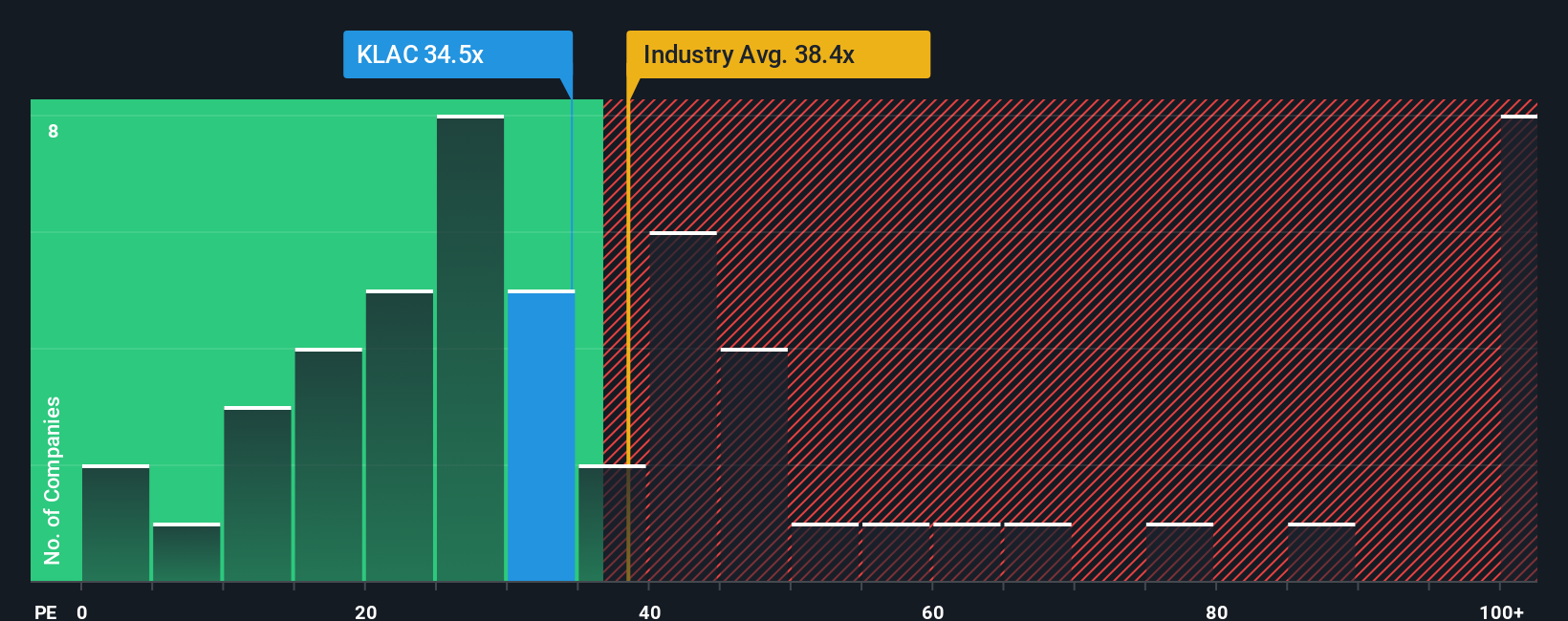

Looking at valuation through the lens of price-to-earnings ratios, KLA trades at 35.5 times earnings, which is slightly above its peer group average of 35 times and also higher than its fair ratio of 33. In practical terms, this means KLA is viewed as a premium stock, but it may carry extra valuation risk if the market starts to normalize or sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KLA Narrative

If you have a different perspective on KLA or want to dig deeper into the numbers yourself, you can easily assemble your own view and narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for More Investment Ideas?

Don't let great opportunities pass you by. Supercharge your portfolio by checking out these high-potential stock groups everyone’s talking about this year:

- Catch the momentum in AI by uncovering breakout innovators. Find them with these 26 AI penny stocks now capitalizing on artificial intelligence breakthroughs that could redefine entire industries.

- Capitalize on future financial growth by hunting for these 924 undervalued stocks based on cash flows primed for a comeback as the market shifts and hidden value surfaces.

- Secure regular income with confidence by selecting these 14 dividend stocks with yields > 3% offering attractive yields above 3%, perfect for boosting your cash flow in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success