- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

A Fresh Look at KLA (KLAC) Valuation After Strong Q1 2026 Results and New Buyback Plan

Reviewed by Simply Wall St

KLA (KLAC) delivered an earnings update that drew attention, as both revenue and net income for fiscal Q1 2026 comfortably surpassed expectations. Momentum from AI infrastructure and advanced packaging demand helped fuel this performance.

See our latest analysis for KLA.

KLA’s shares climbed nearly 90% so far this year, a move fueled by record quarterly profits and aggressive share buybacks. The 1-year total shareholder return of 84% is a testament to real momentum, as demand for AI-driven chipmaking equipment fuels optimism far beyond the latest report.

If KLA’s run has you curious about where the next wave of winners might be found, take a look at the fast growing stocks with high insider ownership. Discover fast growing stocks with high insider ownership

Yet with shares near all-time highs and analysts boosting their targets, the key question now is whether KLA’s red-hot rally still leaves room for upside or if the stock already reflects all that future growth.

Most Popular Narrative: 5% Undervalued

KLA’s fair value, according to the most widely followed narrative, sits at $1,271.88. With the last close at $1,208.74, this view signals modest upside potential and underpins current bullish momentum.

Market share gains are accelerating, with KLA's share of overall wafer fab equipment approaching 8% (up from the prior 7.25% assumption) and further boosted by packaging outperformance. These gains are powered by customer adoption of KLA's differentiated inspection platforms and should amplify both top-line growth and operating leverage, driving EPS growth above revenue growth.

What’s fueling this call? A future shaped by tightening margins, shrinking share counts, and rapid expansion in key segments. Want to see how the narrative projects multi-year upside and the financial levers it expects KLA to pull to get there? See what else drives this price target below.

Result: Fair Value of $1,271.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent China market headwinds or escalating tariff pressures could challenge KLA's growth trajectory and test the strength of even the most bullish outlooks.

Find out about the key risks to this KLA narrative.

Another View: A Multiples-Based Valuation

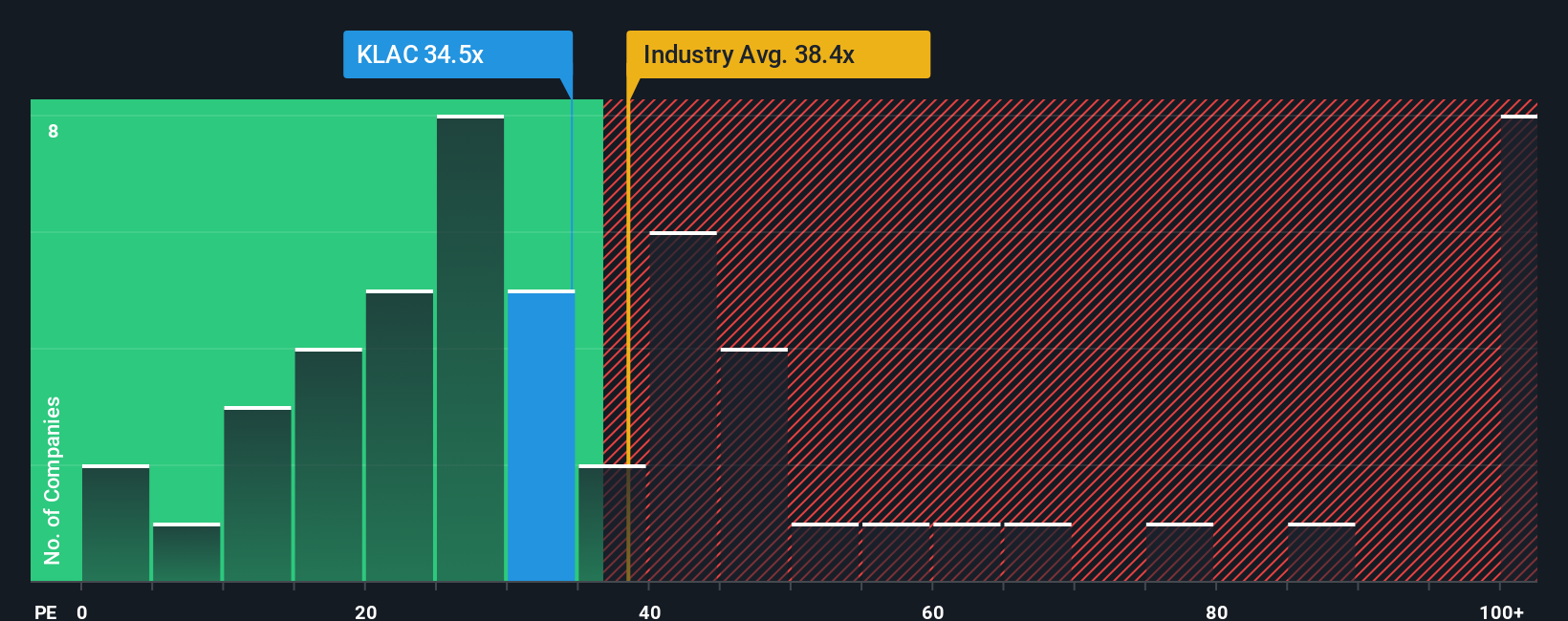

While the current narrative sees KLA as moderately undervalued, our comparison with market valuation ratios paints a more nuanced picture. KLA trades at a price-to-earnings ratio of 37.5x, higher than the industry average of 36.1x and significantly above the fair ratio of 33.1x. This premium suggests added valuation risk if the outlook softens. Could the market be expecting too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KLA Narrative

Prefer to dive into the numbers and tell your own story? You can build a fresh take on KLA’s outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for More Investment Ideas?

Smart moves start with seeing what others miss. Fresh opportunities are waiting just beyond the obvious. Don’t let the next outperformance story pass you by.

- Boost your income-generating potential with these 20 dividend stocks with yields > 3% boasting yields above 3% and strong payout histories.

- Unlock early-access potential by targeting these 3587 penny stocks with strong financials in emerging industries before the crowd catches on.

- Capitalize on next-generation breakthroughs by scanning these 27 AI penny stocks powering everything from automation to intelligent data analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives