- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

A Look at Himax Technologies (HIMX) Valuation After Strong Q3 and Expansion Into AI, Optics, and Automotive Growth

Reviewed by Simply Wall St

Himax Technologies (HIMX) delivered third-quarter results that surpassed its own forecasts, driven by continued strength in automotive IC and Tcon product lines. The company is actively investing in emerging technologies, including AI, optics, and wearables.

See our latest analysis for Himax Technologies.

Himax Technologies’ share price recently pulled back, reflecting a 1-week share price return of -11.8%, even as its Q3 results outperformed expectations and the company doubled down on emerging opportunities in automotive, AI, and wearables. However, the big-picture story is clear: long-term momentum appears to be firmly in place, with a total shareholder return of 46% over the past year and an impressive 120% over five years.

If you’re interested in uncovering other semiconductor innovators riding powerful growth trends, it may be a good moment to explore the full list in our tech and AI stock screener: See the full list for free.

Yet with shares down over the past week and long-term returns still robust, the key question for investors is whether Himax is trading at an attractive valuation based on its future prospects or if the market has already priced in its next phase of growth.

Most Popular Narrative: 11.5% Undervalued

With Himax Technologies closing at $7.73 and the narrative fair value sitting higher at $8.74 per share, expectations are still pointing above the market price. This difference reflects ongoing confidence in future catalysts and the company's ability to harness new growth drivers.

Himax's leading position and rapid expansion in automotive display ICs, including TDDI, traditional DDIC, Tcon, and a growing pipeline of OLED projects, position it at the heart of automotive digital cockpit upgrades and EV/autonomous vehicle adoption. These trends are expected to drive higher ASPs and gross margins in the coming years and accelerate revenue growth from 2027 onwards as mass production ramps up.

Curious what bold future growth targets power this forecast? Find out which assumptions, spanning market dominance, new technology wins, and aggressive profit expansion, fuel the largest gap between price and potential. The numbers behind this valuation might surprise you.

Result: Fair Value of $8.74 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and rising operating expenses could disrupt Himax’s growth outlook. These factors may also challenge the company’s ability to sustain margin improvement.

Find out about the key risks to this Himax Technologies narrative.

Another View: Multiples Tell a Compelling Story

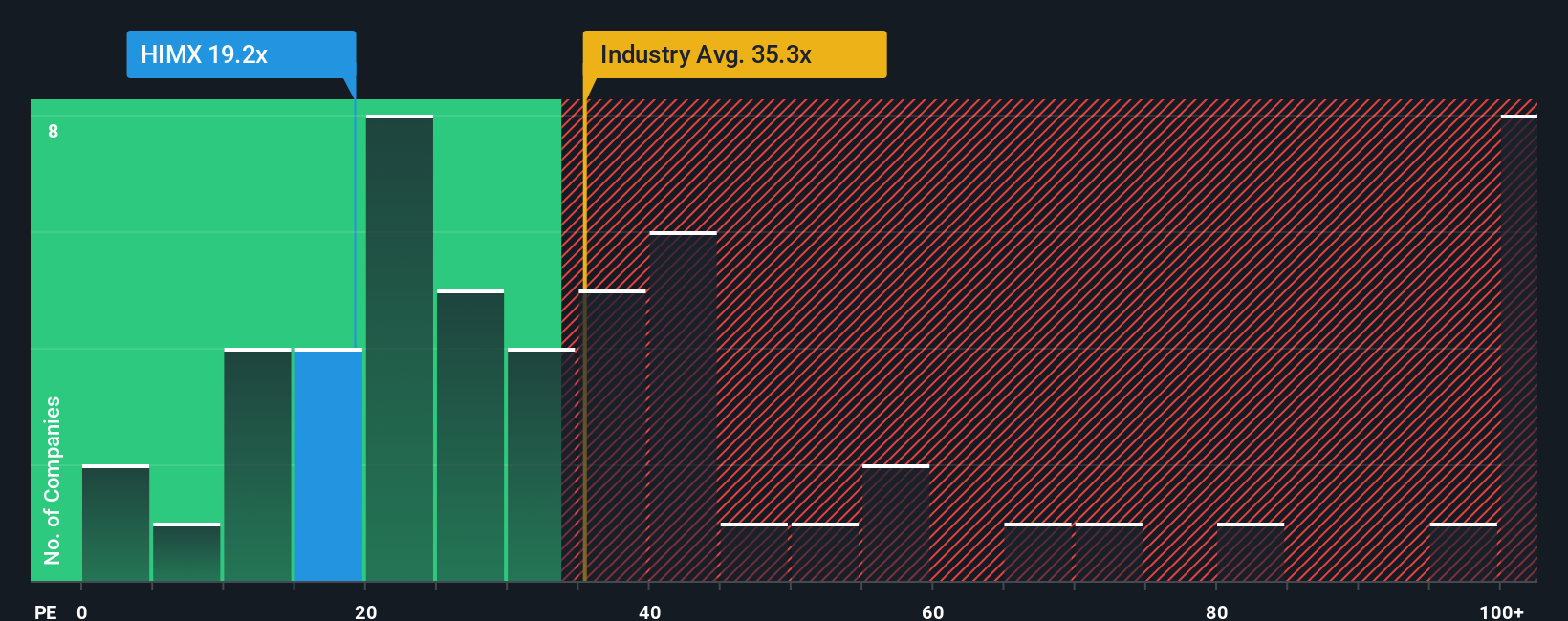

Looking at valuation from a different perspective, Himax trades on a price-to-earnings ratio of 21.7x, which is substantially lower than both the US semiconductor industry average of 36.4x and the peer average of 61.8x. The fair ratio, based on market dynamics, is even higher at 34.4x. This wide gap could point to overlooked value, but it may also signal caution until investor sentiment shifts. Is the market being too conservative, or is there more beneath the headline numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Himax Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Himax Technologies Narrative

If you want to dig into the data on your own terms, you can easily shape your own investment narrative in just a few minutes: Do it your way

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you want to keep your portfolio ahead of the curve, don't miss out on unique stock ideas you can find using our specialized screeners. Your next big win could be just a click away.

- Capture rising annual yields with these 15 dividend stocks with yields > 3%, featuring companies proven to deliver strong, consistent dividends above 3%.

- Unlock tomorrow’s technology trends by starting with these 26 AI penny stocks, which pinpoints AI trailblazers with momentum and the potential to reshape industries.

- Boost your growth potential by targeting these 872 undervalued stocks based on cash flows, stocks that are trading below intrinsic value and may be poised for a rebound.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives