- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

Did Supply Chain Setbacks and Insider Sales Just Shift First Solar's (FSLR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, First Solar reported third-quarter sales of US$1.59 billion and net income of US$455.94 million, alongside lower full-year earnings guidance due to contract terminations and supply chain issues.

- Despite robust U.S. manufacturing expansion and record shipment volumes, investor attention also focused on insider stock sales by the company's Chief Commercial Officer, signaling ongoing concern about near-term operational challenges.

- We'll examine how the combination of supply chain disruptions and reduced earnings guidance impacts First Solar's investment narrative and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

First Solar Investment Narrative Recap

To be a First Solar shareholder, you need to believe in the ongoing U.S. policy support for domestic solar manufacturing and the company’s ability to leverage this with its expanding production capacity and technology leadership. The recent quarterly report, which showed strong sales growth but lowered full-year guidance due to contract terminations and supply chain disruptions, has not materially changed the company’s main short-term catalyst, U.S. facility ramp-up, though it has underscored elevated risks around customer contracts and earnings consistency.

Among the recent announcements, the revised 2025 guidance is most relevant: First Solar now expects net sales of US$4.95 billion to US$5.20 billion and earnings per diluted share between US$14.00 and US$15.00, trimming the upper range from previous expectations. This directly reflects the current operational challenges but also signals that securing new higher-priced contracts and resolving supply chain hurdles will remain crucial in sustaining momentum from domestic manufacturing expansion.

Yet, even as U.S. policies support higher margins for First Solar, the risk of abrupt contract losses and overdue payments could...

Read the full narrative on First Solar (it's free!)

First Solar is projected to reach $7.0 billion in revenue and $3.2 billion in earnings by 2028. Achieving these targets requires a 17.4% annual revenue growth rate and a $1.9 billion earnings increase from the current earnings of $1.3 billion.

Uncover how First Solar's forecasts yield a $259.11 fair value, a 3% downside to its current price.

Exploring Other Perspectives

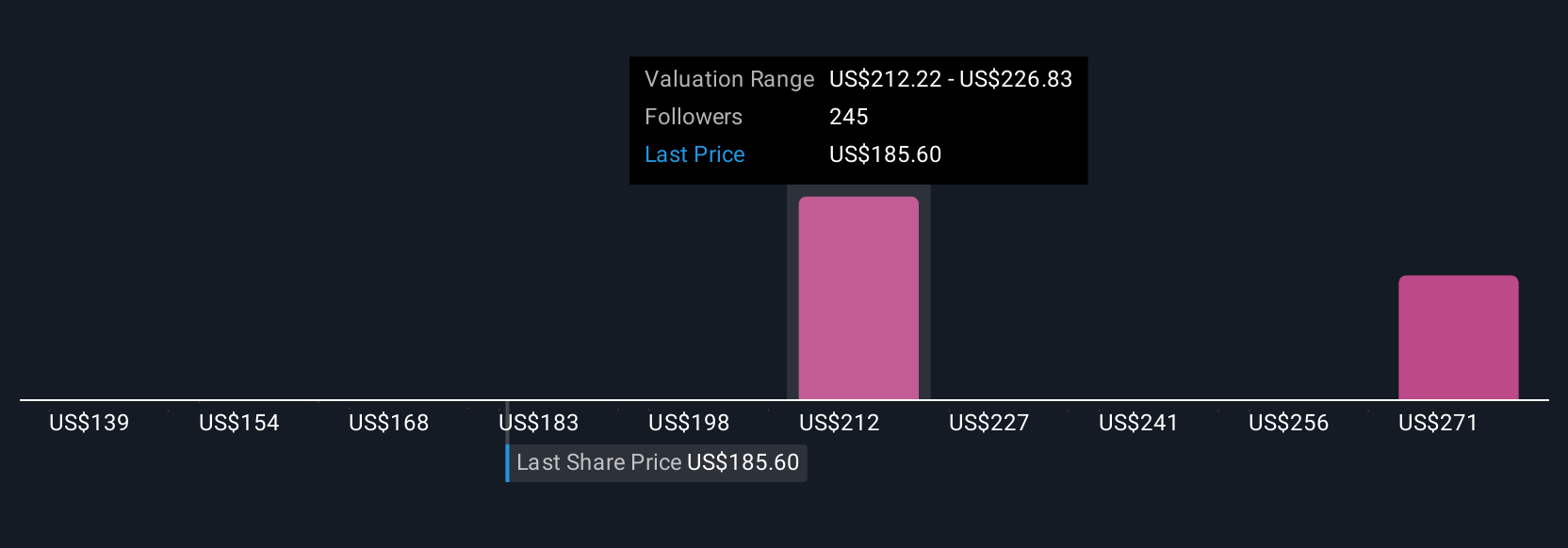

Twenty-eight Simply Wall St Community members estimate First Solar’s fair value anywhere from US$142 to US$481 per share. With contract terminations and supply uncertainties emerging, it pays to consider how much views on risk and reward can differ.

Explore 28 other fair value estimates on First Solar - why the stock might be worth as much as 80% more than the current price!

Build Your Own First Solar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Solar research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free First Solar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Solar's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives