- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Is Now the Right Time to Reevaluate Entegris After Recent 15% Price Drop?

Reviewed by Bailey Pemberton

- Ever wondered if Entegris is a hidden gem or if its recent price can be justified? You are not alone. Let’s explore whether it is truly undervalued right now.

- The stock has been on a bit of a rollercoaster, dropping 6.4% over the last week and losing 11.7% in the past month. This has led to a year-to-date decline of 9.0% and a 15.4% dip over the last year. However, it still boasts a three-year return of 38.2%.

- Recent news has put Entegris in the spotlight, with industry-wide concerns about semiconductor supply chains and evolving end-market demand shaping investor sentiment. Headlines around global chip sector volatility and shifting regulations have added another layer of urgency to reassess the company’s true worth.

- Based on our quantitative checks, Entegris scores 0 out of 6 for undervaluation. The numbers themselves raise questions, but stick around as we break down multiple valuation approaches and reveal a smarter way to size up the stock at the end.

Entegris scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Entegris Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common tool for estimating a company's intrinsic value by projecting its future free cash flows and then discounting those sums back to today's dollars. This approach helps investors determine what the company could truly be worth, based on actual performance and expectations for growth.

For Entegris, the current Free Cash Flow stands at $308.2 Million. Analysts provide detailed cash flow projections for the next five years, with estimates growing from $409.3 Million in 2026 to $743.2 Million by 2029. Beyond 2029, projections are extrapolated and suggest continued growth in Free Cash Flow, though with greater uncertainty. All values are reported in US dollars.

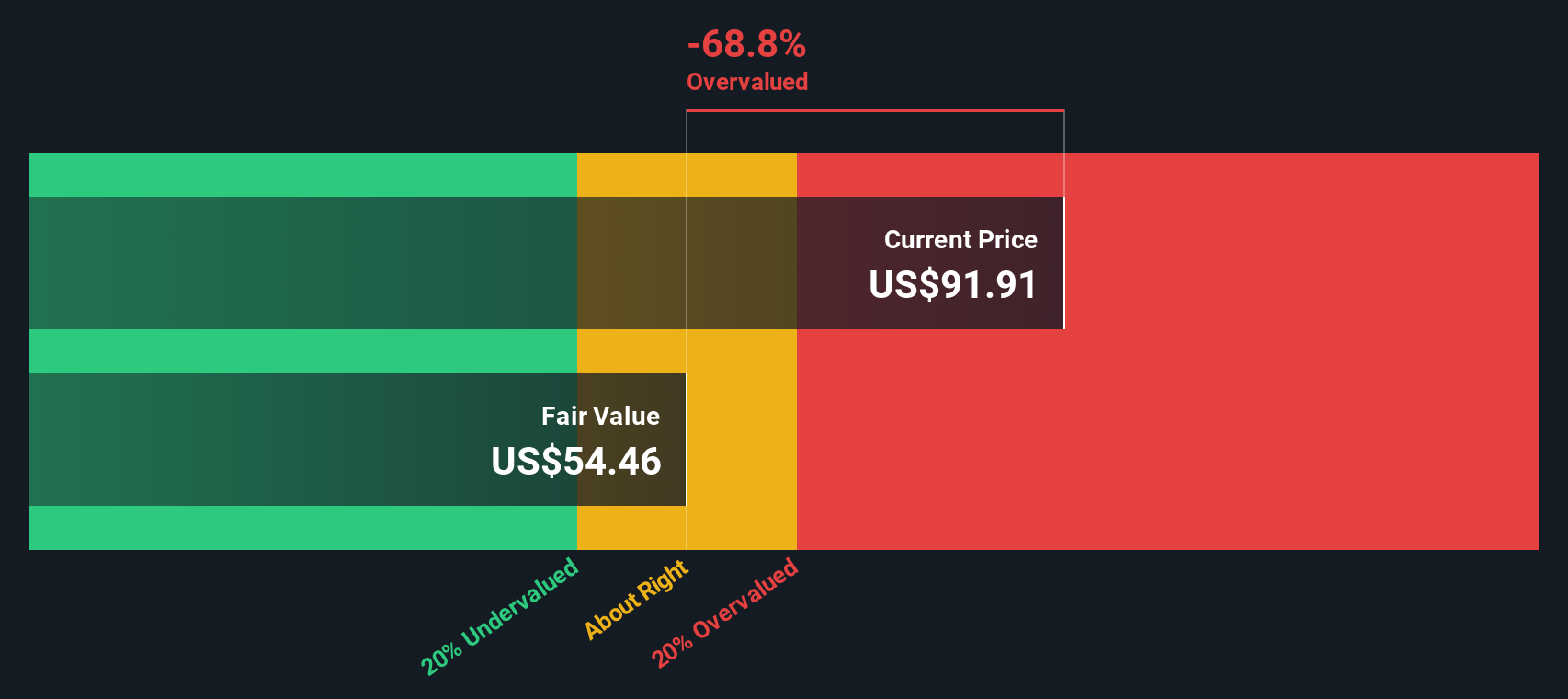

According to this 2 Stage Free Cash Flow to Equity DCF model, the estimated intrinsic value per share for Entegris is $59.75. When compared to the current share price, this result points to Entegris stock being overvalued by 48.1%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Entegris may be overvalued by 48.1%. Discover 849 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Entegris Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Entegris. It helps investors gauge how much they are paying for each dollar of earnings. For mature, consistently profitable firms, the PE ratio provides a direct way to compare value across a range of businesses.

What qualifies as a “normal” or “fair” PE ratio is not universal. Expectations for future growth and the perceived risk attached to those earnings play a significant role in determining the right multiple. Generally, higher expected growth or lower risk justifies a higher PE ratio, while lower growth potential or more risk calls for a lower one.

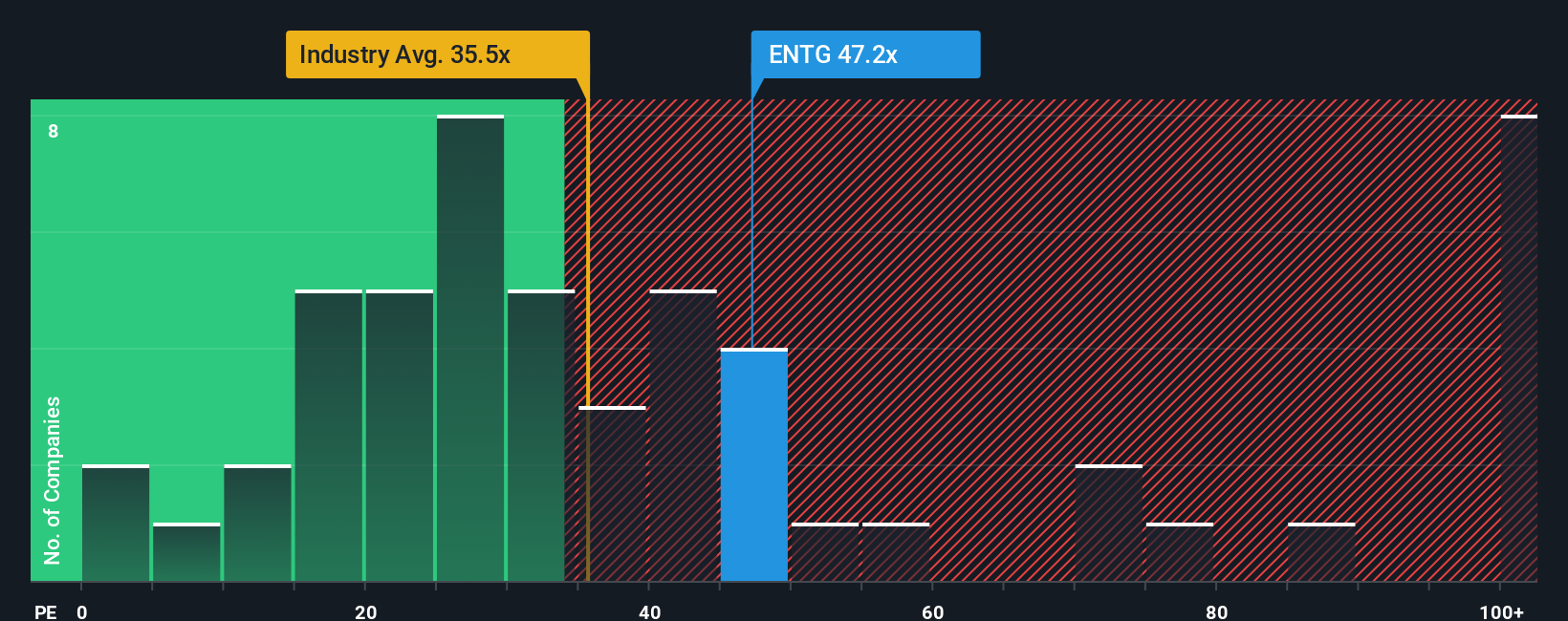

Entegris currently trades at a PE ratio of 46.5x. This is above the semiconductor industry average of 36.9x and also higher than its direct peer group, which averages 43.5x. These benchmarks offer some context, but they do not fully reflect the specifics of Entegris itself.

Simply Wall St's Fair Ratio is a proprietary figure that represents the PE multiple Entegris deserves, factoring in unique details like earnings growth, risk profile, profit margins, market capitalization and how it compares within its industry. This approach goes beyond simply comparing peers or industry averages because it personalizes the valuation based on a broader and more nuanced set of data points.

Looking at Entegris’s Fair Ratio of 32.4x, there is a notable gap compared to its actual PE of 46.5x. This suggests the stock is trading materially higher than what would be expected based on its key fundamentals and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Entegris Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your own story or perspective about a company’s future. It links your beliefs about Entegris’s growth, profit margins, and risks to a specific financial forecast and ultimately to your own estimate of fair value.

This approach goes beyond static ratios or formulas. It lets you connect the company's business drivers, like new manufacturing sites or shifts in semiconductor demand, directly to numbers such as forecasted revenues or earnings. Narratives are an easy-to-use, dynamic feature available on Simply Wall St’s Community page. They empower millions of investors to bring their stories and forecasts to life, compare fair value with current prices, and decide when to buy or sell.

Because Narratives update automatically as fresh news or earnings are announced, your valuation stays accurate and relevant without manual effort. For example, some Entegris investors are optimistic, expecting a price target as high as $115, based on strong future demand for advanced materials. Others are cautious, aiming as low as $85, factoring in trade risks and operational headwinds. Narratives make it simple to see how different future views lead to different valuations so you can make decisions that reflect your outlook, not just the market consensus.

Do you think there's more to the story for Entegris? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives